Loan Agreement Bank Form

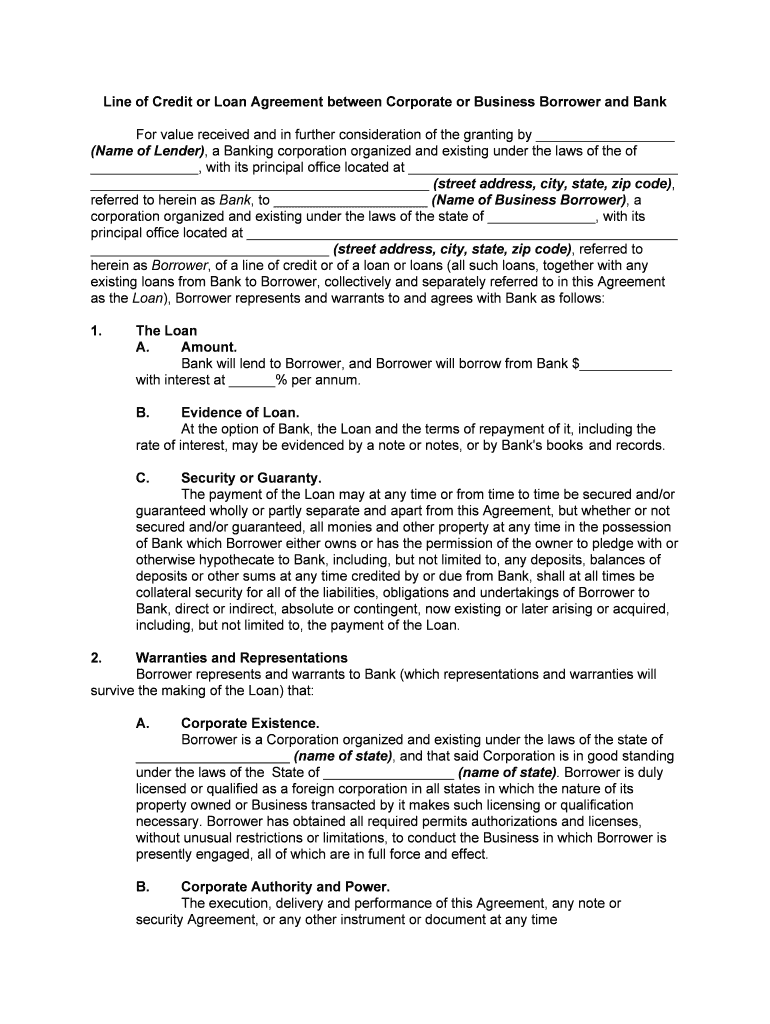

What is the loan agreement bank?

A loan agreement bank is a formal document that outlines the terms and conditions of a loan between a lender, typically a bank, and a borrower. This agreement serves as a legally binding contract that specifies the amount of money being borrowed, the interest rate, repayment schedule, and any collateral involved. It is essential for both parties to understand the obligations and rights established within the agreement to ensure a smooth lending process.

Key elements of the loan agreement bank

Understanding the fundamental components of a loan agreement bank is crucial for both lenders and borrowers. Key elements include:

- Loan amount: The total sum of money being borrowed.

- Interest rate: The percentage charged on the borrowed amount, which can be fixed or variable.

- Repayment terms: The schedule detailing when and how the borrower will repay the loan.

- Collateral: Any assets pledged by the borrower to secure the loan.

- Default clauses: Conditions under which the lender can take action if the borrower fails to meet their obligations.

Steps to complete the loan agreement bank

Completing a loan agreement bank involves several important steps to ensure all necessary information is accurately captured. Follow these steps:

- Gather information: Collect personal and financial information, including income, credit history, and identification.

- Review terms: Carefully examine the loan terms, including interest rates and repayment schedules, to ensure they are acceptable.

- Fill out the form: Complete the loan agreement form with all required details, ensuring accuracy.

- Sign the agreement: Both the lender and borrower must sign the document to make it legally binding.

- Keep copies: Retain copies of the signed agreement for personal records and future reference.

Legal use of the loan agreement bank

The legal use of a loan agreement bank is governed by federal and state laws that regulate lending practices. To be considered legally binding, the agreement must meet specific requirements, such as:

- Written format: The agreement should be in writing to ensure clarity and enforceability.

- Signatures: Both parties must provide their signatures, indicating consent to the terms.

- Compliance with laws: The agreement must adhere to relevant lending laws, including consumer protection regulations.

How to use the loan agreement bank

Using a loan agreement bank effectively involves understanding its purpose and how to navigate the process. Here are some tips:

- Assess your needs: Determine the amount of funding required and the purpose of the loan.

- Research lenders: Compare different banks and financial institutions to find the best terms.

- Prepare documentation: Ensure all necessary documentation is ready for submission, including proof of income and identification.

- Negotiate terms: Don’t hesitate to discuss terms with the lender to secure a favorable agreement.

Examples of using the loan agreement bank

Loan agreement banks can be utilized in various scenarios, including:

- Personal loans: Individuals may use a loan agreement for personal expenses, such as medical bills or home improvements.

- Business loans: Entrepreneurs often rely on loan agreements to secure funding for startup costs or expansion.

- Mortgages: A loan agreement bank is essential for home purchases, outlining the terms of the mortgage.

Quick guide on how to complete loan agreement bank

Complete Loan Agreement Bank effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Loan Agreement Bank on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Loan Agreement Bank without hassle

- Locate Loan Agreement Bank and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Loan Agreement Bank and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan agreement bank?

A loan agreement bank is a formal document that outlines the terms and conditions of a loan provided by a financial institution. It details important information such as interest rates, repayment schedules, and penalties for default. Using airSlate SignNow, you can easily create and sign loan agreements securely and efficiently.

-

How does airSlate SignNow simplify loan agreement bank creation?

airSlate SignNow streamlines the process of creating a loan agreement bank by providing customizable templates that suit different loan types. Users can edit these templates to include specific terms and conditions, ensuring that all legal requirements are met. This saves time and reduces the chances of errors in documentation.

-

Is airSlate SignNow secure for signing loan agreement bank documents?

Yes, airSlate SignNow offers robust security features like encryption and authentication to protect your loan agreement bank documents. Each signed document is legally binding and secure, ensuring that sensitive information remains confidential. You can trust airSlate SignNow to safeguard your financial agreements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans, catering to businesses of all sizes. You can choose from monthly or annual subscriptions. Each plan includes features for creating, sending, and managing loan agreement bank documents without any hidden fees, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other applications for loan agreement bank management?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Salesforce, Google Drive, and Dropbox, enhancing your loan agreement bank management. These integrations allow you to streamline your workflow and manage documents efficiently across different platforms.

-

What benefits does eSigning a loan agreement bank offer?

eSigning a loan agreement bank through airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paperwork. It eliminates the need for physical signatures, allowing both parties to sign from anywhere at any time. This level of convenience can accelerate the loan approval process signNowly.

-

Can airSlate SignNow help with negotiations on loan agreement bank terms?

While airSlate SignNow is primarily a tool for document management and signing, it can help facilitate negotiations on loan agreement bank terms by allowing users to easily modify and resend documents. The collaborative features make it simple for all parties to review and suggest changes in real-time, ensuring clarity and agreement before finalizing.

Get more for Loan Agreement Bank

- Sc 107 small claims subpoena for personal appearance and form

- Form sc 220 ampquotrequest to make paymentsampquot california

- Local dhs office completes doc templatepdffiller form

- Fl 303 declaration regarding notice and service of request form

- Free sc 111 order on request to postpone small claims form

- Sc 112a proof of service by mail small claims form

- Party name and address form

- If you get sued in small claims courtnolo form

Find out other Loan Agreement Bank

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors