Using a BuySell Agreement to Transfer Ownership the Tax Adviser Form

What is the Using A BuySell Agreement To Transfer Ownership The Tax Adviser

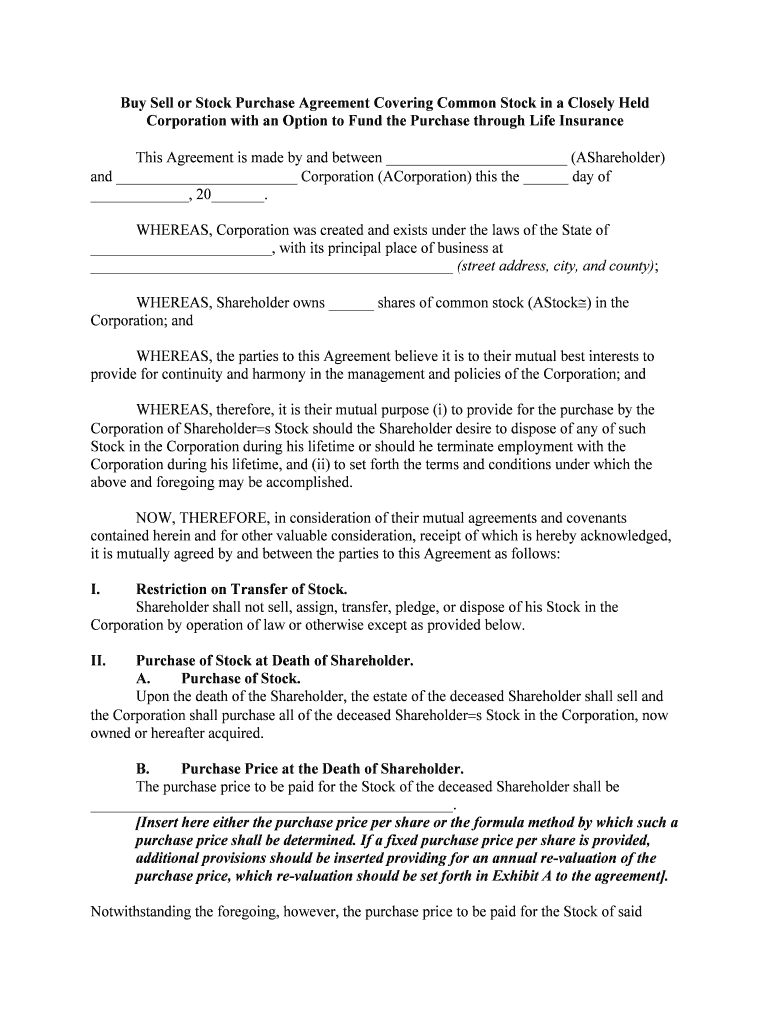

The Using A BuySell Agreement To Transfer Ownership The Tax Adviser is a legal document that outlines the terms under which ownership of a business or asset can be transferred. This agreement is particularly important for businesses with multiple owners, as it helps to ensure a smooth transition of ownership in the event of a sale, retirement, or death of an owner. The agreement typically includes details about the valuation of the business, the process for transferring ownership, and any restrictions on the sale of shares. Understanding this document is crucial for business owners to protect their interests and maintain stability within the company.

Key elements of the Using A BuySell Agreement To Transfer Ownership The Tax Adviser

Several key elements are essential to include in the Using A BuySell Agreement To Transfer Ownership The Tax Adviser. These elements ensure clarity and enforceability:

- Valuation Method: Clearly define how the business will be valued at the time of transfer.

- Triggering Events: Specify the events that will initiate the buy-sell process, such as death, disability, or voluntary exit.

- Payment Terms: Outline how the purchase price will be paid, including any installment options.

- Restrictions on Transfer: Include any limitations on who can buy the shares, ensuring that ownership remains within a designated group.

- Dispute Resolution: Establish a process for resolving disputes that may arise during the transfer process.

Steps to complete the Using A BuySell Agreement To Transfer Ownership The Tax Adviser

Completing the Using A BuySell Agreement To Transfer Ownership The Tax Adviser involves several important steps:

- Identify the Parties: List all owners and their respective ownership percentages.

- Determine Valuation: Agree on a method for valuing the business, which may involve professional appraisals.

- Draft the Agreement: Work with legal counsel to draft the agreement, ensuring all key elements are included.

- Review and Revise: Have all parties review the document, making necessary revisions to address concerns.

- Sign the Agreement: Ensure all parties sign the agreement, preferably in the presence of a notary.

Legal use of the Using A BuySell Agreement To Transfer Ownership The Tax Adviser

The legal use of the Using A BuySell Agreement To Transfer Ownership The Tax Adviser is governed by state laws and regulations. It is essential for the agreement to comply with applicable laws to be enforceable. This includes ensuring that the agreement is properly executed, which may involve notarization or witness signatures. Additionally, the agreement should adhere to any specific legal requirements related to business ownership transfers in the relevant state. Consulting with a legal professional can help ensure compliance and mitigate potential legal issues.

IRS Guidelines

IRS guidelines play a crucial role in the tax implications of transferring ownership through the Using A BuySell Agreement To Transfer Ownership The Tax Adviser. The IRS requires that any transfer of ownership be reported correctly for tax purposes. This includes understanding the tax consequences for both the seller and the buyer, including capital gains tax and any potential deductions. Proper documentation and adherence to IRS guidelines can help avoid penalties and ensure that both parties fulfill their tax obligations.

State-specific rules for the Using A BuySell Agreement To Transfer Ownership The Tax Adviser

State-specific rules significantly impact the Using A BuySell Agreement To Transfer Ownership The Tax Adviser. Each state has its own laws regarding business ownership transfers, including specific requirements for the execution and enforcement of buy-sell agreements. It is important for business owners to familiarize themselves with these rules to ensure compliance. This may include understanding the legal age for signing contracts, any required disclosures, and the specific procedures for transferring ownership. Consulting a local attorney can provide guidance tailored to the state in which the business operates.

Quick guide on how to complete using a buysell agreement to transfer ownership the tax adviser

Easily Prepare Using A BuySell Agreement To Transfer Ownership The Tax Adviser on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Using A BuySell Agreement To Transfer Ownership The Tax Adviser on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Modify and eSign Using A BuySell Agreement To Transfer Ownership The Tax Adviser

- Obtain Using A BuySell Agreement To Transfer Ownership The Tax Adviser and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or overlooked documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Using A BuySell Agreement To Transfer Ownership The Tax Adviser and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a BuySell Agreement and why is it important?

A BuySell Agreement is a legally binding contract that outlines how ownership of a business will be transferred in various situations. Using A BuySell Agreement To Transfer Ownership The Tax Adviser can ensure that all parties are protected and that the process is clear and efficient.

-

How can airSlate SignNow help with BuySell Agreements?

airSlate SignNow offers a platform that simplifies the process of creating, sending, and eSigning BuySell Agreements. Using A BuySell Agreement To Transfer Ownership The Tax Adviser, you can expedite transactions while maintaining legal compliance and efficiency.

-

What features does airSlate SignNow provide for document management?

The platform includes features such as customizable templates, secure eSigning, and document tracking. These features are essential for businesses Using A BuySell Agreement To Transfer Ownership The Tax Adviser, ensuring that the agreements are executed swiftly and with full accountability.

-

Are there any costs associated with using airSlate SignNow for BuySell Agreements?

AirSlate SignNow offers various pricing plans to accommodate different business needs and budgets. Investing in a plan that supports Using A BuySell Agreement To Transfer Ownership The Tax Adviser can save you time and enhance your document management capabilities.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow supports integrations with numerous software applications, making it easier to incorporate into your existing workflow. This is beneficial when Using A BuySell Agreement To Transfer Ownership The Tax Adviser, as you can streamline processes across platforms.

-

What are the benefits of using airSlate SignNow for eSigning?

The benefits include enhanced security, ease of use, and faster turnaround times for document completion. When Using A BuySell Agreement To Transfer Ownership The Tax Adviser, these advantages help ensure a smooth and efficient transfer of ownership.

-

Is airSlate SignNow secure for handling sensitive agreements?

Absolutely. airSlate SignNow employs robust security measures including encryption to protect your documents. This is crucial when Using A BuySell Agreement To Transfer Ownership The Tax Adviser, ensuring that sensitive information remains confidential and secure.

Get more for Using A BuySell Agreement To Transfer Ownership The Tax Adviser

- Attorney general national criminal justice reference service form

- Mo pc am form

- Mo rev stat351290 section 351290 bylaws how form

- Chap 15 ms organizational structure my progress 100 results form

- Attn corporations division form

- Statement of reimbursable attorney fees sections 6301306 form

- Application of creditor for refusal of letters missouri courts form

- Order of refusal of letters to surviving spouse clay county form

Find out other Using A BuySell Agreement To Transfer Ownership The Tax Adviser

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors