Gift Deed Form

What is the Gift Deed

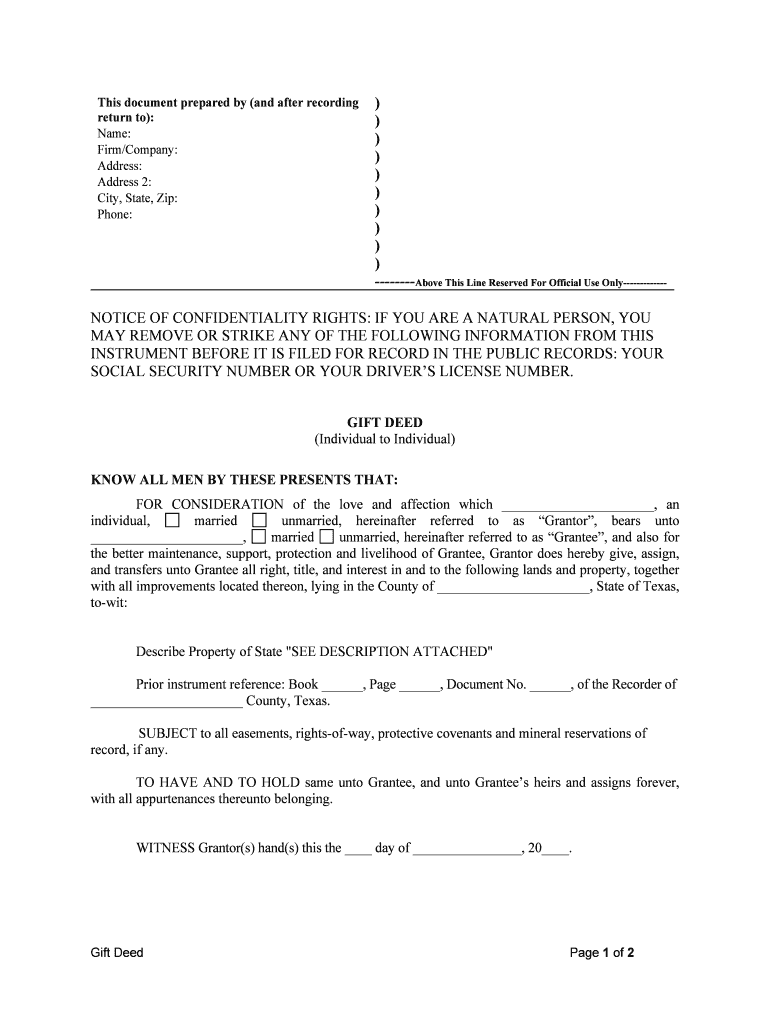

A gift deed is a legal document used to transfer ownership of property from one individual to another without any exchange of money or consideration. In the context of Texas, this document is particularly relevant when a property owner wishes to gift a portion of their property, such as fifty percent, to their spouse. The gift deed serves to formalize the transfer and ensure that the recipient has clear title to the property. It is essential for the deed to be executed properly to avoid any future disputes regarding ownership.

Steps to Complete the Gift Deed

Completing a Texas gift deed form involves several important steps to ensure that the transfer is legally valid. First, the property owner must clearly identify the property being gifted, including a legal description. Next, the owner should fill out the gift deed form with the necessary details, including the names of both the giver and the recipient. It is crucial to include the percentage of ownership being transferred, in this case, fifty percent. After filling out the form, both parties must sign it in the presence of a notary public to validate the deed. Finally, the completed deed should be recorded with the county clerk’s office where the property is located to make the transfer official.

Key Elements of the Gift Deed

Several key elements must be included in a Texas gift deed to ensure its validity. These elements include:

- Names of the Parties: Full legal names of both the donor and the recipient.

- Legal Description of the Property: A detailed description of the property being transferred, including boundaries.

- Percentage of Ownership: Clearly state the percentage of the property being gifted, such as fifty percent.

- Signatures: Both parties must sign the document in front of a notary public.

- Notary Acknowledgment: A notary public must acknowledge the signatures to validate the deed.

Legal Use of the Gift Deed

The legal use of a gift deed in Texas is significant, as it allows for the transfer of property without the need for a sale. This can be particularly useful in estate planning, where individuals wish to transfer property to family members or loved ones while retaining certain rights, such as the right to live on the property until death. It is important to note that the gift deed must comply with Texas laws to be enforceable. Additionally, the transfer may have tax implications, so it is advisable to consult with a legal professional or tax advisor when executing a gift deed.

Required Documents

To complete a Texas gift deed, several documents may be required. These typically include:

- Gift Deed Form: The completed gift deed form itself.

- Identification: Valid identification for both the donor and the recipient.

- Property Deed: A copy of the current deed for the property being transferred.

- Notary Public: Access to a notary public for signature verification.

IRS Guidelines

When transferring property via a gift deed, it is essential to be aware of IRS guidelines regarding gift taxes. In the United States, gifts above a certain value may be subject to taxation. For the year 2023, the annual exclusion amount is set at a specific limit, which allows individuals to gift up to that amount without incurring a gift tax. It is advisable to keep records of the transaction and consult with a tax professional to ensure compliance with IRS regulations and to understand any potential tax implications for both the giver and the recipient.

Quick guide on how to complete gift deed

Complete Gift Deed effortlessly on any device

Online document administration has become increasingly common among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Gift Deed on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Gift Deed effortlessly

- Find Gift Deed and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Gift Deed and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Texas gift deed?

A Texas gift deed is a legal document used to transfer property ownership as a gift, without any exchange of money. This type of deed is essential for ensuring that the transfer complies with Texas laws and eliminates the possibility of future claims. It generally requires the grantor's signature and should be recorded with the county clerk.

-

How can airSlate SignNow assist with drafting a Texas gift deed?

airSlate SignNow provides templates and tools that simplify the drafting process of a Texas gift deed. Our platform enables users to customize the document easily and integrate necessary clauses required by Texas law. This efficiency helps you ensure that your gift deed is both compliant and accurate.

-

What are the benefits of using airSlate SignNow for Texas gift deeds?

Using airSlate SignNow for Texas gift deeds offers several benefits, including easy document management, expedited signing processes, and secure storage. Our platform ensures that all parties can quickly review and sign the deed electronically, streamlining what can often be a lengthy process. Additionally, you can access and manage your documents anywhere, anytime.

-

Is there a cost to use airSlate SignNow for creating a Texas gift deed?

Yes, airSlate SignNow offers flexible pricing plans to suit different needs, including those specifically for creating Texas gift deeds. While there are nominal fees associated with using the platform, the time saved and ease of use often outweigh the costs. For detailed pricing, you can visit our website or contact our sales team.

-

Can I integrate airSlate SignNow with other applications for managing Texas gift deeds?

Absolutely! airSlate SignNow provides integration capabilities with various applications and software to enhance your experience in managing Texas gift deeds. You can connect with tools for accounting, CRM, and more, making it easy to streamline your documentation processes. This integration functionality allows for more efficient workflows.

-

What features does airSlate SignNow offer for eSigning Texas gift deeds?

airSlate SignNow offers features such as secure eSignature collection and tracking for Texas gift deeds. These features ensure that all signatures are legally binding and that you can monitor the signing process in real time. Additionally, reminders can be set for signers to complete the document, which further expedites the process.

-

How do I ensure my Texas gift deed is legally binding?

To ensure your Texas gift deed is legally binding, it must be signed by the grantor and, in some cases, a witness may be required. Additionally, the deed must be properly recorded with the county clerk's office to provide public notice of the transfer. Utilizing airSlate SignNow can help you navigate documentation requirements and ensure compliance with Texas laws.

Get more for Gift Deed

- Claim of exemption client security fund form

- Application for reimbursement client security fund form

- E services electronic attorney registration exemption request form

- E services attorney advertising form

- Form jd gc 6

- Motion for default for failure to plead and judgment eforms

- Motion for default for failure to appear and judgment for form

- Motion for continuance connecticut judicial branch form

Find out other Gift Deed

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word