Promissory Note Secured Form

What is the Promissory Note Secured

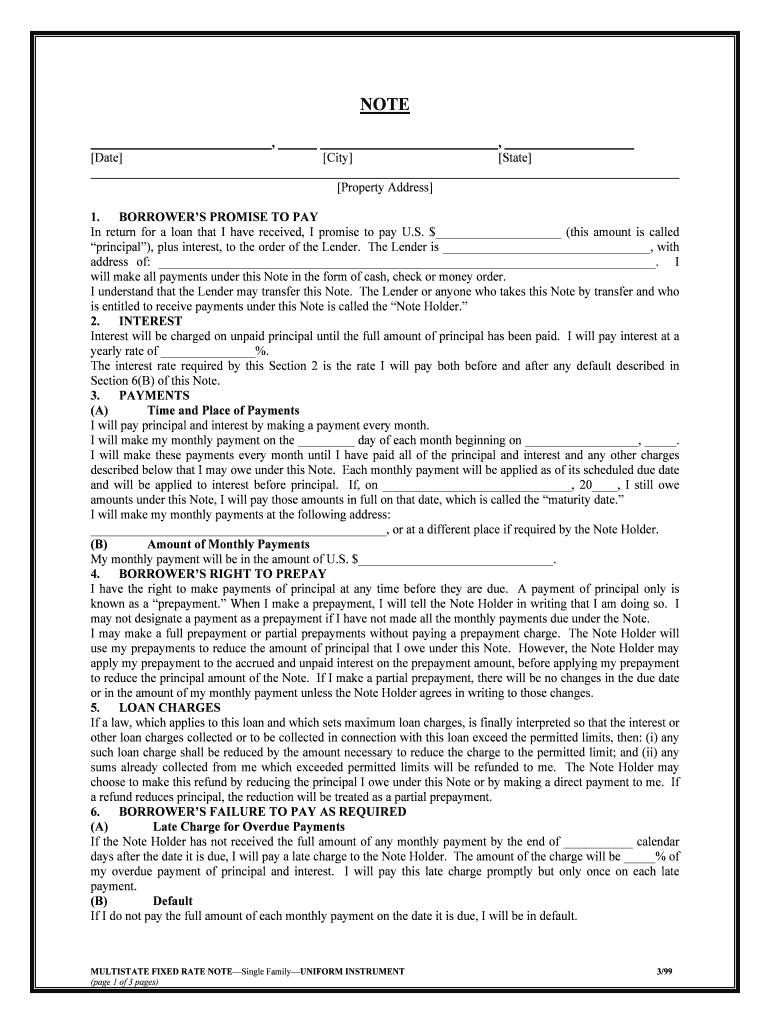

A promissory note secured is a financial instrument that outlines a borrower's promise to repay a loan under specified terms, with the added assurance of collateral. This collateral can be any asset, such as real estate or personal property, that the lender can claim if the borrower defaults. The secured nature of the note provides an extra layer of protection for the lender, making it a popular choice for both personal and business loans. In the context of the promissory note family, this type of note is often used in transactions involving larger amounts or when the lender seeks additional security.

Key elements of the Promissory Note Secured

Understanding the key elements of a promissory note secured is essential for both lenders and borrowers. The primary components include:

- Principal Amount: The total amount borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage of the principal.

- Repayment Schedule: The timeline for repayments, including due dates and amounts.

- Collateral Description: Detailed information about the asset securing the loan.

- Default Terms: Conditions under which the lender can claim the collateral if the borrower fails to meet repayment obligations.

These elements ensure clarity and legal enforceability, making the promissory note secured a reliable document in financial transactions.

Steps to complete the Promissory Note Secured

Completing a promissory note secured involves several important steps to ensure that the document is legally binding and accurately reflects the agreement between parties. Follow these steps:

- Gather Information: Collect all necessary details, including the borrower's and lender's names, addresses, and the principal amount.

- Specify Terms: Clearly outline the interest rate, repayment schedule, and any penalties for late payments.

- Detail Collateral: Provide a thorough description of the asset being used as collateral.

- Review Legal Requirements: Ensure compliance with state laws regarding promissory notes and secured transactions.

- Sign and Date: Both parties must sign and date the document to make it legally binding.

Taking these steps helps prevent misunderstandings and protects the interests of both parties involved.

Legal use of the Promissory Note Secured

The legal use of a promissory note secured is governed by state laws, which can vary significantly. Generally, these notes must adhere to the Uniform Commercial Code (UCC) provisions, which provide a framework for secured transactions in the United States. Key legal considerations include:

- Enforceability: The note must be written and signed by the borrower to be enforceable.

- Collateral Registration: In some cases, the lender may need to file a financing statement to perfect their security interest in the collateral.

- Compliance with State Laws: Each state may have specific requirements regarding interest rates, default procedures, and other terms.

Understanding these legal aspects ensures that the promissory note secured is valid and enforceable in a court of law.

How to use the Promissory Note Secured

Using a promissory note secured effectively involves understanding its purpose and the responsibilities of both the borrower and lender. Here are some practical applications:

- Loan Agreements: Use the note to formalize a loan between individuals or businesses, providing clear terms and conditions.

- Real Estate Transactions: Secure financing for property purchases, ensuring that the lender has a claim on the property in case of default.

- Business Financing: Utilize the note to obtain funds for business operations, with the business assets serving as collateral.

By understanding how to use the promissory note secured, parties can navigate financial agreements with confidence and clarity.

Quick guide on how to complete promissory note secured

Finalize Promissory Note Secured effortlessly on any device

Digital document administration has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruption. Handle Promissory Note Secured on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Promissory Note Secured with ease

- Locate Promissory Note Secured and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information and then click the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Promissory Note Secured and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note family and how does airSlate SignNow help?

A promissory note family refers to a collection of documents related to promissory notes within familial or personal contexts. airSlate SignNow simplifies the creation, sending, and signing of promissory notes, allowing users to easily manage their document workflow in a secure environment.

-

How much does airSlate SignNow cost for managing promissory note family documents?

airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing a promissory note family. The plans include features that streamline document management, with the opportunity for businesses to choose the most suitable package without compromising on functionality.

-

What features does airSlate SignNow offer for promissory note family management?

airSlate SignNow includes features such as document templates, customizable fields, and automated reminders, all designed to enhance the handling of a promissory note family. These tools help ensure that all necessary information is captured accurately and that the process runs smoothly.

-

Is it easy to integrate airSlate SignNow with other applications for my promissory note family?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to incorporate into your existing workflows for managing a promissory note family. This interoperability allows users to enhance their document handling experience without any technical barriers.

-

Can airSlate SignNow help me track the status of my promissory note family documents?

Absolutely! airSlate SignNow provides robust tracking features that allow users to monitor the status of their promissory note family documents in real time. This ensures you stay informed about who has signed or viewed the documents, allowing for better management and follow-up.

-

What security measures does airSlate SignNow implement for promissory note family documents?

airSlate SignNow prioritizes security through encryption, secure data storage, and user authentication processes. These measures ensure that all documents related to your promissory note family are protected from unauthorized access and potential data bsignNowes.

-

Are there mobile options available for managing my promissory note family with airSlate SignNow?

Yes, airSlate SignNow provides a mobile-friendly platform, allowing users to manage their promissory note family documents on the go. The mobile app ensures that signing, sending, and tracking documents is just as convenient as working from a desktop.

Get more for Promissory Note Secured

- Not married so state here form

- Been no significant changes in our financial status i form

- Vtr 262 affidavit of heirship for a motor vehicle txdmvgov form

- I an adult resident citizen of county new form

- Discharge of mortgage this is to certify that a certain form

- Pecialcivilisacourtoflimitedjurisdictioninwhichyoumaysuesomeonethe form

- Ost disputes between landlords and tenants are resolved by the form

- Completion by hand or typewriter form

Find out other Promissory Note Secured

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation