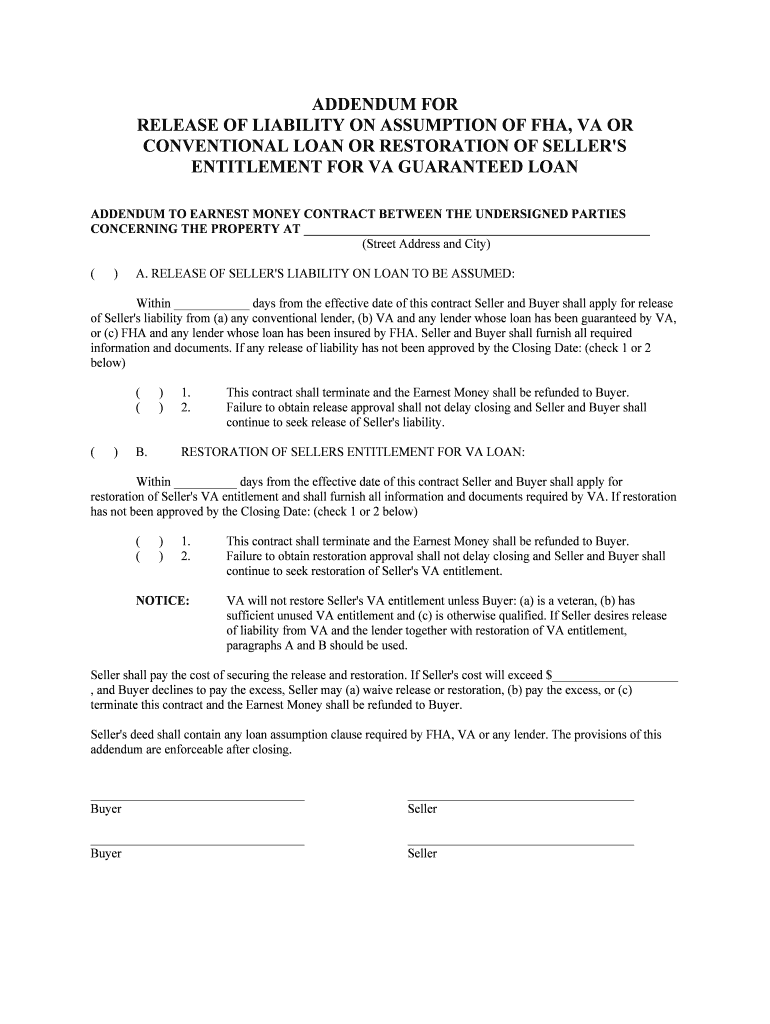

Fha Va Form

What is the FHA VA?

The FHA VA refers to a combination of the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) loan programs. These programs are designed to assist eligible individuals in obtaining financing for home purchases. The FHA provides mortgage insurance on loans made by approved lenders to borrowers with low to moderate incomes, while the VA offers guaranteed loans to veterans, active-duty service members, and certain members of the National Guard and Reserves. Both programs aim to make homeownership more accessible, particularly for those who may face challenges in securing traditional financing.

How to Use the FHA VA

Utilizing the FHA VA involves understanding the specific requirements and benefits of each program. Borrowers must first determine their eligibility based on factors such as military service for VA loans or income levels for FHA loans. Once eligibility is established, prospective homeowners can work with approved lenders to apply for a loan. This process typically includes submitting necessary documentation, such as proof of income, credit history, and details about the property being purchased. Understanding the nuances of each program can help borrowers select the best option for their financial situation.

Steps to Complete the FHA VA

Completing the FHA VA application process involves several key steps:

- Gather necessary documents, including income verification, credit reports, and property details.

- Determine eligibility based on FHA or VA guidelines.

- Choose an approved lender who specializes in FHA or VA loans.

- Complete the loan application form and provide all required documentation.

- Await loan approval, which may involve additional verification from the lender.

- Review loan terms and conditions before closing on the property.

Legal Use of the FHA VA

The legal use of FHA VA loans is governed by specific regulations that ensure compliance with federal guidelines. Both programs require that borrowers meet certain criteria to qualify for the benefits offered. For FHA loans, this includes adhering to income limits and credit score requirements. VA loans have their own set of eligibility criteria, primarily focused on military service. It is critical for borrowers to understand these legal frameworks to ensure their loan application is valid and compliant with the law.

Eligibility Criteria

Eligibility for FHA VA loans varies between the two programs. For FHA loans, borrowers typically need a credit score of at least 580 to qualify for a lower down payment option, while those with scores between 500 and 579 may still qualify with a higher down payment. VA loans require borrowers to have served in the military or be an eligible survivor, along with meeting service length requirements. Understanding these criteria is essential for potential borrowers to navigate the application process successfully.

Required Documents

When applying for an FHA VA loan, borrowers must prepare various documents to support their application. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Credit reports to assess financial history.

- Details of the property being purchased, including purchase agreement.

- Certificate of eligibility for VA loans, if applicable.

- Identification documents, such as a driver's license or Social Security card.

Form Submission Methods

Submitting an FHA VA loan application can be done through various methods, depending on the lender's processes. Most lenders offer online applications, allowing borrowers to fill out and submit their forms digitally. Some may also accept applications via mail or in-person visits to their offices. It is important for borrowers to check with their chosen lender to understand the preferred submission method and any specific requirements associated with it.

Quick guide on how to complete fha va

Complete Fha Va seamlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Fha Va on any device using the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

The simplest way to modify and eSign Fha Va with ease

- Find Fha Va and click Get Form to commence.

- Utilize the features we provide to complete your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal value as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fha Va and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the difference between FHA and VA loans?

FHA and VA loans are both government-backed mortgage options, but they serve different purposes. FHA loans are designed for low to moderate-income borrowers, while VA loans are specifically for eligible veterans and active-duty military members. Understanding these differences helps in selecting the right mortgage type that best fits your needs.

-

How can airSlate SignNow help with FHA VA loan documentation?

airSlate SignNow streamlines the documentation process for FHA VA loans by enabling users to eSign and send essential documents electronically. This eliminates cumbersome paperwork and speeds up the approval process. With our user-friendly platform, both lenders and borrowers can manage their FHA VA transactions efficiently.

-

What are the pricing options for airSlate SignNow for FHA VA transactions?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those handling FHA VA transactions. Our cost-effective solutions allow businesses to choose a plan that fits their budget without compromising on features. Check our website for the latest pricing details tailored specifically for FHA VA-related services.

-

What features does airSlate SignNow offer for FHA VA loan processing?

airSlate SignNow provides essential features including document templates, automated workflows, and real-time tracking specifically for FHA VA loan processing. These features ensure a seamless experience from loan application to closing. Additionally, our secure platform ensures that all sensitive information is protected during this process.

-

Can airSlate SignNow integrate with other tools I use for FHA VA loans?

Yes, airSlate SignNow is designed to integrate seamlessly with various tools and software already in use for FHA VA loans, such as CRM systems and loan origination software. This integration allows for a cohesive workflow and enhances productivity by consolidating all necessary tools in one place. Explore our integration options to see how we can fit into your existing systems.

-

What are the benefits of using airSlate SignNow for FHA VA loan agreements?

Using airSlate SignNow for FHA VA loan agreements offers numerous benefits, including reduced turnaround time for document signing and enhanced security. Our platform allows for easy tracking of document statuses, ensuring no steps are missed in the FHA VA loan process. Additionally, it fosters better communication between lenders and borrowers.

-

Is airSlate SignNow compliant with FHA and VA regulations?

Absolutely, airSlate SignNow is compliant with all relevant FHA and VA regulations, ensuring that your eSigning and documentation processes adhere to industry standards. Our commitment to compliance allows users to confidently handle sensitive FHA VA transactions. We continuously update our platform to align with changing regulations.

Get more for Fha Va

- Defendant through undersigned counsel moves that the in form

- Defendant through undersigned counsel moves that the sentencing in the form

- Defendant through undersigned counsel moves that the trial in the abovecaptioned case be continued from the date on which it is form

- State of louisiana v mario t willis 2018 louisiana form

- Us envtl servs llc v nelsonla ct appjudgment form

- Claude ford form

- Motion and order to continue without date form

- How to file a motion for contemptus legal forms

Find out other Fha Va

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free