Form Availability and Tax Changes Louisiana 2024-2026

Understanding the Form Availability and Tax Changes in Louisiana

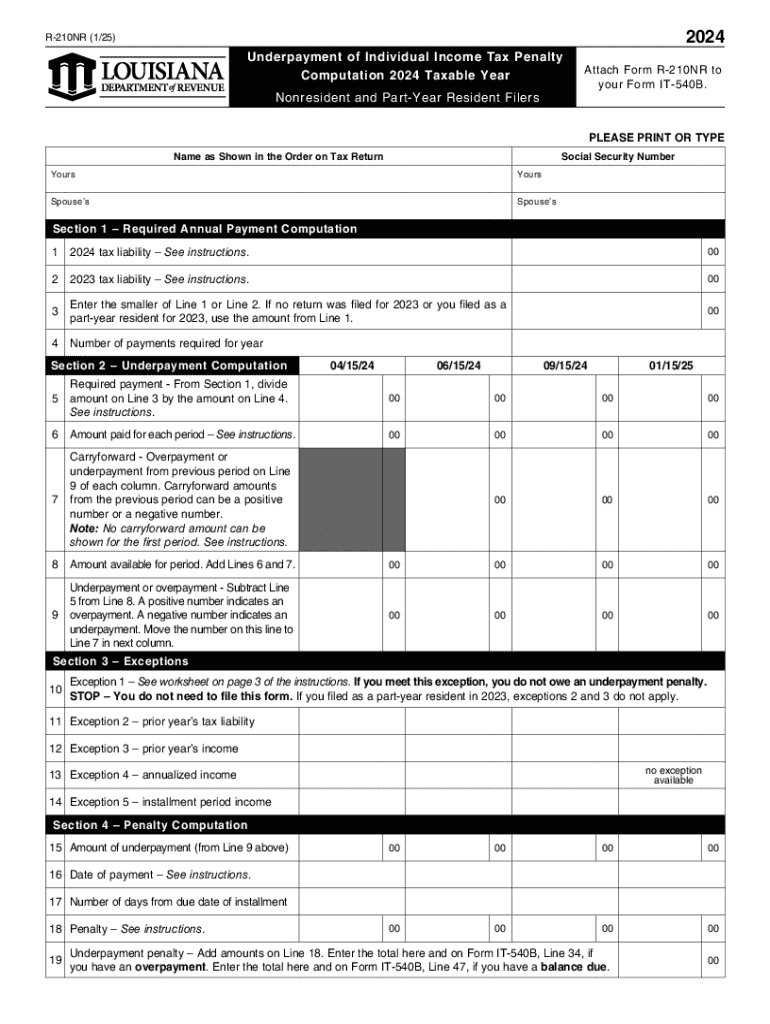

The Form Availability and Tax Changes in Louisiana is essential for individuals and businesses navigating the state's tax landscape. This form provides crucial information about the availability of various tax forms and any recent changes in tax regulations. Understanding the specifics of this form helps taxpayers comply with state requirements and stay informed about their tax obligations.

How to Obtain the Form Availability and Tax Changes in Louisiana

To obtain the Form Availability and Tax Changes in Louisiana, taxpayers can visit the Louisiana Department of Revenue's official website. The form is typically available for download in a PDF format, which can be printed and filled out. Additionally, individuals may request a physical copy by contacting the department directly via phone or email. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Form Availability and Tax Changes in Louisiana

Completing the Form Availability and Tax Changes in Louisiana involves several steps:

- Begin by reviewing the instructions provided with the form to understand the requirements.

- Fill in the necessary personal or business information accurately, ensuring all details are correct.

- Provide any required financial information, such as income or deductions, as specified in the form.

- Double-check your entries for accuracy before submitting the form to avoid delays.

Legal Use of the Form Availability and Tax Changes in Louisiana

The legal use of the Form Availability and Tax Changes in Louisiana is critical for maintaining compliance with state tax laws. This form serves as an official document that communicates important tax information to the Louisiana Department of Revenue. Failure to use the form correctly can lead to penalties or delays in processing tax returns. It is advisable to consult with a tax professional if there are uncertainties regarding its legal implications.

Filing Deadlines and Important Dates

Filing deadlines for the Form Availability and Tax Changes in Louisiana vary depending on the specific tax year and the type of taxpayer. Generally, individual income tax returns are due on May fifteenth, while business taxes may have different deadlines. It is essential to stay updated on these dates to avoid late fees and other penalties. Marking these dates on your calendar can help ensure timely submissions.

Examples of Using the Form Availability and Tax Changes in Louisiana

There are various scenarios in which the Form Availability and Tax Changes in Louisiana is utilized:

- Individuals filing their annual income tax returns may need this form to report changes in their tax situation.

- Businesses may use the form to update their tax status or report changes in ownership or structure.

- Tax professionals often refer to this form when advising clients on compliance and tax planning strategies.

Create this form in 5 minutes or less

Find and fill out the correct form availability and tax changes louisiana

Create this form in 5 minutes!

How to create an eSignature for the form availability and tax changes louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Form Availability And Tax Changes Louisiana for businesses?

Form Availability And Tax Changes Louisiana are crucial for businesses to stay compliant with state regulations. Understanding these changes helps ensure that all necessary forms are filed correctly and on time, avoiding potential penalties. airSlate SignNow simplifies this process by providing easy access to the latest forms and updates.

-

How does airSlate SignNow help with Form Availability And Tax Changes Louisiana?

airSlate SignNow offers a streamlined platform that keeps you updated on Form Availability And Tax Changes Louisiana. Our solution allows you to easily access, fill out, and eSign necessary documents, ensuring compliance with the latest tax regulations. This efficiency saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer related to Form Availability And Tax Changes Louisiana?

Our platform includes features such as customizable templates, automated reminders, and secure eSigning, all tailored to assist with Form Availability And Tax Changes Louisiana. These tools enhance productivity and ensure that your documents are always compliant with the latest tax laws. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for managing Form Availability And Tax Changes Louisiana?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Form Availability And Tax Changes Louisiana. With flexible pricing plans, businesses can choose the option that best fits their needs without compromising on features. This affordability allows companies of all sizes to stay compliant without breaking the bank.

-

Can airSlate SignNow integrate with other software for Form Availability And Tax Changes Louisiana?

Absolutely! airSlate SignNow seamlessly integrates with various software applications to enhance your workflow related to Form Availability And Tax Changes Louisiana. Whether you use accounting software or CRM systems, our integrations ensure that your document management process is efficient and cohesive. This connectivity helps streamline operations and maintain compliance.

-

What are the benefits of using airSlate SignNow for Form Availability And Tax Changes Louisiana?

Using airSlate SignNow for Form Availability And Tax Changes Louisiana offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick access to necessary forms and ensures that they are signed and submitted promptly. This not only saves time but also minimizes the risk of errors that could lead to compliance issues.

-

How can I ensure I am updated on Form Availability And Tax Changes Louisiana with airSlate SignNow?

airSlate SignNow provides regular updates and notifications regarding Form Availability And Tax Changes Louisiana. By subscribing to our service, you will receive alerts about any changes in tax forms or regulations, ensuring that you are always informed. This proactive approach helps you stay compliant and avoid any last-minute surprises.

Get more for Form Availability And Tax Changes Louisiana

- Notice dishonored check form

- Pennsylvania non foreign affidavit under irc 1445 form

- Pennsylvania pennsylvania installments fixed rate promissory note secured by personal property form

- Durable power attorney document form

- South carolina notice of consumers right to cure default form

- South carolina form 481373252

- South carolina lead based paint disclosure form

- South carolina form 481373254

Find out other Form Availability And Tax Changes Louisiana

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile