New York Trust Form

What is the New York Trust

A New York Trust, often referred to as a living trust, is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly beneficial for avoiding probate, which can be a lengthy and costly process. In New York, a revocable living trust can be altered or revoked by the grantor at any time, providing flexibility in asset management.

Key Elements of the New York Trust

Understanding the key elements of a New York Trust is essential for effective estate planning. The primary components include:

- Grantor: The person who creates the trust and transfers assets into it.

- Trustee: The individual or entity responsible for managing the trust assets according to the trust document.

- Beneficiaries: The individuals or organizations that will receive the trust assets after the grantor's death.

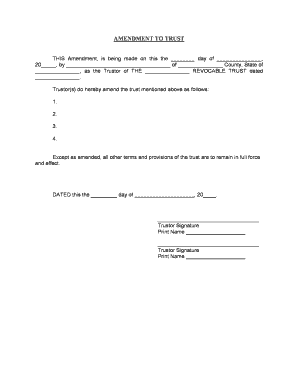

- Trust Document: A legal document outlining the terms of the trust, including how assets are to be managed and distributed.

Steps to Complete the New York Trust

Completing a New York Trust involves several steps to ensure it is legally valid and meets the grantor's intentions. The process typically includes:

- Identifying the assets to be included in the trust.

- Selecting a trustee who will manage the trust.

- Drafting the trust document with clear terms and conditions.

- Funding the trust by transferring the identified assets into it.

- Reviewing and updating the trust as necessary to reflect any changes in circumstances.

Legal Use of the New York Trust

The legal use of a New York Trust is governed by state laws and regulations. It is essential for the grantor to ensure that the trust complies with New York's legal requirements, which include proper execution and witnessing of the trust document. Additionally, the trust must be funded correctly to be effective. Legal advice may be beneficial to navigate these complexities and ensure that the trust serves its intended purpose.

Required Documents

To establish a New York Trust, certain documents are typically required. These may include:

- Trust Agreement: The foundational document that outlines the terms of the trust.

- Asset Deeds: Documents transferring ownership of property or assets into the trust.

- Identification: Valid identification for the grantor and trustee, such as a driver's license or passport.

- Tax Identification Number: If the trust will have its own tax ID, this may be necessary.

Form Submission Methods

In New York, the establishment of a trust does not require formal submission to a government agency; however, certain documents may need to be filed depending on the assets involved. Common submission methods include:

- Online: Some asset transfers can be initiated electronically, especially for financial accounts.

- Mail: Physical documents can be mailed to relevant institutions for asset transfers.

- In-Person: Meeting with a legal professional or financial institution may be necessary for certain transactions.

Quick guide on how to complete new york trust

Effortlessly Prepare New York Trust on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without issues. Manage New York Trust on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign New York Trust with minimal effort

- Locate New York Trust and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign New York Trust and ensure excellent communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are living trust forms and why do I need them?

Living trust forms are legal documents that establish a trust during your lifetime to manage your assets. They allow for smooth asset transfer after your death, avoiding probate delays and legal complexities. Utilizing living trust forms can provide peace of mind and ensure your wishes are honored.

-

How can airSlate SignNow help me with living trust forms?

airSlate SignNow offers a user-friendly platform to easily create, edit, and sign living trust forms digitally. With our intuitive interface, you can manage your documents efficiently, ensuring that your trust is set up correctly and ready to go. Plus, our eSignature feature allows for quick and secure signing, streamlining the entire process.

-

Are there any costs associated with creating living trust forms using airSlate SignNow?

While airSlate SignNow offers flexible pricing plans, there may be costs associated with creating living trust forms based on the specific features you choose. Our platform is designed to provide cost-effective solutions for document management, ensuring that you only pay for what you need. Check our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow provide for living trust forms?

airSlate SignNow provides features such as customizable templates for living trust forms, eSigning, secure storage, and easy sharing capabilities. You can also track the status of your documents and ensure compliance with legal requirements. These features make managing living trust forms straightforward and efficient.

-

Can I integrate airSlate SignNow with other applications for managing living trust forms?

Yes, airSlate SignNow can seamlessly integrate with various applications to enhance your experience in managing living trust forms. Whether you need to connect with cloud storage solutions or workflow tools, our integrations provide a robust ecosystem to ensure smooth operations. Discover our integration options to maximize your efficiency.

-

How secure is my data when using airSlate SignNow for living trust forms?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your living trust forms and personal information. You can trust that your documents are safe and confidential throughout the signing process and beyond.

-

Do I need legal assistance when using airSlate SignNow to create living trust forms?

While airSlate SignNow provides easy-to-use templates for creating living trust forms, it is advisable to consult with a legal professional to ensure that your documents meet all legal requirements. This extra step can provide assurance that your trust is valid and enforceable. Use our platform to streamline document preparation and focus on the legal safeguards.

Get more for New York Trust

- With prejudice form

- Focus ampamp keyboard operabilityusability ampamp web accessibility form

- Mi do 11 form

- Original obligor form

- 2016 2019 form mi foc 23 fill online printable fillable

- Order regarding change of form

- Mipolice report no form

- Approved scao state of michigan case no judicial district form

Find out other New York Trust

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself