Utah Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children Form

What is the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

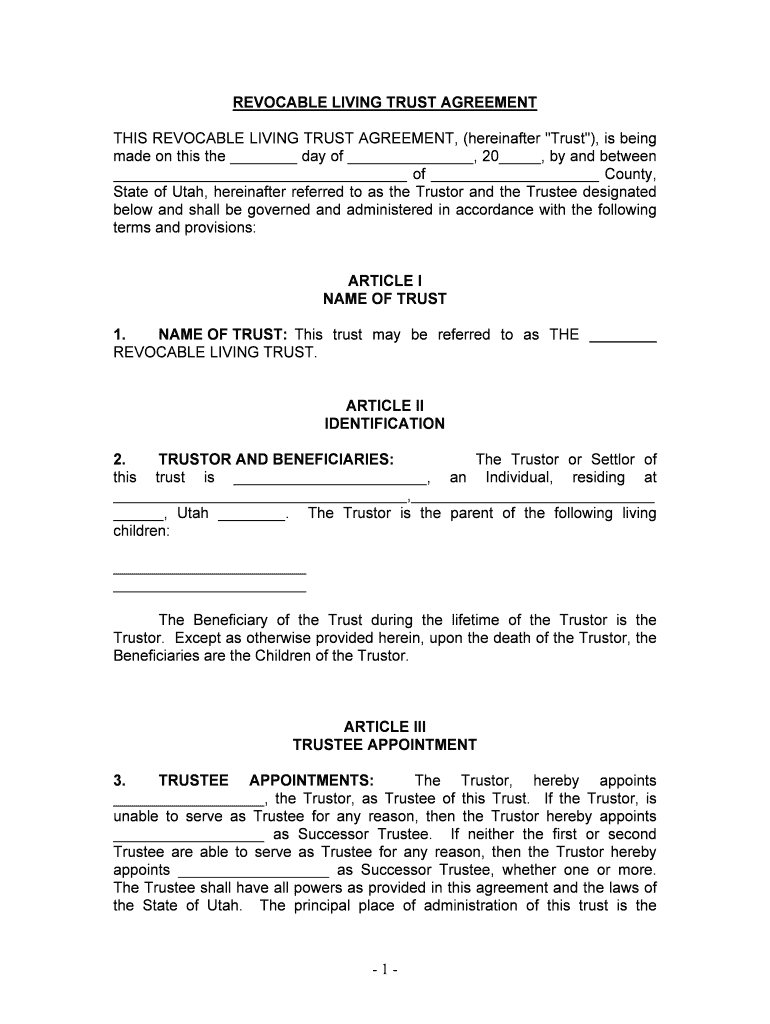

The Utah Living Trust for individuals who are single, divorced, or widowed with children is a legal document designed to manage and distribute a person's assets after their death. This trust allows individuals to specify how their assets should be handled, ensuring that their children and other beneficiaries receive their intended inheritance. Unlike a will, a living trust can help avoid the probate process, which can be lengthy and costly. This type of trust is particularly beneficial for those who want to maintain control over their assets while providing for their loved ones.

How to Use the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

Using the Utah Living Trust involves several key steps. First, individuals must identify their assets and decide how they wish to distribute them among their beneficiaries. Next, they will need to create the trust document, which outlines the terms of the trust, including the trustee's responsibilities. Once the trust is established, assets should be transferred into the trust. This ensures that the trust controls these assets upon the individual's passing. Regular reviews and updates to the trust are recommended to reflect any changes in personal circumstances or state laws.

Steps to Complete the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

Completing the Utah Living Trust involves a systematic approach:

- Identify Assets: List all assets you wish to include in the trust.

- Select Beneficiaries: Determine who will inherit your assets.

- Choose a Trustee: Appoint a trusted individual or institution to manage the trust.

- Draft the Trust Document: Create the legal document outlining the trust's terms.

- Transfer Assets: Legally transfer ownership of your assets into the trust.

- Review Regularly: Update the trust as necessary to reflect changes in circumstances.

Key Elements of the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

Several key elements are essential in creating a valid Utah Living Trust:

- Trustee: The person or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive the trust assets.

- Trust Property: The assets placed into the trust, including real estate, bank accounts, and investments.

- Terms of Distribution: Specific instructions on how and when beneficiaries will receive their inheritance.

- Revocability: The ability to alter or revoke the trust during the grantor's lifetime.

State-Specific Rules for the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

Utah has specific laws governing the creation and management of living trusts. It is important to comply with state requirements to ensure the trust is valid. For instance, the trust document must be signed by the grantor and, if necessary, notarized. Additionally, Utah law allows for the revocation of living trusts, providing flexibility for individuals as their circumstances change. Understanding these rules is crucial for effective estate planning.

Eligibility Criteria for the Utah Living Trust for Individuals Who Are Single, Divorced, or Widowed with Children

Eligibility for creating a Utah Living Trust is generally open to any adult individual who wishes to manage their assets. However, specific considerations apply to those who are single, divorced, or widowed with children. Individuals must have the legal capacity to enter into a trust agreement, meaning they should be of sound mind and at least eighteen years old. Additionally, it is advisable for individuals in these situations to consider their children's needs and future welfare when establishing the trust.

Quick guide on how to complete utah living trust for individual who is single divorced or widow or widower with children

Effortlessly prepare Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children on any device

Digital document management has gained traction among businesses and individuals. It offers a seamless, eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and safely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents swiftly without any delays. Manage Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children with ease

- Find Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent portions of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, either via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children while ensuring effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Utah Living Trust for individuals who are single, divorced, or widowed with children?

A Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children is a legal document that allows you to manage your assets during your lifetime and designate beneficiaries for your children after your passing. This type of trust ensures that your assets are distributed according to your wishes, providing peace of mind for you and financial security for your loved ones.

-

How does a Utah Living Trust benefit single or divorced individuals with children?

A Utah Living Trust provides several benefits for single, divorced, or widowed individuals with children, such as avoiding probate, ensuring privacy, and allowing for direct management of assets. This structure can be particularly advantageous for protecting children's interests and simplifying the transfer of assets upon your death.

-

What are the costs involved in setting up a Utah Living Trust for individuals who are single, divorced, or widowed?

The costs for setting up a Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children can vary depending on the complexity of your estate and whether you choose legal assistance. However, airSlate SignNow offers a cost-effective solution that can streamline the creation process, often resulting in lower overall expenses compared to traditional methods.

-

Can I modify my Utah Living Trust if my situation changes?

Yes, you can modify your Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children if your circumstances change, such as remarriage or the birth of another child. It is advisable to review and update your trust periodically to reflect your current wishes and family situation.

-

What documents are needed to create a Utah Living Trust?

To create a Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children, you'll need documentation related to your assets, such as property deeds, bank statements, and insurance policies. Collecting these documents alows for a smoother and more accurate drafting process.

-

How does airSlate SignNow assist in creating a Utah Living Trust?

airSlate SignNow simplifies the process of creating a Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children by providing an easy-to-use platform for document creation and e-signature. Our user-friendly interface allows you to manage your trust efficiently while ensuring compliance with Utah laws.

-

Is a Utah Living Trust necessary if I have a will?

While having a will is important, a Utah Living Trust for Individuals Who Are Single, Divorced, or Widow or Widower With Children can offer additional benefits such as avoiding probate and providing more control over asset distribution. Many individuals find that having both a will and a trust provides the best protection and peace of mind for their families.

Get more for Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children

- Chapter 5 notices and filing and service of form

- Instructions for starting a cityjustice court civil case form

- Form 1 summons official form montana legislature

- Of receipt of summons form

- To city officer constable county sheriff process server form

- Montana judges deskbook municipal justice and city courts form

- The state of montana to the above named defendants greetings form

- 162 pretrial procedure in civil cases a matters to be form

Find out other Utah Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With Children

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free