Form 5870A Tax on Accumulation Distribution of Trusts , Form 5870A, Tax on Accumulation Distribution of Trusts 2024-2026

Understanding the California 5870A Tax on Accumulation Distribution of Trusts

The California 5870A tax applies to trusts that accumulate income rather than distribute it to beneficiaries. This tax is specifically designed to ensure that trusts pay taxes on undistributed income, similar to how individuals are taxed on their earnings. The Franchise Tax Board (FTB) administers this tax, which is crucial for maintaining compliance with California tax laws. Trusts that fall under this category must file Form 5870A to report any accumulation distributions and calculate the associated tax liability.

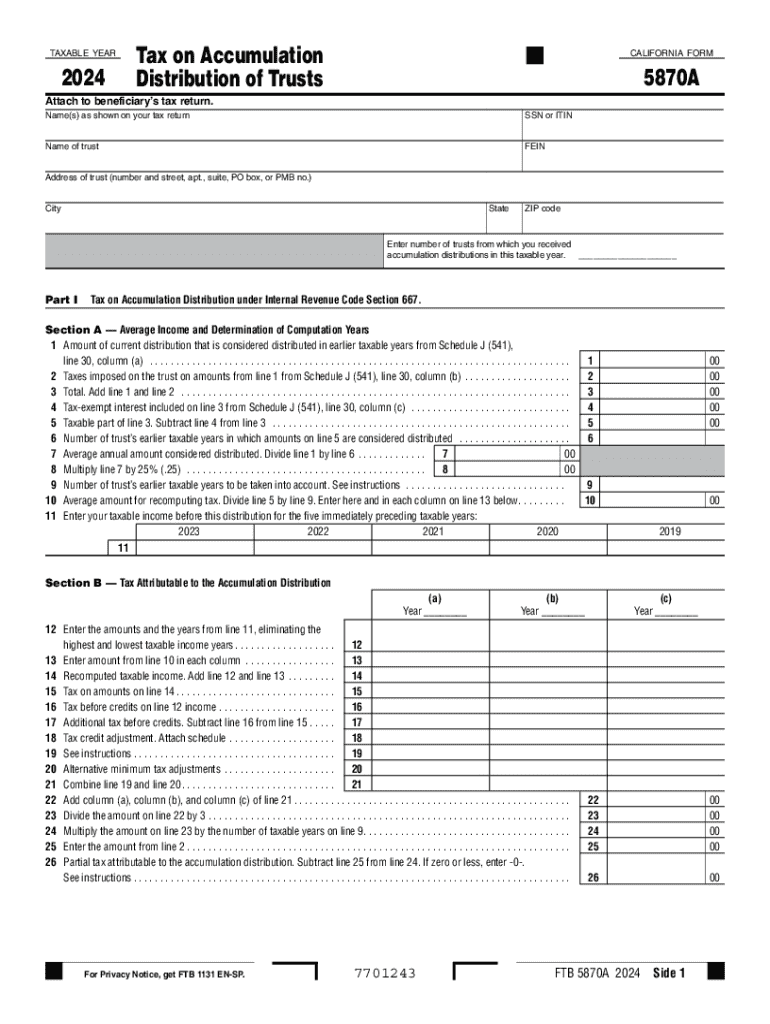

How to Complete the California 5870A Form

Filling out the California 5870A form involves several key steps. Start by gathering all necessary financial information regarding the trust, including income, distributions, and expenses. The form requires detailed reporting of the trust's income, including any amounts that were accumulated rather than distributed. Each section of the form must be completed accurately, ensuring that all figures align with the trust's financial records. After completing the form, it should be reviewed for accuracy before submission to avoid any potential penalties.

Obtaining the California 5870A Form

The California 5870A form can be obtained directly from the Franchise Tax Board's website. It is available for download in a PDF format, allowing for easy access and printing. Additionally, taxpayers can request a physical copy of the form by contacting the FTB directly. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the California 5870A Form

Several key elements are crucial when completing the California 5870A form. These include:

- Trust Information: Basic details about the trust, including its name, address, and taxpayer identification number.

- Income Reporting: A comprehensive account of the trust's income, including any accumulated income that is subject to tax.

- Distribution Details: Information on any distributions made to beneficiaries during the tax year.

- Calculation of Tax: A section dedicated to calculating the tax owed based on accumulated distributions.

Filing Deadlines for the California 5870A Tax

Timely filing of the California 5870A form is essential to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the trust's taxable year. For trusts operating on a calendar year, this means the form should be filed by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to keep track of these deadlines to ensure compliance with California tax laws.

Penalties for Non-Compliance with the California 5870A Tax

Failure to file the California 5870A form on time can result in significant penalties. The Franchise Tax Board may impose fines for late submissions, which can accumulate over time. Additionally, trusts that do not comply with the tax obligations may face interest charges on any unpaid taxes. It is crucial for trustees to understand these potential penalties and ensure that all necessary forms are filed accurately and on time to avoid financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form 5870a tax on accumulation distribution of trusts form 5870a tax on accumulation distribution of trusts 772091082

Create this form in 5 minutes!

How to create an eSignature for the form 5870a tax on accumulation distribution of trusts form 5870a tax on accumulation distribution of trusts 772091082

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the california 5870a tax and how does it affect my business?

The california 5870a tax is a specific tax form used for reporting certain business transactions in California. Understanding this tax is crucial for compliance and can help avoid penalties. By utilizing airSlate SignNow, businesses can streamline their document management related to the california 5870a tax, ensuring timely submissions.

-

How can airSlate SignNow help with california 5870a tax documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the california 5870a tax. With its user-friendly interface, businesses can easily manage their tax documents, ensuring they are completed accurately and submitted on time. This reduces the risk of errors and enhances compliance.

-

What are the pricing options for airSlate SignNow when dealing with california 5870a tax?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on california 5870a tax documentation. Each plan provides access to essential features that simplify the eSigning process. Businesses can choose a plan that best fits their budget while ensuring compliance with tax regulations.

-

Are there any features specifically designed for managing california 5870a tax forms?

Yes, airSlate SignNow includes features that are particularly beneficial for managing california 5870a tax forms. These features allow users to create templates, automate workflows, and track document status. This ensures that all necessary forms are completed and submitted efficiently.

-

Can I integrate airSlate SignNow with other tools for california 5870a tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software that can assist in managing california 5870a tax documentation. This seamless integration helps streamline workflows and ensures that all tax-related documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for california 5870a tax compliance?

Using airSlate SignNow for california 5870a tax compliance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform simplifies the eSigning process, allowing businesses to focus on their core operations while ensuring compliance with tax regulations. This ultimately saves time and resources.

-

Is airSlate SignNow secure for handling california 5870a tax documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling california 5870a tax documents. The platform employs advanced encryption and security protocols to protect sensitive information. Businesses can confidently manage their tax documentation without worrying about data bsignNowes.

Get more for Form 5870A Tax On Accumulation Distribution Of Trusts , Form 5870A, Tax On Accumulation Distribution Of Trusts

- Child and adult care food program monthly milk pur form

- Child and adult care food program monthly milk purchase estimate ccresourcesinc form

- P2236a rev 01 09form 3046 limited school choice qxd qxd

- Homecoming dance guest permission form wcpss net

- Dance guest permission form pchs student name

- Understanding acceptable use policies aups form

- Fta team vendor id request form

- Fillable online oklahoma capital gain deduction for trusts and form

Find out other Form 5870A Tax On Accumulation Distribution Of Trusts , Form 5870A, Tax On Accumulation Distribution Of Trusts

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now