Deed Upon Death Nevada Form

What is the Deed Upon Death Nevada

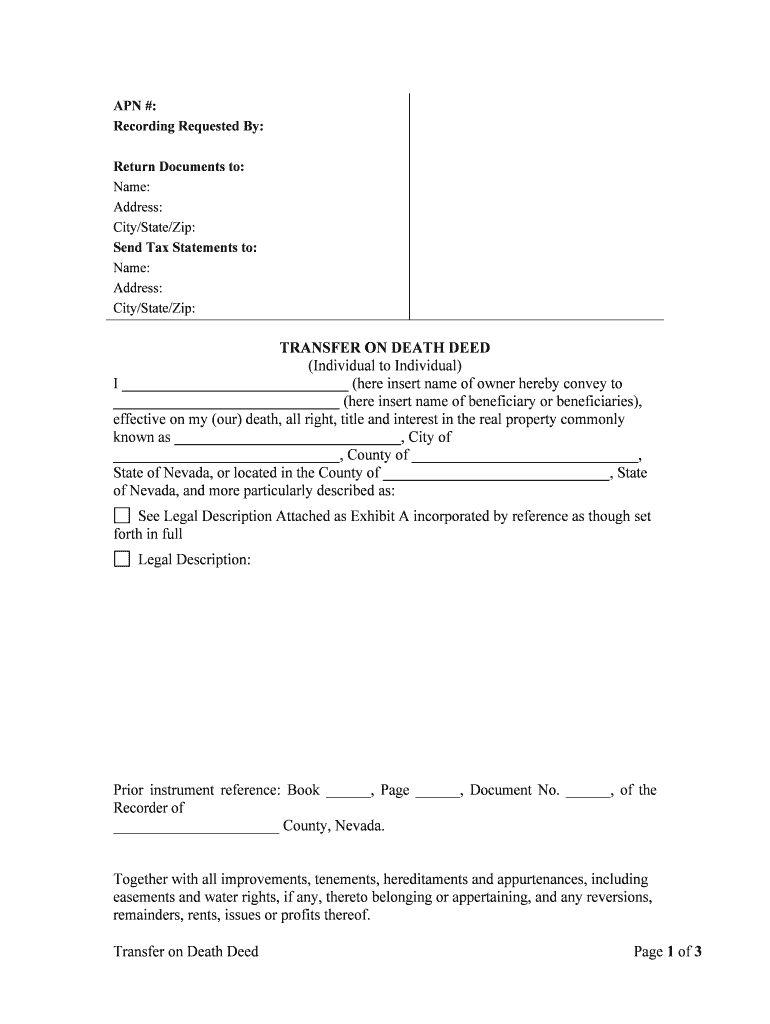

The deed upon death in Nevada is a legal document that allows individuals to transfer real property to beneficiaries upon their death, bypassing the probate process. This type of deed is particularly useful for estate planning, as it simplifies the transfer of assets and can help avoid complications associated with probate court. The deed must be executed and recorded during the property owner's lifetime to be effective after their passing.

How to use the Deed Upon Death Nevada

To utilize the deed upon death in Nevada, the property owner must complete the deed form, designating the beneficiaries who will receive the property. It is essential to ensure that the form is filled out accurately, including the legal description of the property and the names of the beneficiaries. Once completed, the deed must be signed and notarized. After notarization, the document should be recorded with the county recorder's office where the property is located to ensure its validity and enforceability.

Steps to complete the Deed Upon Death Nevada

Completing the deed upon death in Nevada involves several key steps:

- Obtain the appropriate deed upon death form from a reliable source.

- Fill out the form, including the property description and beneficiary information.

- Sign the document in the presence of a notary public to ensure it is legally binding.

- Record the notarized deed with the county recorder's office to make it effective.

Following these steps carefully will help ensure that the transfer of property occurs smoothly after the owner's death.

Legal use of the Deed Upon Death Nevada

The legal use of the deed upon death in Nevada is governed by state law, which allows property owners to designate beneficiaries without the need for probate. This deed must comply with specific requirements, such as being executed during the owner's lifetime and properly recorded. It is important to note that the deed does not take effect until the property owner passes away, and the beneficiaries must be clearly identified to avoid any disputes.

Required Documents

To complete the deed upon death in Nevada, the following documents are typically required:

- The deed upon death form, which can be obtained from legal resources or online.

- A valid form of identification for the property owner.

- Proof of ownership of the property, such as a previous deed.

- Notarization of the deed to ensure its legal validity.

Gathering these documents in advance can streamline the process of executing and recording the deed.

State-specific rules for the Deed Upon Death Nevada

Nevada has specific rules governing the use of the deed upon death. The property owner must be at least eighteen years old and of sound mind when executing the deed. Additionally, the deed must be recorded before the owner's death to be valid. Nevada law also allows for multiple beneficiaries, and if one beneficiary predeceases the owner, their share can be distributed among the surviving beneficiaries unless otherwise specified.

Quick guide on how to complete deed upon death nevada

Prepare Deed Upon Death Nevada easily on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Deed Upon Death Nevada on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Deed Upon Death Nevada with ease

- Find Deed Upon Death Nevada and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details, then click on the Done button to store your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Deed Upon Death Nevada and guarantee outstanding communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed upon death in Nevada?

A deed upon death in Nevada allows property owners to transfer their real estate assets directly to their beneficiaries without the need for probate. This simple document ensures that the transfer occurs automatically upon the owner’s death, streamlining the inheritance process.

-

How does airSlate SignNow facilitate the creation of a deed upon death in Nevada?

airSlate SignNow provides an intuitive platform for drafting and signing a deed upon death in Nevada. Users can easily access templates, customize them according to their needs, and ensure legally binding signatures, all from the comfort of their home.

-

What are the benefits of using airSlate SignNow for a deed upon death in Nevada?

Using airSlate SignNow for a deed upon death in Nevada offers several advantages including ease of use, cost-effectiveness, and fast document turnaround times. Additionally, electronically signed deeds are securely stored, ensuring that important documents are readily accessible.

-

Is there a cost associated with creating a deed upon death in Nevada using airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans tailored to different user needs, making it affordable for individuals and businesses alike. You'll find that the investment in creating a deed upon death in Nevada can save you signNow time and resources in the long run.

-

Can I integrate airSlate SignNow with other tools for managing my deed upon death in Nevada?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, allowing you to efficiently manage your deed upon death in Nevada and other related documents in one centralized platform.

-

How secure is the process of signing a deed upon death in Nevada with airSlate SignNow?

airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect all documents, including deed upon death in Nevada. This ensures that your personal data and signed documents remain safe and confidential throughout the signing process.

-

What features does airSlate SignNow offer for managing a deed upon death in Nevada?

airSlate SignNow provides several features for managing a deed upon death in Nevada, including customizable templates, electronic signature capabilities, and cloud storage. Users can easily collaborate with stakeholders, making the document management process efficient and straightforward.

Get more for Deed Upon Death Nevada

- Form dv 600 ampquotorder to register out of state or tribal

- Respond to a restraining order elderabuseselfhelp form

- Form ea 120 response to request for elder or dependent

- Ch 115 request to continue court hearing and to reissue form

- Ea 135 form

- Ea 136 form

- Ea 137 form

- Domestic violence san diego superior court cagov form

Find out other Deed Upon Death Nevada

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT