California California Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

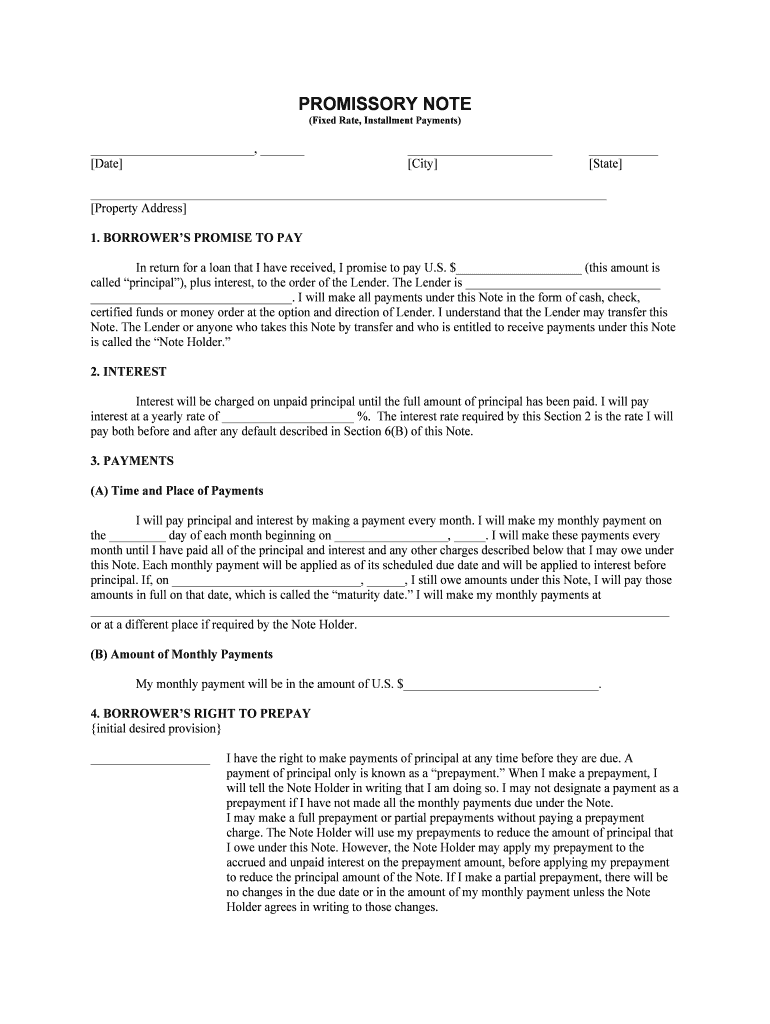

The California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property in California. This form specifies the repayment schedule, interest rate, and obligations of both the borrower and lender. It serves as a binding agreement that protects the interests of both parties involved in the transaction.

Key elements of the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements are essential for the validity of this promissory note. These include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: Detailed information on how and when payments will be made.

- Secured Property: Identification of the residential real estate that secures the loan.

- Signatures: Required signatures from both the borrower and lender, which validate the agreement.

Steps to complete the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the promissory note involves several steps:

- Gather necessary information, including the principal amount, interest rate, and payment terms.

- Clearly identify the residential property being used as collateral.

- Fill out the form accurately, ensuring all details are correct.

- Review the document for completeness and accuracy.

- Obtain signatures from both parties, ensuring that they are dated appropriately.

Legal use of the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This promissory note is legally binding when executed properly. It must comply with California state laws regarding secured loans and promissory notes. Both parties should be aware of their rights and obligations as outlined in the document. Legal advice may be beneficial to ensure compliance with all applicable laws.

How to use the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This form can be utilized in various scenarios, such as personal loans between individuals or transactions involving financial institutions. It is crucial to ensure that the note is filled out correctly and signed by both parties to facilitate a smooth lending process. Once completed, the note can be stored securely, either digitally or in paper form, for future reference.

State-specific rules for the California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

California has specific regulations governing promissory notes and secured loans. It is important to adhere to these rules to ensure the enforceability of the note. This includes understanding the requirements for interest rates, disclosure obligations, and the rights of the parties involved. Familiarity with these state-specific rules can help prevent legal disputes in the future.

Quick guide on how to complete california california installments fixed rate promissory note secured by residential real estate

Effortlessly Prepare California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and efficiently. Handle California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any device using airSlate SignNow applications for Android or iOS, and streamline any document-driven procedure today.

How to Alter and eSign California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate with Ease

- Locate California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click Get Form to initiate.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to store your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misdirected files, tedious form searches, or errors necessitating reprinting of new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate to assure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document outlining a borrower's repayment obligations for a loan that is backed by residential property. This promissory note specifies fixed installment payments over a predetermined period, providing security for lenders and clarity for borrowers.

-

How do I create a California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Creating a California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate can be easily accomplished using airSlate SignNow's user-friendly interface. Simply select a template, customize it to meet your specific loan terms, and ensure all parties eSign the document for legal validity.

-

What are the benefits of using airSlate SignNow for my California California Installments Fixed Rate Promissory Note?

Using airSlate SignNow for your California California Installments Fixed Rate Promissory Note offers numerous benefits, including faster document processing, enhanced security with electronic signatures, and cost-effectiveness. The platform streamlines the workflow and ensures that all documentation is compliant with California regulations.

-

Is the California California Installments Fixed Rate Promissory Note legally binding?

Yes, a California California Installments Fixed Rate Promissory Note secured by residential real estate is legally binding as long as it meets the requirements set forth by California law. This includes proper execution and eSignatures, which airSlate SignNow facilitates to ensure compliance and enforceability.

-

Can I customize my California California Installments Fixed Rate Promissory Note template?

Absolutely! With airSlate SignNow, you can fully customize your California California Installments Fixed Rate Promissory Note template to reflect the specific terms and conditions of your loan agreement. Adjust variables such as interest rate, payment schedule, and borrower information to fit your needs.

-

What integrations does airSlate SignNow offer for managing my California California Installments Fixed Rate Promissory Note?

airSlate SignNow offers various integrations with popular platforms such as Google Drive, Salesforce, and Zapier to enhance your workflow. These integrations make it easier to manage your California California Installments Fixed Rate Promissory Note alongside other business processes, improving efficiency and productivity.

-

How much does it cost to use airSlate SignNow for my California California Installments Fixed Rate Promissory Note?

AirSlate SignNow provides various pricing plans that are cost-effective for managing documents, including California California Installments Fixed Rate Promissory Notes. The pricing typically depends on the features needed; however, the solution is designed to be affordable for businesses and individuals alike.

Get more for California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Find out other California California Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF