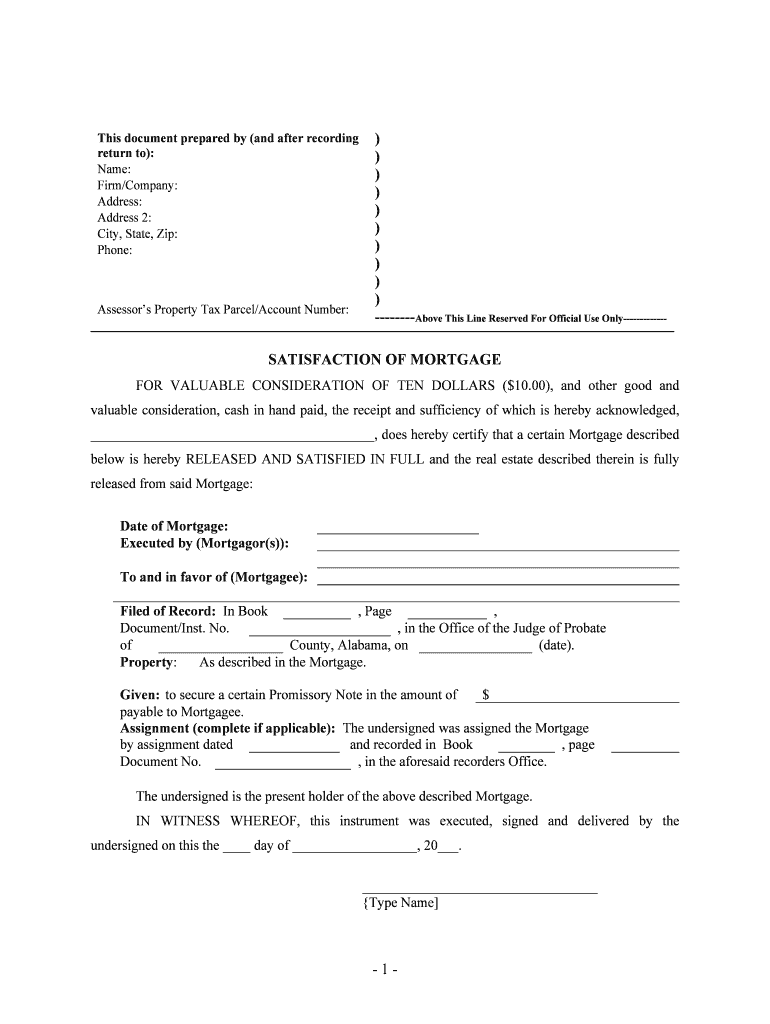

Alabama Mortgage Form

What is the Alabama Mortgage Form

The Alabama Mortgage Form is a legal document used in the state of Alabama to secure a loan against real property. This form outlines the terms of the mortgage agreement between the borrower and the lender. It provides a detailed account of the loan amount, interest rate, repayment schedule, and any other conditions tied to the mortgage. Understanding this form is crucial for borrowers as it establishes their obligations and rights under the mortgage agreement.

How to use the Alabama Mortgage Form

To use the Alabama Mortgage Form, borrowers must first ensure they have the correct version of the form, which can typically be obtained from a lender or legal source. The form must be completed accurately, detailing personal information, property details, and loan specifics. Once filled out, the form requires signatures from both the borrower and the lender. It is essential to review the document carefully before signing to ensure all information is correct and all parties understand their responsibilities.

Steps to complete the Alabama Mortgage Form

Completing the Alabama Mortgage Form involves several key steps:

- Gather necessary information, including personal identification and property details.

- Fill out the form with accurate information regarding the loan amount, interest rate, and repayment terms.

- Review the form for any errors or omissions.

- Obtain signatures from all required parties, including the borrower and lender.

- Submit the completed form to the appropriate county office for recording.

Legal use of the Alabama Mortgage Form

The Alabama Mortgage Form must adhere to state laws to be considered legally binding. This includes compliance with the Alabama Code regarding mortgages and real estate transactions. The form must be signed in the presence of a notary public to ensure its validity. Additionally, it is important to keep a copy of the recorded form for personal records and future reference.

Key elements of the Alabama Mortgage Form

Several key elements are essential to the Alabama Mortgage Form, including:

- Borrower Information: Names and addresses of all parties involved.

- Property Description: A detailed description of the property being mortgaged.

- Loan Details: Amount borrowed, interest rate, and repayment terms.

- Signatures: Required signatures from both the borrower and lender, along with a notary acknowledgment.

State-specific rules for the Alabama Mortgage Form

Alabama has specific regulations governing the use of mortgage forms. These include requirements for notarization, recording the mortgage with the county, and adhering to state disclosure laws. Borrowers should be aware of these rules to ensure their mortgage is legally enforceable. It is advisable to consult with a legal professional if there are any uncertainties regarding the completion or submission of the form.

Quick guide on how to complete alabama mortgage form

Easily Prepare Alabama Mortgage Form on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Alabama Mortgage Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Edit and eSign Alabama Mortgage Form Effortlessly

- Find Alabama Mortgage Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mismanaged documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Alabama Mortgage Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an al satisfaction mortgage?

An al satisfaction mortgage is a financial product that allows borrowers to ensure their mortgage obligations are fulfilled to the lender's satisfaction. This type of mortgage can provide peace of mind, knowing that as long as you meet the terms, your loan won't become a burden. In essence, it combines reliability and assurance for mortgage holders.

-

How does airSlate SignNow support al satisfaction mortgage processes?

airSlate SignNow streamlines the documentation required for an al satisfaction mortgage by offering a user-friendly platform for eSigning and sending documents. Our solution eliminates the hassle of paper trails and saves time in the mortgage approval process. With easy-to-use templates, businesses can efficiently manage their mortgage agreements.

-

What are the costs associated with using airSlate SignNow for al satisfaction mortgage agreements?

Using airSlate SignNow for your al satisfaction mortgage agreements involves transparent pricing with options tailored to various business needs. We offer competitive plans that are designed to be cost-effective without sacrificing quality or features. You can choose a plan that best suits your monthly document requirements.

-

What are the key features of airSlate SignNow for handling al satisfaction mortgage?

Key features of airSlate SignNow that benefit those dealing with an al satisfaction mortgage include customizable templates, advanced security protocols, and integrations with popular software. Additionally, the platform allows for multiple signatures, making it easier for all parties to complete the mortgage process efficiently. These features collectively enrich the user experience.

-

Can I integrate airSlate SignNow with my current mortgage management system?

Yes, airSlate SignNow offers seamless integrations with various mortgage management systems and CRM platforms. This compatibility ensures that your al satisfaction mortgage documentation processes can flow smoothly into your existing operations. Our API and integration capabilities allow lenders and borrowers to work efficiently together.

-

What benefits does airSlate SignNow provide for al satisfaction mortgage clients?

airSlate SignNow provides numerous benefits for clients handling al satisfaction mortgages, including faster transaction times and improved document accuracy. The platform enhances communication by allowing real-time updates and notifications, ensuring that all stakeholders are informed throughout the process. This leads to greater satisfaction and efficiency for both lenders and borrowers.

-

How secure is the airSlate SignNow platform for managing al satisfaction mortgage documents?

AirSlate SignNow prioritizes security, using advanced encryption methods to protect all documents related to your al satisfaction mortgage. Compliance with industry standards ensures that sensitive information remains safe throughout the entire eSigning process. You can trust our platform to maintain the confidentiality and integrity of your mortgage data.

Get more for Alabama Mortgage Form

- Corporation organized under the laws of the state of its successors or assigns 490118165 form

- Or respondent form

- Under delaware law an equine professional is not liable for an injury to or the form

- 25 del form

- A limited liability company organized under the laws of the state of form

- Limited liability company organized under the laws of the state of its successors or form

- Superior court of the state of delaware leonard l form

- Release of liability agreement waiver of claims form

Find out other Alabama Mortgage Form

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy