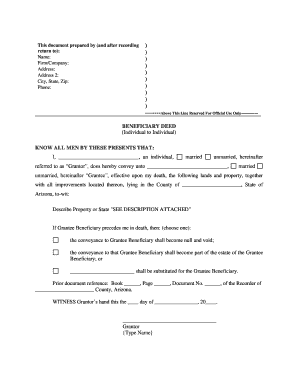

Beneficiary Deed Arizona Form

What is the Beneficiary Deed Arizona

The Beneficiary Deed Arizona is a legal document that allows property owners to transfer their real estate to a designated beneficiary upon their death, without the need for probate. This deed is particularly useful for individuals looking to simplify the transfer process of their property to heirs while avoiding the complexities and costs associated with probate proceedings. The beneficiary deed becomes effective immediately upon signing, but the transfer of ownership only occurs after the owner's death. This tool provides peace of mind for property owners and can help ensure that their wishes are honored.

How to Use the Beneficiary Deed Arizona

Using the Beneficiary Deed Arizona involves several key steps. First, the property owner must complete the deed form, ensuring all required information is accurately filled out, including the legal description of the property and the name of the beneficiary. Once completed, the deed must be signed in the presence of a notary public. After notarization, the deed should be recorded with the county recorder's office in the county where the property is located. This recording is essential for the deed to be legally binding and to provide public notice of the beneficiary designation.

Steps to Complete the Beneficiary Deed Arizona

Completing the Beneficiary Deed Arizona involves a series of straightforward steps:

- Obtain the Beneficiary Deed form, which can be found online or through legal offices.

- Fill in the property details, including the legal description and the names of the beneficiaries.

- Sign the form in front of a notary public to ensure its validity.

- Record the signed and notarized deed with the county recorder's office.

- Keep a copy of the recorded deed for personal records.

Key Elements of the Beneficiary Deed Arizona

Several key elements must be included in the Beneficiary Deed Arizona to ensure its validity:

- The name and address of the property owner (grantor).

- The name and address of the beneficiary (grantee).

- A clear legal description of the property being transferred.

- A statement indicating that the transfer occurs upon the death of the grantor.

- The signatures of the grantor and a notary public.

State-Specific Rules for the Beneficiary Deed Arizona

Arizona has specific laws governing the use of beneficiary deeds. It is important to adhere to these regulations to ensure that the deed is enforceable. For instance, the deed must explicitly state that it is a beneficiary deed and must be executed in compliance with Arizona Revised Statutes. Additionally, the deed must be recorded in the county where the property is located, and it is advisable to consult with a legal professional to ensure compliance with all state requirements.

Legal Use of the Beneficiary Deed Arizona

The legal use of the Beneficiary Deed Arizona is primarily to facilitate the transfer of property upon death, avoiding probate. This deed is recognized by Arizona law and can be a powerful estate planning tool. However, it is crucial to understand that the beneficiary does not have any rights to the property while the grantor is alive. The grantor retains full control over the property, including the ability to sell or mortgage it without the beneficiary's consent.

Quick guide on how to complete beneficiary deed arizona 481366998

Complete Beneficiary Deed Arizona effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Beneficiary Deed Arizona on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Beneficiary Deed Arizona with ease

- Find Beneficiary Deed Arizona and click Get Form to initiate.

- Leverage the tools we provide to complete your document.

- Mark crucial parts of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Beneficiary Deed Arizona and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Arizona beneficiary deed form?

An Arizona beneficiary deed form is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. This form provides a straightforward way to ensure that assets are passed directly to heirs, simplifying the estate process.

-

How can I obtain an Arizona beneficiary deed form?

You can easily obtain an Arizona beneficiary deed form through various online legal document services, including airSlate SignNow. Our platform provides customizable templates that you can fill out and sign electronically, ensuring a hassle-free experience.

-

What are the benefits of using an Arizona beneficiary deed form?

Using an Arizona beneficiary deed form offers several benefits, including avoiding probate and retaining control of the property while you are alive. Additionally, it allows for a smooth transfer of ownership to your chosen beneficiaries, ensuring your wishes are honored.

-

Are there any costs associated with the Arizona beneficiary deed form?

While the cost of the Arizona beneficiary deed form may vary depending on the service provider, airSlate SignNow offers a cost-effective solution with transparent pricing. We provide access to all necessary features at competitive rates, ensuring you get the best value for your needs.

-

How does eSigning an Arizona beneficiary deed form work?

eSigning an Arizona beneficiary deed form through airSlate SignNow is simple. Users can upload the document, add relevant information, and invite other parties to sign electronically, all within a secure platform. This process is both efficient and legally binding.

-

Can I integrate the Arizona beneficiary deed form with other applications?

Yes, airSlate SignNow allows seamless integrations with various applications to streamline your document management processes. This means you can easily incorporate the Arizona beneficiary deed form into the tools you already use, enhancing your overall workflow.

-

What if I need assistance filling out the Arizona beneficiary deed form?

If you require assistance filling out the Arizona beneficiary deed form, our customer support team is available to help you every step of the way. We provide resources and guidance to ensure that you complete the form accurately and efficiently.

Get more for Beneficiary Deed Arizona

- Name of person asking for protection protected person form

- Dv 130 restraining order after hearing order of protection form

- Dv 130 c restraining order after hearing cletsoah chinese judicial council forms

- Dv 130 k restraining order after hearing cletsoah korean judicial council forms

- Dv 1030 s restraining order after hearing cletsoah spanish judicial council forms

- Dv 130 v restraining order after hearing cletsoah vietnamese judicial council forms

- This form is attached to check one

- Supervised visitation order form

Find out other Beneficiary Deed Arizona

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast