Idaho Estate Form

What is the Idaho Estate

The Idaho estate refers to the legal framework governing the distribution of a deceased person's assets in Idaho. This process ensures that the decedent's wishes, as expressed in their will or through state laws, are honored. The Idaho estate encompasses various components, including real estate, personal property, and financial assets. Understanding the Idaho estate is crucial for individuals involved in estate planning or those who need to navigate the probate process after a loved one passes away.

Key elements of the Idaho Estate

Several key elements define the Idaho estate process:

- Probate Process: This legal procedure validates a deceased person's will and oversees the distribution of their assets.

- Executor Responsibilities: The appointed executor manages the estate, ensuring debts are paid and assets are distributed according to the will.

- Intestate Succession: If a person dies without a will, Idaho law outlines how assets will be distributed among heirs.

- Estate Taxes: Understanding potential tax obligations is essential for managing the estate efficiently.

Steps to complete the Idaho Estate

Completing the Idaho estate process involves several steps, which may vary based on whether there is a will:

- Gathering Documents: Collect necessary documents, including the will, death certificate, and asset information.

- Filing for Probate: Submit the will and other required documents to the appropriate Idaho probate court.

- Notifying Heirs and Creditors: Inform all relevant parties of the probate proceedings.

- Settling Debts: Pay any outstanding debts and taxes owed by the estate.

- Distributing Assets: Once debts are settled, distribute the remaining assets according to the will or state law.

Legal use of the Idaho Estate

The legal use of the Idaho estate encompasses various aspects, including the creation of wills, trusts, and other estate planning documents. These documents ensure that an individual's wishes are carried out after their death. Additionally, understanding the legal requirements for executing these documents is essential to avoid disputes among heirs and beneficiaries. Legal compliance with Idaho's probate laws is crucial for the smooth administration of an estate.

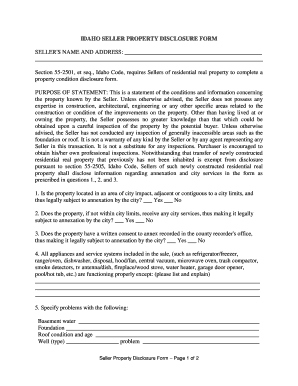

Disclosure Requirements

Disclosure requirements in the context of the Idaho estate often pertain to the information that must be provided to heirs and beneficiaries. Executors are typically required to disclose details about the estate's assets, debts, and the overall value. This transparency helps maintain trust among all parties involved and ensures compliance with legal obligations. Additionally, specific forms, such as the residential disclosure form, may be required when transferring real estate within the estate.

Form Submission Methods (Online / Mail / In-Person)

Submitting forms related to the Idaho estate can be done through various methods, depending on the specific requirements of the probate court. Common submission methods include:

- Online: Many Idaho counties offer online filing options for probate documents, allowing for quicker processing.

- Mail: Forms can often be submitted via mail, ensuring that all documents are sent to the correct court.

- In-Person: Individuals may also choose to file documents in person at the local probate court for immediate assistance.

Quick guide on how to complete idaho estate

Effortlessly Prepare Idaho Estate on Any Device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed materials, allowing you to retrieve the correct document and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any hold-ups. Manage Idaho Estate on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Steps to Alter and eSign Idaho Estate with Ease

- Locate Idaho Estate and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the specific tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device of your preference. Modify and eSign Idaho Estate to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for managing Idaho estate documents?

airSlate SignNow provides a robust set of features tailored for Idaho estate documents, such as customizable templates, eSignature capabilities, and real-time document tracking. This ensures that your estate documents are handled efficiently and securely, streamlining the signing process. You can also easily share and collaborate on Idaho estate files with clients and other stakeholders.

-

How can I integrate airSlate SignNow with my existing Idaho estate management tools?

Integrating airSlate SignNow with your existing Idaho estate management tools is seamless. The platform supports various integrations with popular applications, allowing you to synchronize your workflows and improve productivity. Whether you need to connect your CRM or document storage solution, airSlate SignNow can be easily paired with your current systems.

-

What is the pricing structure for airSlate SignNow for Idaho estate usage?

airSlate SignNow offers flexible pricing plans that cater to Idaho estate professionals, starting with a free trial and scalable options thereafter. The plans are designed to provide cost-effective solutions for businesses of all sizes, ensuring you only pay for what you need. You can choose from monthly or annual billing to fit your budget and usage requirements.

-

Is airSlate SignNow legally compliant for Idaho estate documents?

Yes, airSlate SignNow is legally compliant and adheres to the eSignature laws in Idaho, making it a reliable choice for handling estate documents. Our platform ensures that all electronic signatures are secure and valid, giving you peace of mind when executing your Idaho estate transactions. You can confidently use SignNow for all your document signing needs.

-

What are the benefits of using airSlate SignNow for Idaho estate transactions?

Utilizing airSlate SignNow for Idaho estate transactions offers numerous benefits, including faster processing times and enhanced security. The ease of use helps you manage documents more efficiently, reducing the time spent on administrative tasks. Additionally, the ability to electronically sign documents improves client experiences, making the process smoother and more straightforward.

-

Can I access my Idaho estate documents from anywhere using airSlate SignNow?

Absolutely! airSlate SignNow is cloud-based, allowing you to access your Idaho estate documents from anywhere with an internet connection. Whether you're in the office or on the go, you can manage, send, and sign documents without hassle. This flexibility is essential for professionals managing various estate transactions throughout Idaho.

-

How does airSlate SignNow enhance collaboration for Idaho estate teams?

airSlate SignNow enhances collaboration for Idaho estate teams by enabling real-time document sharing and team management features. Multiple users can work on the same document simultaneously, discussing changes and updates instantly. This collaborative approach helps streamline the estate management process, ensuring all team members are on the same page.

Get more for Idaho Estate

Find out other Idaho Estate

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe