Massachusetts Estate Form

What is the Massachusetts Estate

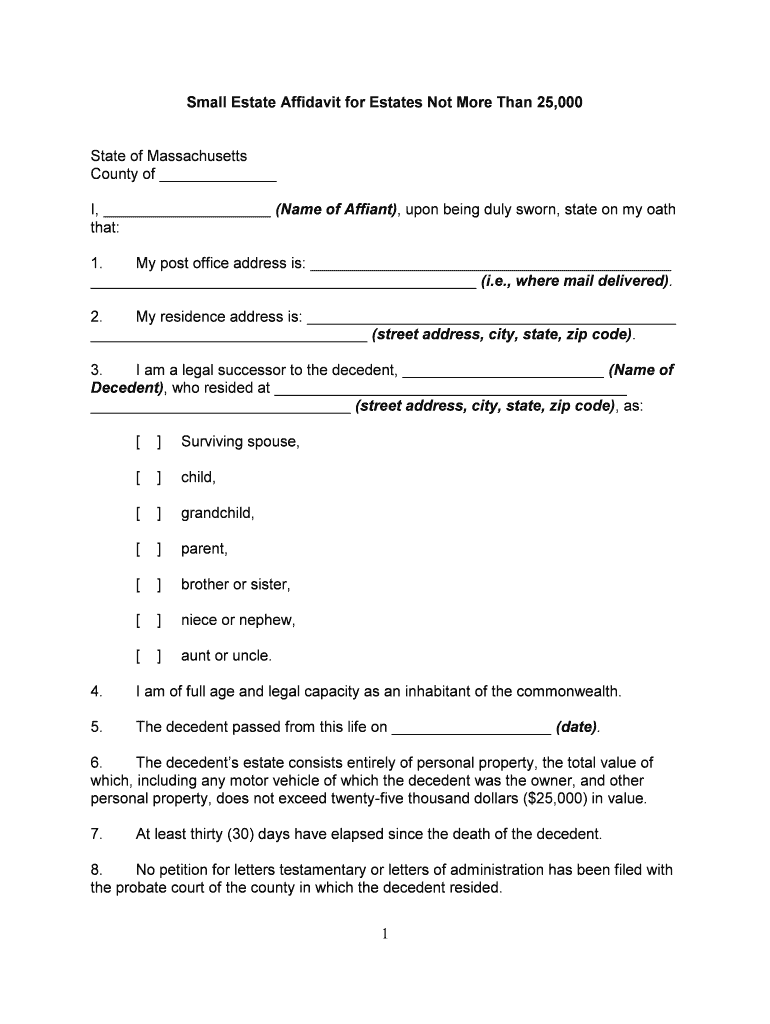

The Massachusetts estate refers to the total value of a deceased individual's assets, including real estate, personal property, and financial accounts, before any debts or taxes are paid. In Massachusetts, an estate may be classified as a small estate if its total value is under twenty-five thousand dollars. This classification allows for simplified probate procedures, which can expedite the distribution of assets to beneficiaries. Understanding the nature of the estate is crucial for heirs and executors to manage the estate effectively and ensure compliance with state laws.

Steps to complete the Massachusetts Estate

Completing the Massachusetts estate process involves several key steps. First, gather all necessary documentation, including the death certificate and a list of the deceased's assets and liabilities. Next, determine whether the estate qualifies as a small estate under Massachusetts law. If it does, you can utilize the small estate affidavit form, which simplifies the probate process. Fill out the form accurately, ensuring all information is complete and correct. Once completed, submit the affidavit to the appropriate court along with any required supporting documents. Finally, notify beneficiaries and distribute the assets according to the will or state law if no will exists.

Legal use of the Massachusetts Estate

The legal use of the Massachusetts estate involves adhering to state laws governing the probate process. Executors or administrators must manage the estate responsibly, ensuring that all debts and taxes are settled before distributing assets. The small estate affidavit serves as a legal instrument to facilitate the transfer of property without formal probate proceedings, provided the estate meets the necessary criteria. It is essential to follow the legal requirements to avoid potential disputes among heirs and ensure that the estate is settled efficiently and in compliance with Massachusetts law.

Required Documents

To process a Massachusetts estate, several documents are typically required. Key documents include the death certificate, which officially records the individual's passing, and the small estate affidavit form if the estate qualifies as a small estate. Additionally, a list of assets and liabilities must be compiled, along with any relevant wills or trust documents. If applicable, tax returns and notices from creditors may also be necessary. Collecting these documents in advance can streamline the estate administration process.

Eligibility Criteria

Eligibility for utilizing the small estate affidavit in Massachusetts hinges on the total value of the estate. To qualify, the estate must not exceed twenty-five thousand dollars in value, excluding certain assets such as real estate. Additionally, the decedent must have been a resident of Massachusetts at the time of death. Heirs or beneficiaries seeking to use the small estate affidavit must also be able to provide proof of their relationship to the deceased, ensuring that they have the legal right to claim the assets.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Massachusetts estate documents can be done through various methods. For those using the small estate affidavit, the form can often be submitted in person at the local probate court. Some jurisdictions may allow for mail submissions, providing a convenient option for those unable to visit the court. However, online submission is generally not available for estate documents in Massachusetts. It is advisable to check with the local probate court for specific submission guidelines and options available in your area.

Quick guide on how to complete massachusetts estate

Effortlessly prepare Massachusetts Estate on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Massachusetts Estate on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Massachusetts Estate with ease

- Obtain Massachusetts Estate and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Massachusetts Estate and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Massachusetts estate buy with airSlate SignNow?

The process for a Massachusetts estate buy using airSlate SignNow is straightforward. First, users can create a digital document outlining the estate transaction details. After that, parties involved can easily eSign the document, ensuring a quick and secure buying process.

-

How much does it cost to use airSlate SignNow for Massachusetts estate buy?

The pricing for using airSlate SignNow for a Massachusetts estate buy is competitive and affordable. We offer various plans to accommodate different business needs, ensuring you get the best value while facilitating your estate transactions efficiently. Check our website for detailed pricing options.

-

What features does airSlate SignNow provide for Massachusetts estate buy?

airSlate SignNow offers features tailored for a Massachusetts estate buy, including customizable templates, document tracking, and audit trails. These features streamline the signing process and enhance the overall efficiency of managing estate documents, making it easier for all parties involved.

-

How does airSlate SignNow ensure security during a Massachusetts estate buy?

Security is a top priority at airSlate SignNow, especially during a Massachusetts estate buy. Our platform utilizes advanced encryption technologies and complies with industry standards to protect your sensitive information, ensuring your documents are safe throughout the signing process.

-

Can airSlate SignNow integrate with other applications for Massachusetts estate buy?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the efficiency of a Massachusetts estate buy. Whether you need to connect with CRM systems, cloud storage, or payment processors, our integrations simplify your workflow and boost productivity.

-

What are the benefits of using airSlate SignNow for a Massachusetts estate buy?

Using airSlate SignNow for a Massachusetts estate buy offers numerous benefits, including reduced processing time and improved document accuracy. The user-friendly interface allows even those unfamiliar with digital tools to navigate the signing process effortlessly, facilitating smoother transactions.

-

Is airSlate SignNow suitable for real estate agents handling Massachusetts estate buy?

Absolutely! airSlate SignNow is ideal for real estate agents managing Massachusetts estate buy transactions. Our platform simplifies document management and eSigning, allowing agents to focus on their clients while ensuring compliance and efficiency in every deal.

Get more for Massachusetts Estate

- Jv 510 proof of servicejuvenile form

- Request for trial by written declaration vehicle code form

- Srnc fc addendum quotaquot americans with disabilities act form

- Fillable online academics uww what led to desegregation in form

- Tr 500 info instructions to defendant for remote video proceeding judicial council forms

- 2015 2019 form ca tr 505 fill online printable fillable

- Tr inst notice to appear and related forms judicial council forms

- Form ucc 5 download printable pdf information statement

Find out other Massachusetts Estate

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT