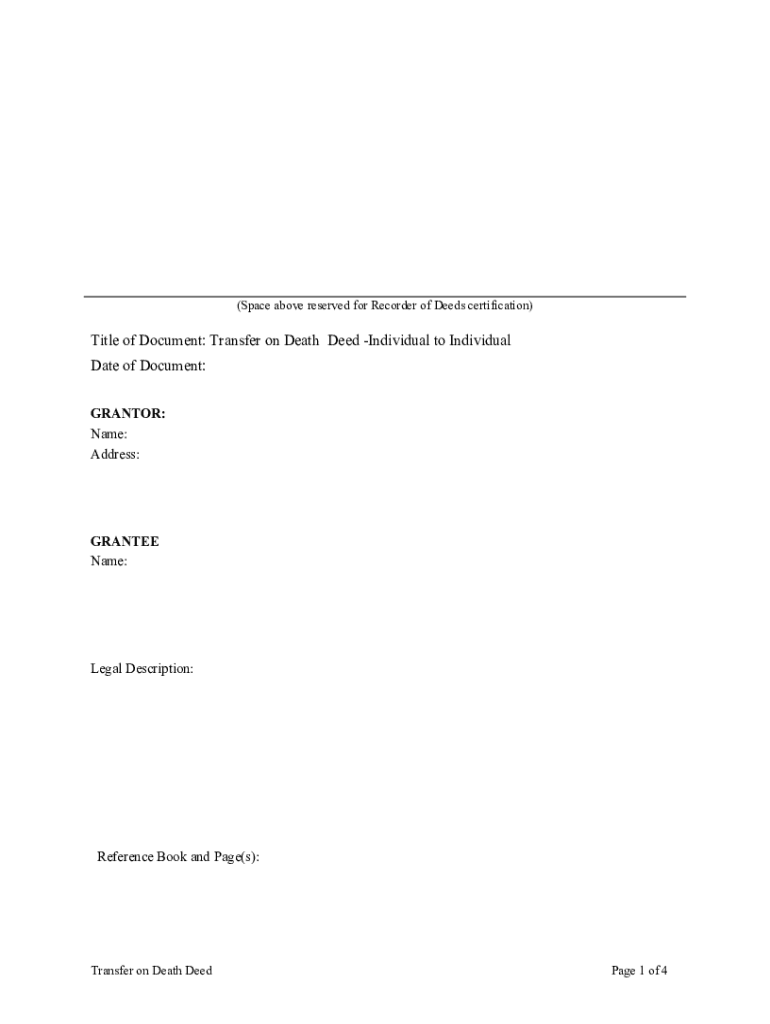

Transfer Death Deed Form

What is the transfer on death deed?

A transfer on death deed is a legal document that allows an individual to designate a beneficiary who will receive their property upon their death. This deed enables the property owner to retain full control over the property during their lifetime, while ensuring a smooth transition of ownership after their passing. The transfer on death deed is particularly useful in estate planning, as it bypasses the probate process, allowing beneficiaries to inherit the property directly and efficiently.

How to use the transfer on death deed

To utilize a transfer on death deed, the property owner must complete the deed form, specifying the beneficiary's name and the property details. Once the form is filled out, it must be signed in the presence of a notary public to ensure its validity. After notarization, the deed should be recorded with the appropriate county office where the property is located. This recording is crucial, as it officially establishes the beneficiary's rights to the property upon the owner's death.

Steps to complete the transfer on death deed

Completing a transfer on death deed involves several key steps:

- Obtain the transfer on death deed form specific to your state.

- Fill out the form with the required information, including the property description and beneficiary details.

- Sign the form in front of a notary public to validate the document.

- File the signed deed with your local county recorder's office to ensure it is legally recognized.

- Keep a copy of the recorded deed for your records and inform the beneficiary of its existence.

Legal use of the transfer on death deed

The legal use of a transfer on death deed is governed by state laws, which may vary significantly. Generally, the deed must be executed according to the specific requirements of the state, including proper notarization and recording. This legal framework ensures that the transfer of property occurs seamlessly upon the owner’s death, provided all conditions are met. It is advisable to consult with a legal professional to ensure compliance with local regulations.

Key elements of the transfer on death deed

Several key elements are essential for a valid transfer on death deed:

- Property description: A clear and accurate description of the property being transferred.

- Beneficiary designation: The name of the individual or entity that will inherit the property upon the owner's death.

- Signature and notarization: The property owner's signature, along with notarization, to validate the document.

- Recording: Filing the deed with the county recorder's office to make it part of the public record.

State-specific rules for the transfer on death deed

Each state in the U.S. has its own regulations regarding the transfer on death deed. Some states may require additional information or specific language in the deed. Additionally, certain states may limit the types of property that can be transferred using this method. It is important for property owners to familiarize themselves with their state’s rules and requirements to ensure the deed is valid and enforceable.

Quick guide on how to complete transfer death deed

Effortlessly Prepare Transfer Death Deed on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delay. Handle Transfer Death Deed on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and Electronically Sign Transfer Death Deed with Ease

- Locate Transfer Death Deed and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools offered specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or shared link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, and mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Transfer Death Deed and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer on death deed?

A transfer on death deed (TOD deed) is a legal document that allows an individual to transfer their property directly to a beneficiary upon their death. This avoids probate, making the process of transferring assets simple and efficient. With a TOD deed, property owners can maintain full control during their lifetime while ensuring a smooth transition for their heirs.

-

How does airSlate SignNow support the creation of transfer on death deeds?

airSlate SignNow provides a user-friendly platform to create, send, and e-sign transfer on death deeds online. Our templates simplify the document preparation process and ensure that all necessary legal language is included. With the ease of our solution, you can efficiently manage such important documents at your convenience.

-

Is there a cost associated with using airSlate SignNow for transfer on death deeds?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including plans specifically for individuals drafting transfer on death deeds. Each plan comes with features that enhance document management and secure signing. You can choose a plan that fits your budget while enjoying comprehensive functionalities.

-

What features does airSlate SignNow offer for transfer on death deeds?

airSlate SignNow includes features such as customizable templates, secure e-signatures, and cloud storage for your transfer on death deeds. You can easily share documents with beneficiaries or attorneys, track changes, and ensure that your documents are legally binding. These features streamline the process of preparing and signing important estate planning documents.

-

Can I use airSlate SignNow on mobile devices for transfer on death deeds?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing you to create, send, and e-sign transfer on death deeds anytime, anywhere. The mobile app offers the same functionalities as the desktop version, making it simple to manage your important documents on the go, ensuring that your estate planning is always within signNow.

-

What are the benefits of using airSlate SignNow for transfer on death deeds?

Using airSlate SignNow for your transfer on death deeds provides efficiency, security, and convenience. You eliminate the hassle of paper processes and face-to-face meetings, enabling a streamlined experience. Furthermore, having an electronic record enhances the safety of your documents, reducing the risk of loss or damage.

-

Does airSlate SignNow integrate with other tools for managing transfer on death deeds?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when dealing with transfer on death deeds. You can connect with CRM systems, cloud storage services, and other productivity tools. These integrations make it easier to manage your estate planning documents and ensure seamless communication among your stakeholders.

Get more for Transfer Death Deed

- Free legal form complaint for fraud kinsey law offices

- If i need additional space on pld c 010 for section 4 what form

- Cause of action general negligence pld pi 0012 forms

- Cause of action intentional tort 98214 cause of action intentional tort 98214 form

- Cause of action premise liability 98215 cause of action premise liability 98215 form

- Cause of action products liability 98216 cause of action products liability 98216 form

- Personal injury property damage complaint california courts form

- Cross defendant form

Find out other Transfer Death Deed

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement