Transfer on Death Deed Form

What is the Transfer On Death Deed

A Transfer On Death Deed (TOD deed) is a legal document that allows an individual to designate a beneficiary who will receive their property upon their death, bypassing the probate process. This type of deed is particularly useful for ensuring that assets are transferred smoothly and efficiently without the need for court intervention. In Michigan, the TOD deed must be executed according to state laws to be considered valid.

How to use the Transfer On Death Deed

To use a Transfer On Death Deed, an individual must fill out the form with the necessary information, including the property description and the beneficiary's details. Once completed, the deed must be signed and notarized. It is then recorded with the county register of deeds where the property is located. This process ensures that the beneficiary's rights are recognized and that the property will transfer directly to them upon the owner's death.

Steps to complete the Transfer On Death Deed

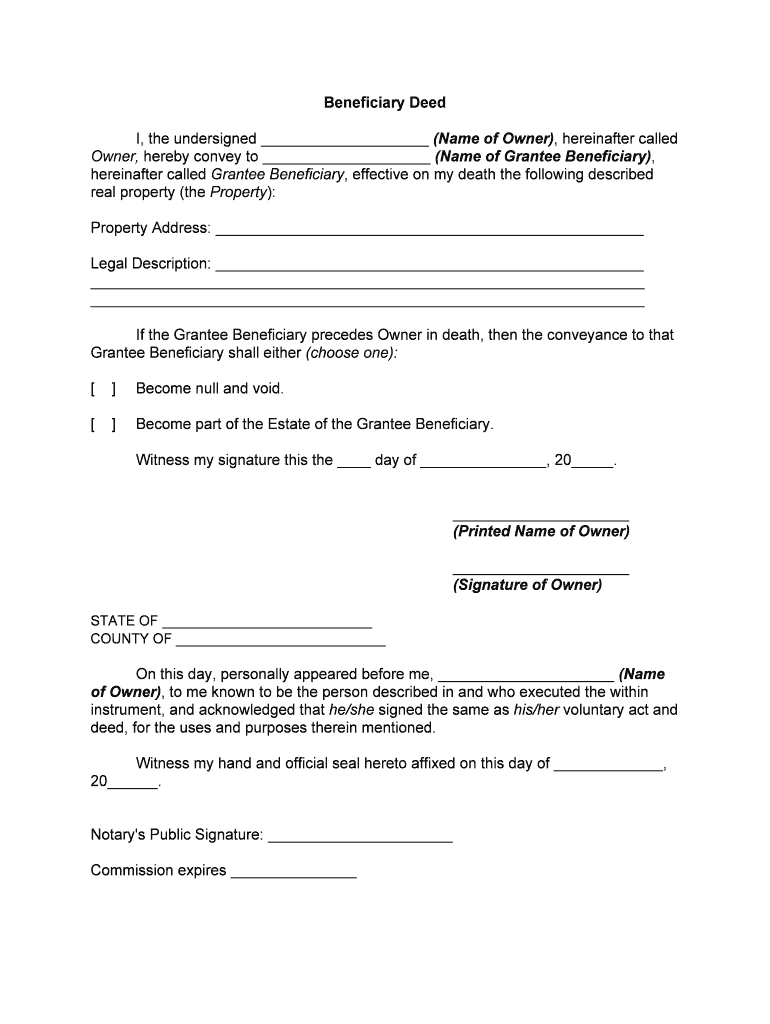

Completing a Transfer On Death Deed involves several key steps:

- Obtain a printable transfer on death deed form specific to Michigan.

- Fill out the form with accurate property and beneficiary information.

- Sign the document in the presence of a notary public.

- Record the signed deed with the county register of deeds.

Following these steps carefully ensures that the deed is legally binding and effective in transferring property upon death.

Key elements of the Transfer On Death Deed

Several key elements must be included in a Transfer On Death Deed for it to be valid:

- The name and address of the property owner.

- A clear description of the property being transferred.

- The name and address of the designated beneficiary.

- The signature of the property owner, along with notarization.

Including all these elements helps avoid disputes and ensures that the transfer occurs as intended.

State-specific rules for the Transfer On Death Deed

Michigan has specific rules governing the use of Transfer On Death Deeds. The deed must be recorded within a certain time frame after execution, and it must comply with state laws regarding property transfers. Additionally, the beneficiary must be an individual or a trust; entities such as corporations cannot be named as beneficiaries. Understanding these state-specific rules is crucial for ensuring the validity of the deed.

Legal use of the Transfer On Death Deed

The legal use of a Transfer On Death Deed in Michigan allows property owners to maintain control over their assets during their lifetime while designating a beneficiary for automatic transfer upon death. This legal tool can help avoid probate, reduce estate taxes, and simplify the transfer process for heirs. However, it is important to consult with a legal professional to ensure compliance with all applicable laws and regulations.

Quick guide on how to complete transfer on death deed

Easily Prepare Transfer On Death Deed on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the proper forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly and without delays. Manage Transfer On Death Deed on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

Steps to Edit and Electronically Sign Transfer On Death Deed Effortlessly

- Find Transfer On Death Deed and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and hit the Done button to save your changes.

- Choose your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and electronically sign Transfer On Death Deed and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer on death deed in Michigan?

A transfer on death deed in Michigan is a legal document that allows an individual to transfer real estate assets to a designated beneficiary upon their death without going through probate. This convenient option simplifies the transfer process and ensures that your property goes directly to your loved ones.

-

How do I create a transfer on death deed in Michigan?

To create a transfer on death deed in Michigan, you need to fill out the appropriate form, which includes details about the property and the beneficiary. After properly signing and notarizing the document, it must be recorded with the county register of deeds to be effective.

-

What are the benefits of using a transfer on death deed in Michigan?

Using a transfer on death deed in Michigan provides several benefits, including avoiding probate, reducing estate settlement costs, and allowing for complete control over your property during your lifetime. Additionally, it offers peace of mind knowing that your designated beneficiary will receive the property directly upon your passing.

-

Is there a cost associated with filing a transfer on death deed in Michigan?

Yes, there is typically a fee associated with filing a transfer on death deed in Michigan, which varies by county. It's advisable to check with your local county register of deeds for specific pricing and any additional costs that may arise for notarization or legal assistance.

-

Can I revoke a transfer on death deed in Michigan?

Yes, you can revoke a transfer on death deed in Michigan at any time while you are still alive. To do so, you need to file a revocation document with the county register of deeds, ensuring that your wishes are accurately reflected and that your property transfer plans can be modified.

-

Are there any restrictions on beneficiaries for the transfer on death deed in Michigan?

In Michigan, you can name an individual or multiple beneficiaries in a transfer on death deed, but there are certain restrictions. For example, minors or individuals who may not be able to manage the property effectively should be considered carefully when naming beneficiaries.

-

How does airSlate SignNow assist with a transfer on death deed in Michigan?

airSlate SignNow offers an easy-to-use platform that enables you to create, send, and eSign your transfer on death deed in Michigan efficiently. Our cost-effective solution simplifies the document preparation process, allowing you to focus on your estate planning needs.

Get more for Transfer On Death Deed

- Filers interface getting started eflex delawaregov form

- Balloon mortgage note form balloon mortgage

- Secured promissory note installment payments suze orman form

- Signed and sworn to or affirmed before me on form

- How do you change your business name with the irs form

- 49a 105 execution of personal power of attorney justia law form

- Delaware legal form titles legal documentsus legal

- West virginia statutory power of attorney form peia state

Find out other Transfer On Death Deed

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy