In Llc Form

What is the Indiana Limited Liability Company?

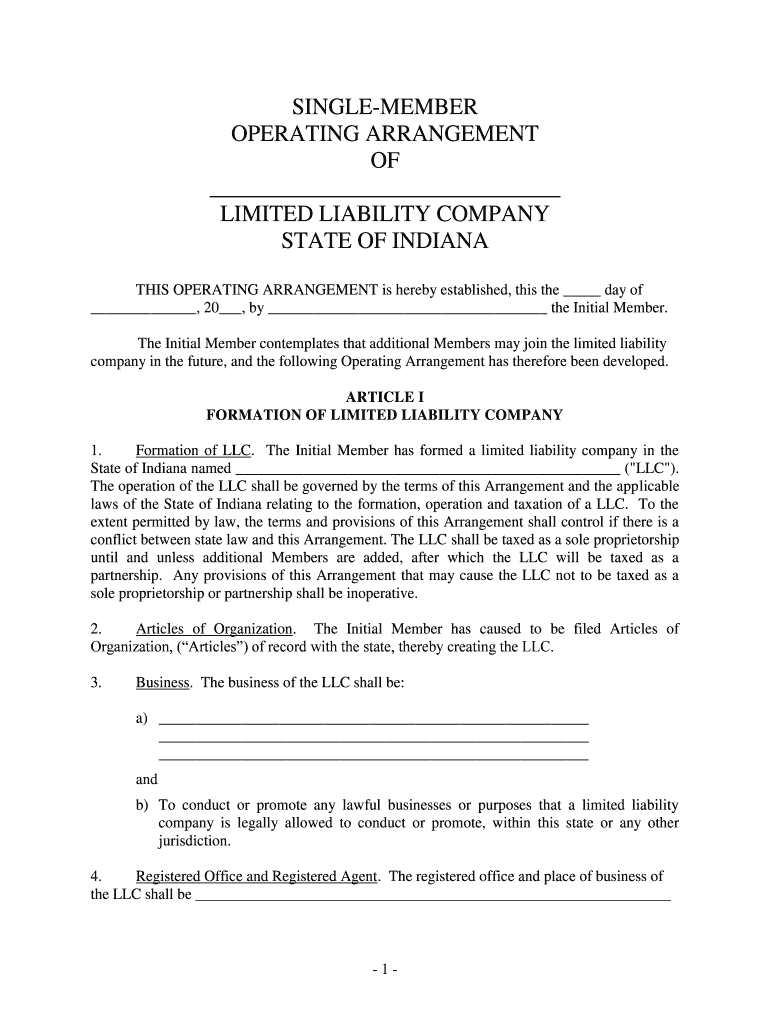

The Indiana Limited Liability Company (LLC) is a popular business structure that combines the benefits of both a corporation and a partnership. It provides personal liability protection for its members while allowing for flexible management and tax options. An Indiana LLC can be owned by one or more individuals or entities, known as members. This structure is particularly appealing for small business owners seeking to protect their personal assets from business liabilities.

Steps to Complete the Indiana Limited Liability Company Formation

Establishing an Indiana LLC involves several key steps to ensure compliance with state regulations. Here is a simplified process:

- Choose a unique name: The name must include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C." and cannot be similar to existing businesses.

- Designate a registered agent: This agent will receive legal documents on behalf of the LLC and must have a physical address in Indiana.

- File Articles of Organization: Submit the Articles of Organization with the Indiana Secretary of State, including necessary details about the LLC.

- Create an Operating Agreement: Although not required, this document outlines the management structure and operating procedures of the LLC.

- Obtain an EIN: An Employer Identification Number (EIN) is necessary for tax purposes and can be obtained from the IRS.

Legal Use of the Indiana Limited Liability Company

Operating as an Indiana LLC provides legal protections and benefits. Members are generally not personally liable for the debts and obligations of the LLC, protecting personal assets from business-related lawsuits. Additionally, Indiana LLCs enjoy flexibility in management and taxation, allowing members to choose how the company is taxed, whether as a sole proprietorship, partnership, or corporation.

Required Documents for Indiana LLC Formation

To successfully form an Indiana LLC, certain documents are necessary:

- Articles of Organization: The primary document filed with the state to create the LLC.

- Operating Agreement: While not mandatory, this document is recommended to clarify the management structure.

- Employer Identification Number (EIN): Required for tax purposes, especially if the LLC has employees.

State-Specific Rules for the Indiana Limited Liability Company

Indiana has specific rules governing LLCs that must be adhered to for compliance. These include:

- Annual reporting requirements: Indiana LLCs must file an annual report to maintain good standing.

- Registered agent requirements: The registered agent must be a resident of Indiana or a business entity authorized to do business in the state.

- Business licenses: Depending on the nature of the business, additional licenses or permits may be required.

How to Obtain the Indiana Limited Liability Company

To obtain an Indiana LLC, follow the steps outlined in the formation process. Start by ensuring the chosen name is available, then file the Articles of Organization with the Indiana Secretary of State. This can typically be done online or by mail. After filing, you will receive confirmation, and the LLC will be officially recognized. Ensure to complete any additional steps, such as obtaining an EIN and setting up necessary business licenses.

Quick guide on how to complete in llc

Complete In Llc effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle In Llc on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign In Llc without hassle

- Find In Llc and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow uniquely provides for this purpose.

- Create your signature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your liking. Adjust and eSign In Llc and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for Indiana limited businesses?

airSlate SignNow offers flexible pricing plans suitable for Indiana limited businesses. Depending on your needs, you can choose from monthly or annual subscriptions that provide signNow cost savings. This allows Indiana limited users to manage their document signing effectively without breaking the bank.

-

What features does airSlate SignNow offer for Indiana limited companies?

Designed specifically for Indiana limited companies, airSlate SignNow includes robust features such as document templates, customizable workflows, and advanced security options. These features enhance efficiency and help ensure compliance with Indiana regulations. With airSlate SignNow, Indiana limited businesses can streamline their document processes.

-

How does airSlate SignNow benefit Indiana limited businesses?

airSlate SignNow provides Indiana limited businesses with a cost-effective solution for electronic signatures and document management. It simplifies the signing process, reduces turnaround time, and enhances productivity. By using airSlate SignNow, Indiana limited businesses can focus on growth while ensuring their documents are handled efficiently.

-

Can Indiana limited businesses integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software platforms that Indiana limited businesses may already be using. Whether it's CRM systems, cloud storage, or productivity tools, these integrations help streamline workflows. This ensures that Indiana limited businesses can maintain a cohesive operational environment.

-

Is airSlate SignNow secure for Indiana limited companies?

Absolutely! airSlate SignNow prioritizes security for Indiana limited companies by employing advanced encryption and compliance with industry standards. This commitment ensures your documents are safe from unauthorized access. Indiana limited businesses can confidently utilize airSlate SignNow for all their document signing needs.

-

Does airSlate SignNow offer customer support for Indiana limited users?

Yes, airSlate SignNow provides dedicated customer support for Indiana limited users. Our team is available to assist with any questions or issues that may arise. Whether you're new to eSigning or a seasoned user, Indiana limited businesses can rely on airSlate SignNow for timely support.

-

How can Indiana limited businesses ensure compliance when using airSlate SignNow?

airSlate SignNow is designed to help Indiana limited businesses remain compliant with local and federal regulations. Features like audit trails and timestamping ensure that all signatures are verifiable and legally binding. By using airSlate SignNow, Indiana limited companies can confidently manage their document compliance.

Get more for In Llc

- Nonconsensual sexual conduct form

- The undersigned moves that the court modify the order for child support now in effect in this action and in support of this form

- Case type code form

- Name of obligee index as plaintiff form

- Application summons and order form

- Fillable online johnfinalformatteddoc fax email print

- Motion to withhold form

- Fillable online dol 97 0851doc dol fax email print form

Find out other In Llc

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online