Indemnification Form

What is indemnification?

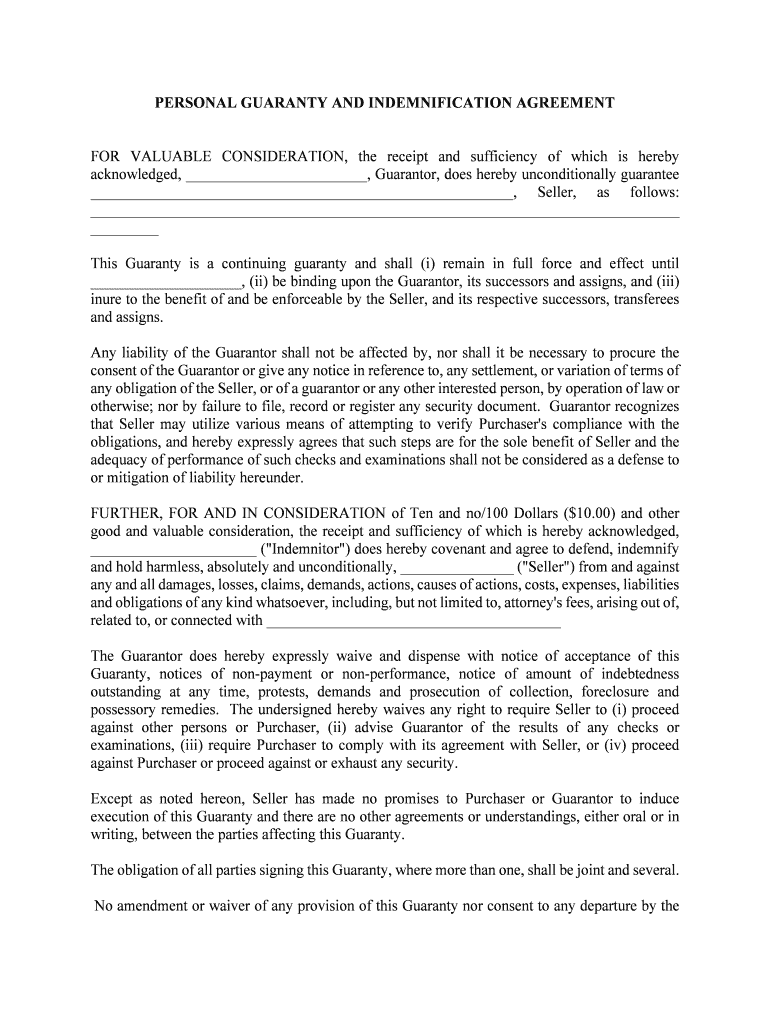

Indemnification refers to a legal provision that protects one party from financial loss or liability caused by the actions of another party. This concept is often included in contracts to ensure that if one party faces claims or damages, the other party will compensate them. An indemnification agreement typically outlines the responsibilities of each party and specifies the circumstances under which indemnification will occur.

In the context of a simple indemnity agreement, the indemnifying party agrees to "indemnify and hold harmless" the indemnified party from any claims, damages, or losses arising from specified activities or events. This agreement serves to provide reassurance and security in various business transactions.

Key elements of an indemnification agreement

An effective indemnification agreement should include several essential elements to ensure clarity and enforceability:

- Parties involved: Clearly identify the indemnifying party and the indemnified party.

- Scope of indemnification: Define the specific circumstances under which indemnification applies, including any limitations or exclusions.

- Claims process: Outline the procedure for notifying the indemnifying party of any claims and the timeline for response.

- Defense obligations: Specify whether the indemnifying party is responsible for defending the indemnified party against claims.

- Governing law: Indicate which jurisdiction's laws will govern the agreement.

Steps to complete the indemnification form

Completing an indemnification form involves several straightforward steps to ensure that the document is legally binding and effective:

- Gather necessary information: Collect all relevant details about the parties involved, including names, addresses, and contact information.

- Define the scope: Clearly articulate the specific activities or events that will trigger indemnification.

- Draft the agreement: Use a template or create a custom document that includes all key elements of indemnification.

- Review the terms: Ensure that all parties understand the terms and conditions outlined in the agreement.

- Sign the document: All parties should sign the form, either in person or electronically, to validate the agreement.

Legal use of indemnification

Indemnification clauses are commonly used in various legal contexts, including contracts, leases, and service agreements. They serve to allocate risk between parties and provide a mechanism for compensation in the event of a loss. To be legally enforceable, indemnification provisions must be clearly stated and agreed upon by all parties involved.

It is important to note that the enforceability of indemnification agreements can vary by state, as some jurisdictions may impose limitations on indemnification for certain types of liability, such as gross negligence or willful misconduct. Therefore, understanding state-specific rules is crucial when drafting or signing an indemnification agreement.

Examples of indemnification in practice

Indemnification agreements can be found in numerous scenarios, such as:

- Construction contracts: Contractors may require subcontractors to indemnify them against claims arising from the subcontractor's work.

- Service agreements: A service provider may include an indemnification clause to protect against claims resulting from their services.

- Leases: Landlords may require tenants to indemnify them for any damages or injuries occurring on the leased property.

These examples highlight the versatility of indemnification provisions in protecting parties from potential liabilities across various industries and agreements.

Quick guide on how to complete indemnification 481371370

Effortlessly Complete Indemnification on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and efficiently. Manage Indemnification on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Indemnification with Ease

- Locate Indemnification and click on Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize pertinent sections of the documents or black out sensitive information with the specialized tools offered by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Indemnification while ensuring outstanding communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to indemnify and hold harmless in a contract?

To indemnify and hold harmless means that one party agrees to protect another party from any losses or damages that may arise while fulfilling the contract. This legal provision is crucial for mitigating risks associated with contract bsignNowes or claims. In the context of airSlate SignNow, including an indemnification clause can safeguard your business during eSignature transactions.

-

How can airSlate SignNow help manage indemnify and hold harmless clauses?

airSlate SignNow allows users to add indemnify and hold harmless clauses directly within their documents. This feature simplifies the process of ensuring that your agreements are legally sound and protects you from potential liabilities. With easy document editing and eSigning, you can streamline this essential aspect of contract management.

-

What are the pricing plans for airSlate SignNow, especially for businesses focused on indemnity clauses?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses, including those focused on managing indemnity clauses. The plans provide robust features for legally binding eSignatures, customization, and workflow automation. Investing in a plan can safeguard your legal agreements, providing peace of mind when handling indemnify and hold harmless provisions.

-

Are there specific features that assist in drafting indemnify and hold harmless agreements?

Yes, airSlate SignNow includes specific features designed to assist in drafting indemnify and hold harmless agreements. Users can leverage customizable templates and document collaboration tools to create accurate and enforceable contracts. This ensures that all necessary clauses are included to protect all parties involved efficiently.

-

What benefits does airSlate SignNow provide for businesses dealing with indemnity issues?

By using airSlate SignNow, businesses can streamline their contract workflow involving indemnity issues, saving time and reducing errors. The platform enhances efficiency, allowing teams to focus on compliance and risk management. Ultimately, this reliable solution helps businesses better protect themselves with sound indemnify and hold harmless practices.

-

Can airSlate SignNow integrate with other software to handle indemnity-related documents?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enabling users to manage indemnity-related documents effectively. This integration capability allows for better workflow management, data transfer, and decreased operational friction. Combining these tools can signNowly enhance the handling of indemnify and hold harmless provisions.

-

How does airSlate SignNow ensure the legality of indemnify and hold harmless agreements?

airSlate SignNow ensures the legality of indemnify and hold harmless agreements by adhering to industry standards for electronic signatures. Each signed document is encrypted and securely stored, providing legal protection. Additionally, the platform offers compliance with regulations such as ESIGN and UETA, which further strengthens the validity of your agreements.

Get more for Indemnification

- Caption of the case form

- Recent nj supreme court decision highlights pitfalls of form

- Rules 459 1g and 67 1b form

- Th mcelvain oil ampampamp gas ltd pship v benson montin greer form

- Counties of practice form

- Instructions for completing the request for arbitration form

- Application for new car lemon law dispute resolution form

- Lemon law mediation attorney questionnaire form

Find out other Indemnification

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document