T2050 Application Form 2011

What is the T2050 Application Form

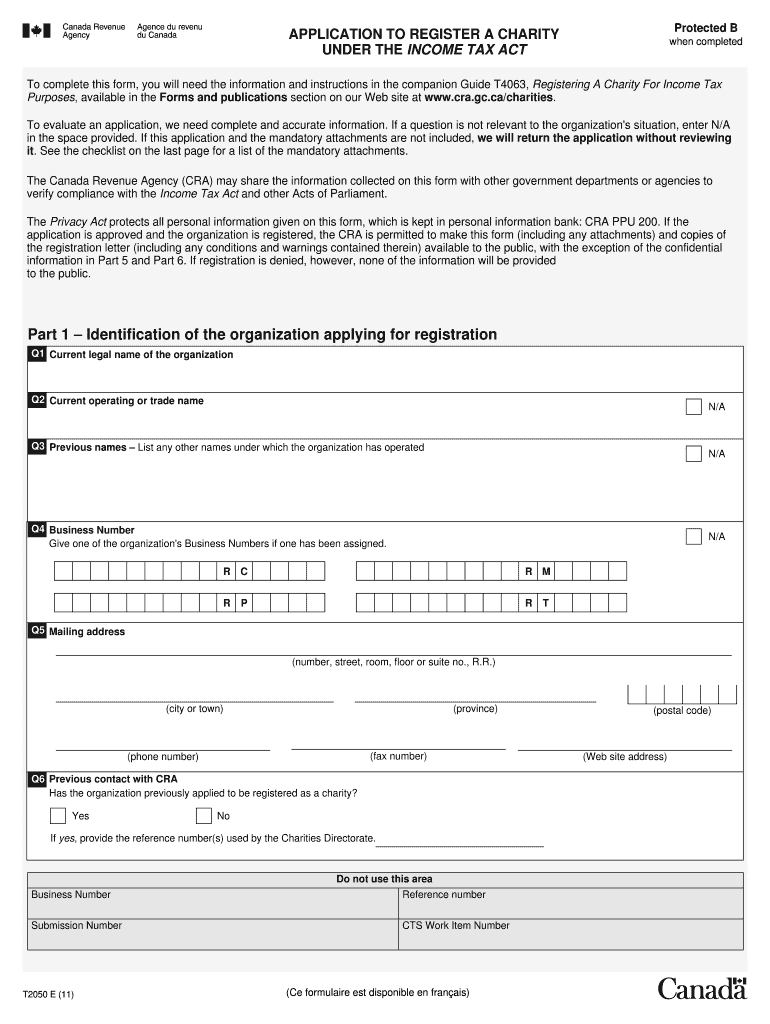

The T2050 application form is a legal document used to register a charity under the Income Tax Act in Canada. This form is essential for organizations seeking to obtain charitable status, allowing them to issue tax receipts for donations and access certain tax benefits. Completing the T2050 application accurately is crucial, as it ensures compliance with the legal requirements set forth by the Canada Revenue Agency (CRA).

How to use the T2050 Application Form

Using the T2050 application form involves several steps to ensure that all necessary information is provided. First, gather all required documents that support your application, such as your organization’s governing documents and financial statements. Next, fill out the form carefully, providing accurate details about your charity's purpose, activities, and structure. Once completed, review the form for any errors or omissions before submission to the CRA.

Steps to complete the T2050 Application Form

Completing the T2050 application form requires a systematic approach:

- Gather all necessary documents, including your organization's bylaws and financial records.

- Provide detailed information about your charity's objectives and proposed activities.

- Ensure that all sections of the form are filled out completely and accurately.

- Review the application for any errors or missing information.

- Submit the completed form to the CRA along with any required supporting documentation.

Required Documents

When submitting the T2050 application form, certain documents are required to support your application. These typically include:

- Governing documents, such as bylaws or articles of incorporation.

- Financial statements from the last fiscal year.

- A detailed description of your charity’s activities and objectives.

- Any additional documentation that demonstrates your organization’s charitable purpose.

Eligibility Criteria

To be eligible to use the T2050 application form, organizations must meet specific criteria set by the CRA. These include:

- The organization must operate exclusively for charitable purposes.

- It must be established in Canada.

- The activities of the organization must benefit the public or a significant segment of the public.

Application Process & Approval Time

The application process for the T2050 form involves several stages. After submission, the CRA reviews the application to ensure compliance with all requirements. The approval time can vary, but organizations should expect a waiting period of several months. During this time, the CRA may request additional information or clarification regarding the application.

Quick guide on how to complete application to register a charityunder the income tax act

A concise manual on how to prepare your T2050 Application Form

Finding the correct template can be a difficulty when you must provide official foreign documents. Even when you have the necessary form, it may be cumbersome to quickly fill it out according to all the stipulations if you use physical copies instead of handling everything digitally. airSlate SignNow is the online electronic signature solution that assists you in overcoming all of that. It allows you to obtain your T2050 Application Form and swiftly complete and sign it on-site without reprinting papers whenever you make an error.

Here are the actions you need to take to prepare your T2050 Application Form with airSlate SignNow:

- Click the Get Form button to upload your document to our editor immediately.

- Begin with the first empty box, input details, and proceed with the Next feature.

- Fill in the empty fields using the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to emphasize the most critical information.

- Click on Image and upload one if your T2050 Application Form necessitates it.

- Utilize the right-side panel to add more fields for you or others to complete if necessary.

- Review your responses and approve the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete modifying the form by clicking the Done button and selecting your file-sharing preferences.

Once your T2050 Application Form is prepared, you can share it just the way you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finalized documents in your account, organized in folders based on your choices. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct application to register a charityunder the income tax act

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How do you claim income tax exemption under Section 10 (18) of the IT Act as no column exists to reflect the said exemption in the ITR form?

The sheet of Taxes Paid and Verification in ITR Form has an option to disclose exempt incomes. You need to manually add Nature of Exempt Income and Amount.

-

What are the tax implications of donations made in the form of shares to a charitable trust under the Income-tax Act, 1961?

As far as the charitable trust is concerned the value of shares received in donation is income since the definition of the word `income’ in context of Income tax is inclusive and of wide import. However, if the donor gives a specific direction that the shares donated should form part of the corpus of the trust, than the value of shares received by the Trust will not be treated as its income under clause (d) of section 11 (1) of the I.T.Act.As far as the donor is concerned he will not be able to claim a deduction from his income u/s 80G of the value of shares donated to the charitable trust because explanation 5 to the section provides that the donation made must be of a sum of money.“Explanation 5.—For the removal of doubts, it is hereby declared that no deduction shall be allowed under this section in respect of any donation unless such donation is of a sum of money.”

-

Is income tax applicable to banks? If so, under which section of the Income Tax Act does it fall?

Is income tax applicable to banks? If so under which section of income tax act?Banks are generally corporations, and the goal is to earn a profit like other businesses, and they pay income tax on that profit.

Create this form in 5 minutes!

How to create an eSignature for the application to register a charityunder the income tax act

How to make an electronic signature for your Application To Register A Charityunder The Income Tax Act online

How to make an eSignature for your Application To Register A Charityunder The Income Tax Act in Google Chrome

How to make an eSignature for signing the Application To Register A Charityunder The Income Tax Act in Gmail

How to generate an electronic signature for the Application To Register A Charityunder The Income Tax Act right from your smart phone

How to create an eSignature for the Application To Register A Charityunder The Income Tax Act on iOS devices

How to make an eSignature for the Application To Register A Charityunder The Income Tax Act on Android

People also ask

-

What is the t2050 application and how does it work?

The t2050 application is a powerful tool integrated within airSlate SignNow that allows businesses to streamline their document signing processes. With this application, users can easily send and eSign documents online, ensuring a secure and efficient workflow. By harnessing the capabilities of the t2050 application, organizations can improve productivity and reduce turnaround times.

-

What are the key features of the t2050 application?

The t2050 application offers a range of features designed to enhance the eSigning experience, including document templates, automated workflows, and real-time status tracking. Users can also leverage advanced security measures such as two-factor authentication and audit trails to protect their documents. These features make the t2050 application a comprehensive solution for any business.

-

How much does the t2050 application cost?

The t2050 application is offered at competitive pricing designed to accommodate businesses of all sizes. airSlate SignNow provides various subscription plans with different features, allowing users to choose the one that best meets their needs. Additionally, a free trial is available for potential customers to explore the benefits of the t2050 application before committing.

-

What benefits can businesses expect from using the t2050 application?

Businesses can expect numerous benefits from using the t2050 application, including increased efficiency, cost savings, and enhanced document security. By digitizing the signing process, organizations can eliminate paper-based workflows and reduce administrative burdens. Furthermore, the t2050 application supports seamless collaboration between team members and clients.

-

Is the t2050 application easy to integrate with other tools?

Yes, the t2050 application is designed for easy integration with various business tools such as CRM systems, document management software, and more. This flexibility allows businesses to sync their existing workflows with the eSigning process, enhancing overall efficiency. airSlate SignNow offers a robust API that facilitates seamless integration of the t2050 application.

-

Can I use the t2050 application on mobile devices?

Absolutely! The t2050 application is fully compatible with mobile devices, allowing users to send and sign documents on-the-go. Whether you’re using a smartphone or tablet, the application provides a user-friendly interface to access and manage your documents easily. This mobility ensures that you can conduct business anytime, anywhere.

-

What types of documents can I sign with the t2050 application?

The t2050 application supports a wide variety of document types, including contracts, agreements, and forms. You can easily upload your documents in various formats like PDF, Word, and more for signing. This versatility makes the t2050 application suitable for different industries and applications.

Get more for T2050 Application Form

- Grant of easement sidewalk ferguson township form

- Sidewalk easement this easement is made and form

- National union fire ins v nicholas 438 pa super 98 form

- Docket number 490213297 form

- How to file a petition to expunge summary form

- Petition for expungement pursuant to parcrimp 9122b form

- And the board of directors of a form

- Incorporators shareholders and the board of directors of a form

Find out other T2050 Application Form

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure