Sale of Partnership Interest Form

What is the Sale of Partnership Interest Form

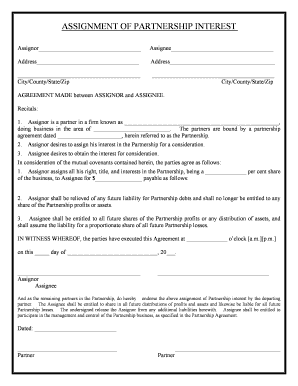

The sale of partnership interest form is a legal document used to formalize the transfer of a partner's ownership stake in a partnership. This form outlines the details of the transaction, including the identities of the parties involved, the percentage of interest being sold, and the terms of the sale. It is essential for ensuring that the transfer is recognized by all parties and complies with applicable laws.

How to Use the Sale of Partnership Interest Form

To effectively use the sale of partnership interest form, the involved parties must first gather relevant information, including the partnership agreement and any necessary financial documents. Once the form is filled out, it should be reviewed by all parties to ensure accuracy. After obtaining the necessary signatures, the completed form should be filed according to the partnership's rules and any state-specific regulations.

Steps to Complete the Sale of Partnership Interest Form

Completing the sale of partnership interest form involves several key steps:

- Identify the parties involved in the transaction.

- Specify the percentage of partnership interest being sold.

- Outline the terms of the sale, including payment details.

- Ensure all parties sign the document to validate the agreement.

- File the completed form with the appropriate authorities or keep it for partnership records.

Key Elements of the Sale of Partnership Interest Form

Essential elements of the sale of partnership interest form include:

- The names and addresses of the selling and purchasing partners.

- The specific percentage of interest being sold.

- The purchase price and payment terms.

- Any conditions or contingencies related to the sale.

- Signatures of all involved parties to confirm agreement.

Legal Use of the Sale of Partnership Interest Form

The legal use of the sale of partnership interest form ensures that the transfer of ownership is binding and recognized under the law. Proper execution of this form can prevent disputes among partners and protect the rights of both the seller and buyer. It is crucial to adhere to state laws and the partnership agreement to maintain compliance and avoid legal complications.

Who Issues the Form

The sale of partnership interest form is typically not issued by a specific governmental agency. Instead, it is often drafted by the partners involved or their legal representatives. In some cases, templates may be available through legal resources or business organizations, but it is advisable to customize the form to fit the specific needs of the partnership and comply with relevant laws.

Quick guide on how to complete sale of partnership interest form

Complete Sale Of Partnership Interest Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Sale Of Partnership Interest Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Sale Of Partnership Interest Form with ease

- Locate Sale Of Partnership Interest Form and select Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device. Alter and eSign Sale Of Partnership Interest Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a partnership interest agreement?

A partnership interest agreement is a legal document that outlines the rights, responsibilities, and obligations of partners in a business. This agreement helps ensure all partners are on the same page regarding profit sharing, decision-making, and investment details. By using airSlate SignNow, you can easily create and eSign such agreements to streamline your business operations.

-

How can airSlate SignNow help with partnership interest agreements?

airSlate SignNow provides a user-friendly platform that allows you to create, send, and eSign partnership interest agreements efficiently. Our software simplifies the document management process, ensuring that all necessary parties can quickly review and sign the agreement from anywhere. This ensures timely execution and helps uphold the integrity of your partnerships.

-

What features does airSlate SignNow offer for creating partnership interest agreements?

With airSlate SignNow, you get a range of features tailored for creating partnership interest agreements, including customizable templates, tagging options for signers, and automatic reminders. Our platform also supports secure storage and allows for real-time tracking of document status, making it easier to manage the entire signing process efficiently.

-

Is airSlate SignNow suitable for small businesses needing partnership interest agreements?

Absolutely! AirSlate SignNow is designed to be cost-effective and accessible for businesses of all sizes, including small enterprises. By using our service for partnership interest agreements, small businesses can enhance their professional image while ensuring compliance and clarity in their business relationships without breaking the bank.

-

What is the pricing structure for airSlate SignNow's partnership interest agreement services?

AirSlate SignNow offers several pricing tiers to accommodate different business needs, including a flexible subscription model. You only pay for the features you need, making it budget-friendly for partnerships looking to create and manage partnership interest agreements. Additionally, we provide a free trial so you can explore our features before committing.

-

Can I integrate airSlate SignNow with other software for partnership interest agreements?

Yes, airSlate SignNow offers seamless integrations with various software solutions, including CRM systems, project management tools, and cloud storage services. This allows you to automate the workflow surrounding partnership interest agreements and ensures that all your tools work in harmony. Integrating airSlate SignNow can save you time and improve efficiency.

-

How does airSlate SignNow ensure the security of partnership interest agreements?

At airSlate SignNow, we prioritize the security of your documents, including partnership interest agreements. Our platform employs advanced encryption methods, secure cloud storage, and compliance with industry standards to safeguard your data. This ensures that all sensitive information remains confidential and protected throughout the signing process.

Get more for Sale Of Partnership Interest Form

- Declarant executed an advance directive for health care on the day of form

- Business types oregon secretary of state form

- Request for medication to end my life in a form

- I declarant having made an anatomical gift by virtue of that form

- Control number or p026 pkg form

- Control number or p027 pkg form

- Sample short form employment offer

- Oregon mortgage formsus legal forms

Find out other Sale Of Partnership Interest Form

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe