New Mexico New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

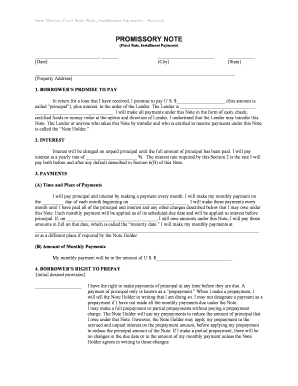

The New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This note is secured by the residential property, meaning that if the borrower defaults, the lender has the right to take possession of the property. It is commonly used in real estate transactions to formalize the terms of a loan, ensuring both parties understand their obligations.

How to use the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

To use the New Mexico Installments Fixed Rate Promissory Note, both the borrower and lender must fill out the document accurately. The borrower provides personal information, loan amount, interest rate, and repayment schedule. The lender must ensure that the property is adequately described and that the terms are clear. Once completed, both parties should sign the document, ideally in the presence of a notary to enhance its legal standing.

Steps to complete the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the New Mexico Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information, including borrower and lender details, loan amount, and property description.

- Clearly outline the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

- Fill in the required fields in the document, ensuring accuracy and clarity.

- Both parties should review the document to confirm all terms are understood and agreed upon.

- Sign the document in the presence of a notary, if possible, to ensure its validity.

Key elements of the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements must be included in the New Mexico Installments Fixed Rate Promissory Note to ensure its effectiveness:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate of interest applied to the loan.

- Repayment Schedule: Details on how often payments are made and the amount of each payment.

- Property Description: A clear description of the residential real estate securing the loan.

Legal use of the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

The legal use of the New Mexico Installments Fixed Rate Promissory Note is governed by state laws. This document must adhere to the legal requirements set forth in New Mexico regarding promissory notes and secured transactions. Proper execution, including signatures and notarization, enhances its enforceability in court. It is advisable to consult with a legal professional to ensure compliance with all applicable laws.

State-specific rules for the New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

New Mexico has specific rules governing the use of promissory notes secured by real estate. These include:

- Requirements for notarization to validate the document.

- Regulations regarding the disclosure of terms to the borrower.

- Provisions for foreclosure in case of default, which must comply with state foreclosure laws.

Quick guide on how to complete new mexico new mexico installments fixed rate promissory note secured by residential real estate

Effortlessly Prepare New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the required form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly and without delays. Handle New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Modify and eSign New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate Seamlessly

- Obtain New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors necessitating new document printouts. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property in New Mexico. It ensures that lenders have a claim on the property until the loan is paid off in fixed installments. This type of note provides clarity on the repayment schedule and terms.

-

How does airSlate SignNow simplify the process of creating a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

airSlate SignNow provides templates and user-friendly tools that allow you to efficiently create a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate. The platform streamlines document generation, enabling you to customize terms and conditions to meet your specific needs. You can easily access your documents anytime and from anywhere.

-

What are the benefits of using a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Using a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate offers numerous benefits, including legal protection for lenders and structured repayment plans for borrowers. It also enhances transparency between parties involved and can facilitate better financial planning. This note structure may potentially lower the risk associated with lending.

-

Are there any costs associated with using airSlate SignNow for my New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

While airSlate SignNow offers a cost-effective solution for creating a New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate, there may be associated subscription fees depending on the features you choose. However, the platform provides value by saving time and reducing paper-related overhead. Detailed pricing can be found on their website.

-

Can I integrate airSlate SignNow with other tools when managing my New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when managing your New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate. Whether you are using CRM systems or cloud storage solutions, integration helps streamline document management and eSigning processes. Check the integration options available on the platform.

-

Is eSigning legally valid for New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Yes, eSigning is legally valid for New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate under the Uniform Electronic Transactions Act (UETA) and the Electronic Signatures in Global and National Commerce Act (ESIGN). Using airSlate SignNow ensures that your electronically signed documents comply with legal standards. This adds security and authenticity to your transactions.

-

What features does airSlate SignNow offer for New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

airSlate SignNow includes features such as customizable templates, easy document sharing, secure cloud storage, and electronic signatures for your New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate. These features enhance efficiency and accuracy while handling legal agreements. Moreover, the platform supports collaboration among multiple parties.

Get more for New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Signature authorization card authorizing attorney to sign signature of depositor form

- Sample letter for dissolution and liquidation template form

- Agreement to provide consulting service for health care projects form

- What assets need to be listed for probatelegalzoom form

- Re withheld delivery form

- Contract or agreement to make exchange or barter and assume debt form

- 15 exchange agreement templates business templates form

- 31 agreement introducing a new partner in the existing form

Find out other New Mexico New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors