New York Assignment of Lien by Corporation or LLC Form

What is the New York Assignment Of Lien By Corporation Or LLC

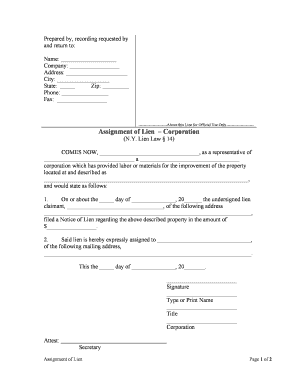

The New York Assignment of Lien by Corporation or LLC is a legal document that enables a corporation or limited liability company (LLC) to assign its lien rights to another party. This process is often utilized in construction and real estate transactions, where a contractor or supplier may need to transfer their lien rights to a lender or another entity. The assignment of lien serves as a formal acknowledgment of this transfer, ensuring that the new lien holder has the legal right to enforce the lien against the property in question.

How to use the New York Assignment Of Lien By Corporation Or LLC

To effectively use the New York Assignment of Lien by Corporation or LLC, follow these steps:

- Identify the parties involved: Ensure that both the assignor (the original lien holder) and the assignee (the new lien holder) are clearly defined in the document.

- Complete the form: Fill out the necessary information, including the details of the lien being assigned, the property description, and the signatures of both parties.

- Notarization: Have the document notarized to validate the signatures, which adds an extra layer of legal protection.

- File the assignment: Submit the completed form to the appropriate county clerk's office where the original lien was recorded.

Steps to complete the New York Assignment Of Lien By Corporation Or LLC

Completing the New York Assignment of Lien by Corporation or LLC involves several key steps:

- Gather required information: Collect all necessary details regarding the original lien, including the lien holder's name, property description, and the date of the original lien.

- Draft the assignment: Use a template or create a document that includes all relevant information about the assignment, including the names of the assignor and assignee.

- Review for accuracy: Ensure that all information is accurate and complete to avoid potential legal issues.

- Sign and notarize: Both parties should sign the document in the presence of a notary public to ensure its legality.

- File the document: Submit the notarized assignment to the appropriate county office to officially record the transfer of lien rights.

Key elements of the New York Assignment Of Lien By Corporation Or LLC

The New York Assignment of Lien by Corporation or LLC should include several key elements to ensure its validity:

- Names of the parties: Clearly state the names of the assignor and assignee.

- Property description: Provide a detailed description of the property associated with the lien.

- Original lien details: Include information about the original lien, such as the date it was filed and its recording number.

- Signatures: Both parties must sign the document, and it should be notarized to validate the agreement.

Legal use of the New York Assignment Of Lien By Corporation Or LLC

The legal use of the New York Assignment of Lien by Corporation or LLC is crucial for maintaining the integrity of lien rights in real estate transactions. This document must comply with New York state laws, ensuring that the assignment is executed properly. Failure to adhere to legal requirements can result in the assignment being deemed invalid, which may jeopardize the assignee's ability to enforce the lien. It is essential to consult legal counsel when drafting or executing this document to ensure compliance with all applicable laws.

State-specific rules for the New York Assignment Of Lien By Corporation Or LLC

In New York, specific rules govern the Assignment of Lien by Corporation or LLC. These include:

- The assignment must be in writing and signed by both parties.

- The document must be notarized to be legally binding.

- The assignment should be filed with the county clerk's office where the original lien was recorded.

- Timely filing is essential to maintain the validity of the lien rights, as delays may lead to complications in enforcement.

Quick guide on how to complete new york assignment of lien by corporation or llc

Complete New York Assignment Of Lien By Corporation Or LLC seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle New York Assignment Of Lien By Corporation Or LLC on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign New York Assignment Of Lien By Corporation Or LLC effortlessly

- Locate New York Assignment Of Lien By Corporation Or LLC and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign New York Assignment Of Lien By Corporation Or LLC and ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York Assignment Of Lien By Corporation Or LLC?

A New York Assignment Of Lien By Corporation Or LLC is a legal document that allows a corporation or LLC to transfer its lien rights to another party. This document is essential for businesses that want to ensure their financial interests are protected in New York. Using airSlate SignNow, you can eSign and securely manage these documents with ease.

-

How can airSlate SignNow help with a New York Assignment Of Lien By Corporation Or LLC?

airSlate SignNow streamlines the process of creating and signing a New York Assignment Of Lien By Corporation Or LLC. Our platform offers templates and a user-friendly interface that simplifies document management. Save time and reduce errors with electronic signatures and automated workflows.

-

What are the benefits of using airSlate SignNow for New York Assignment Of Lien By Corporation Or LLC?

Using airSlate SignNow for your New York Assignment Of Lien By Corporation Or LLC has several benefits, including improved efficiency through electronic signing, increased security, and reduced paperwork. Our platform also allows for easy access and storage of documents, ensuring that your records are always organized and secure.

-

Is airSlate SignNow affordable for businesses handling New York Assignments Of Lien?

Yes, airSlate SignNow is a cost-effective solution for businesses managing New York Assignments Of Lien. We offer flexible pricing plans that cater to businesses of all sizes, ensuring that everyone can access our powerful eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with other software for New York Assignments Of Lien By Corporation Or LLC?

Absolutely! airSlate SignNow offers integrations with various software applications commonly used in business operations. This makes it easy to synchronize your documents for New York Assignments Of Lien By Corporation Or LLC seamlessly across platforms, enhancing your overall productivity.

-

What features does airSlate SignNow provide for managing New York Assignment Of Lien documents?

airSlate SignNow provides several features for managing New York Assignment Of Lien documents, including customizable templates, real-time tracking, and automated reminders for signatories. These tools help you stay organized and ensure that important documents are completed promptly.

-

How can I ensure the legality of my New York Assignment Of Lien By Corporation Or LLC using airSlate SignNow?

Using airSlate SignNow ensures that your New York Assignment Of Lien By Corporation Or LLC is legally binding. We comply with eSignature laws and regulations, so your digitally signed documents are valid and enforceable. You also have the option of adding audit trails for additional authenticity.

Get more for New York Assignment Of Lien By Corporation Or LLC

- Assignment of accounts receivable la business connect form

- What are debt collection lawscreditcom form

- Letter informing to debt collector to cease communications

- Employment contract with mold inspection and remediation company form

- Insurance mn docsharetips form

- Personal jurisdiction in internet cases in the united states form

- Contract assignmentfree legal forms

- Writing an unable to pay debt letter sample letters form

Find out other New York Assignment Of Lien By Corporation Or LLC

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer