Limited Liability Company Form

What is the Limited Liability Company

A Limited Liability Company (LLC) is a popular business structure in the United States that combines the benefits of both corporations and partnerships. An LLC provides its owners, known as members, with limited liability protection, meaning their personal assets are generally protected from business debts and liabilities. This structure is particularly appealing for small business owners due to its flexibility in management and taxation options.

In Delaware, the formation of a limited liability company is governed by specific state laws, making it essential for business owners to understand these regulations. The LLC structure allows for pass-through taxation, where profits and losses are reported on the members' personal tax returns, avoiding double taxation that corporations typically face.

How to obtain the Limited Liability Company

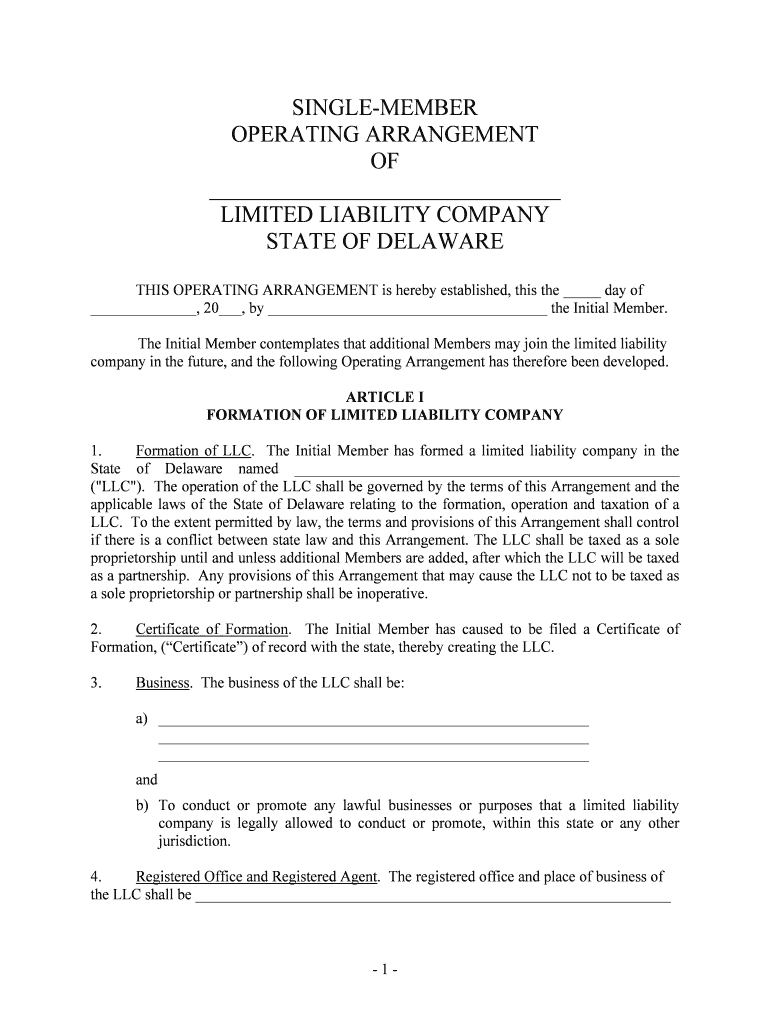

To establish a Delaware limited liability company, business owners must follow a series of steps. First, they should choose a unique name for their LLC that complies with Delaware naming requirements. This name must include the words "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

Next, the formation documents, known as the Certificate of Formation, must be filed with the Delaware Division of Corporations. This document includes essential information such as the LLC's name, the registered agent's name and address, and the purpose of the business. After filing, there is a fee that must be paid, which varies based on the type of filing.

Steps to complete the Limited Liability Company

Completing the formation of a Delaware limited liability company involves several important steps:

- Choose a unique name for your LLC that meets state requirements.

- Select a registered agent who will receive legal documents on behalf of the LLC.

- Prepare and file the Certificate of Formation with the Delaware Division of Corporations.

- Pay the required filing fee.

- Create an operating agreement, although it is not mandatory, it is highly recommended to outline the management structure and operating procedures.

- Obtain any necessary business licenses or permits required for your industry.

Legal use of the Limited Liability Company

The legal use of a Delaware limited liability company involves adhering to state laws and regulations governing LLCs. This includes maintaining compliance with annual reporting requirements and paying the annual franchise tax. Members should also keep accurate records of all business activities and decisions to ensure transparency and legal protection.

Additionally, it is crucial for LLCs to operate within the scope defined in their Certificate of Formation and operating agreement. Engaging in activities outside this scope may jeopardize the limited liability protection afforded to members.

Key elements of the Limited Liability Company

Several key elements define a Delaware limited liability company:

- Limited Liability Protection: Members are protected from personal liability for business debts.

- Flexible Management Structure: LLCs can be managed by members or appointed managers, allowing for varied operational flexibility.

- Pass-Through Taxation: Business income is taxed at the member level, avoiding double taxation.

- Fewer Formalities: LLCs have fewer ongoing compliance requirements compared to corporations.

Eligibility Criteria

To form a Delaware limited liability company, there are specific eligibility criteria that must be met:

- At least one member is required to form an LLC, and there is no maximum limit on the number of members.

- Members can be individuals or other business entities, including corporations and other LLCs.

- There are no residency requirements for members or managers, meaning non-residents can form an LLC in Delaware.

Quick guide on how to complete limited liability company 481371108

Complete Limited Liability Company effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Limited Liability Company on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign Limited Liability Company with ease

- Obtain Limited Liability Company and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Limited Liability Company and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Delaware limited liability and how does it affect my business?

Delaware limited liability refers to the legal protections offered to members of a limited liability company (LLC) formed in Delaware. This structure safeguards personal assets from business debts and liabilities, making it ideal for entrepreneurs. Choosing to operate as a Delaware limited liability can enhance your company's credibility and attract investors.

-

How much does it cost to form a Delaware limited liability company?

The cost to form a Delaware limited liability company includes state filing fees, which typically range from $90 to $300 depending on your business structure. Additional costs may encompass registered agent fees and annual franchise taxes. Overall, forming a Delaware limited liability is a cost-effective choice for business owners seeking legal protection.

-

What are the key features of airSlate SignNow for Delaware limited liability companies?

AirSlate SignNow offers features tailored for Delaware limited liability companies, including secure e-signature capabilities and document management. It ensures compliance with legal standards while streamlining contract processing. Business owners can effectively send and track documents, simplifying workflows and improving productivity.

-

How does using airSlate SignNow benefit my Delaware limited liability company?

Utilizing airSlate SignNow can signNowly benefit your Delaware limited liability company by enhancing efficiency and reducing operational costs. The platform automates document workflows, allowing for quicker turnaround times. Additionally, the secure e-signature feature ensures that all agreements are legally binding and compliant with Delaware law.

-

Can I integrate airSlate SignNow with other tools for my Delaware limited liability company?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications, which can be crucial for a Delaware limited liability company. Popular integrations include CRMs, project management software, and email platforms. This flexibility allows you to streamline operations and maintain a cohesive workflow across your business.

-

What types of documents can I manage with airSlate SignNow for my Delaware limited liability company?

AirSlate SignNow allows you to manage a variety of documents relevant to your Delaware limited liability company, including contracts, agreements, and internal forms. The platform supports various file formats, ensuring all your documentation needs are met. Additionally, you can customize templates to suit your specific business requirements.

-

Is airSlate SignNow secure for my Delaware limited liability company's sensitive information?

Absolutely, airSlate SignNow is designed with top-notch security features to protect your Delaware limited liability company's sensitive information. It employs encryption protocols and secure cloud storage, ensuring that your documents are safe from unauthorized access. Trust in airSlate SignNow for compliant and secure document handling.

Get more for Limited Liability Company

- App 103 appellants notice designating record on appeal form

- App 104 proposed statement on appeal limited civil case form

- App 102 notice of appealcross appeal limited civil case form

- App 107 form

- App 109 proof of service appellate division california courts form

- App 009 info information sheet for proof of service court

- 2019 form ca app 110 fill online printable fillable blank

- App 150 info information on writ proceedings in misdemeanor infraction and limited civil cases judicial council forms

Find out other Limited Liability Company

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation