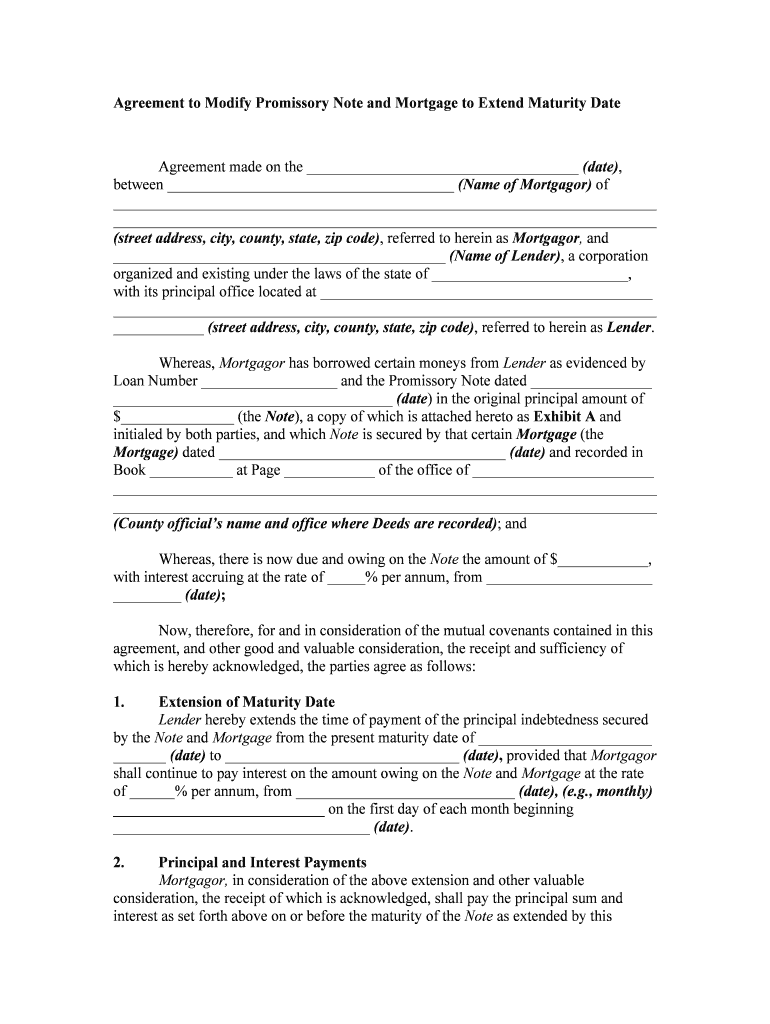

Maturity Date Form

What is the maturity date?

The maturity date refers to the specific date when the principal amount of a loan or financial instrument, such as a note mortgage document, becomes due and payable. This date is crucial as it marks the end of the loan term, at which point the borrower is expected to repay the remaining balance. Understanding the maturity date is essential for both lenders and borrowers, as it influences payment schedules and interest calculations.

How to use the maturity date

Using the maturity date effectively involves understanding its implications on your mortgage or loan agreement. Borrowers should be aware of the maturity date to ensure timely payments and avoid penalties. It is also important for planning future financial commitments. Lenders use the maturity date to assess risk and manage their loan portfolios, ensuring that they receive payments as scheduled.

Key elements of the maturity date

Several key elements define the maturity date in a note mortgage document:

- Loan Term: The duration of the loan, which can range from a few months to several decades.

- Payment Schedule: The frequency of payments (monthly, quarterly, etc.) leading up to the maturity date.

- Interest Rate: The rate at which interest is calculated on the outstanding balance until the maturity date.

- Amortization: The process of gradually paying off the loan through scheduled payments, which may affect the final amount due at maturity.

Steps to complete the maturity date

Completing the maturity date process involves several steps:

- Review the Loan Agreement: Understand the terms, including the maturity date and any conditions attached.

- Prepare for Payment: Ensure that funds are available to cover the final payment, including any accrued interest.

- Confirm Payment Methods: Determine how the payment will be made, whether online, by mail, or in person.

- Document the Payment: Keep records of the payment made on or before the maturity date for future reference.

Legal use of the maturity date

The maturity date has legal significance in a note mortgage document. It establishes the timeline for repayment and can affect the borrower’s credit rating if payments are missed. Legal frameworks, such as the Uniform Commercial Code (UCC), govern how maturity dates are handled in financial agreements. Understanding these legal aspects helps ensure compliance and protects the rights of both parties involved.

Examples of using the maturity date

Examples of how the maturity date is applied include:

- A borrower taking out a thirty-year fixed-rate mortgage will have a maturity date set thirty years from the loan origination date.

- If a borrower refinances their mortgage, the new maturity date will reset based on the terms of the new agreement.

- In the case of a balloon mortgage, the maturity date may require a large final payment, necessitating careful financial planning.

Quick guide on how to complete maturity date

Effortlessly Prepare Maturity Date on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without hindrance. Manage Maturity Date on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Maturity Date Effortlessly

- Find Maturity Date and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details carefully and hit the Done button to preserve your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Maturity Date to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a note mortgage document?

A note mortgage document is a legally binding agreement between a borrower and a lender, outlining the terms of a loan secured by real property. It includes details like the amount borrowed, interest rate, and repayment schedule. Understanding this document is crucial for both parties to ensure compliance and clarity.

-

How can airSlate SignNow help with signing note mortgage documents?

airSlate SignNow streamlines the process of signing note mortgage documents by allowing users to eSign them electronically. This eliminates the need for physical signatures and speeds up the document processing time. Its user-friendly interface makes it easy for all parties to review and sign important agreements.

-

What are the pricing options for using airSlate SignNow for note mortgage documents?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it a cost-effective solution for managing note mortgage documents. Pricing varies based on features and the number of users, ensuring businesses can choose a plan that fits their budget. There are also free trial options available for new users.

-

What features does airSlate SignNow provide for note mortgage document management?

airSlate SignNow offers a variety of features for managing note mortgage documents, including document templates, customizable workflows, and secure storage. The platform also provides an audit trail to track changes and signer actions, enhancing security and compliance. Additionally, integration with various cloud storage services ensures seamless document handling.

-

Are note mortgage documents legally binding when signed with airSlate SignNow?

Yes, note mortgage documents signed through airSlate SignNow are legally binding. The platform complies with eSignature laws, ensuring that electronic signatures hold the same legal weight as traditional handwritten signatures. This allows for safe and efficient transactions in the real estate industry.

-

Can I integrate airSlate SignNow with other tools for managing note mortgage documents?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business tools, including CRM systems and project management software. This allows for efficient workflow creation and management of note mortgage documents across different platforms, enhancing productivity and collaboration among teams.

-

What benefits does using airSlate SignNow for note mortgage documents provide?

Using airSlate SignNow for note mortgage documents provides numerous benefits, including faster processing times and reduced paperwork. The platform's user-friendly interface and mobile accessibility allow for easy signing anywhere at any time. Additionally, enhanced security features help protect sensitive information.

Get more for Maturity Date

- The grantors and husband and form

- The grantors and form

- Accordance with the applicable laws of the state of illinois form

- Accordance with the applicable laws of the state of illinois and form

- Cohabitation agreement between parties living together but remaining unmarriedwith residence owned by one of the parties form

- Section 4 subcontractors written contract notice filing form

- Architect mechanics lien notice and claim corporation form

- Control number il 019 77 form

Find out other Maturity Date

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form