Ohio Assignment of Mortgage by Individual Mortgage Holder Form

What is the Ohio Assignment of Mortgage by Individual Mortgage Holder

The Ohio Assignment of Mortgage is a legal document that allows an individual mortgage holder to transfer their interest in a mortgage to another party. This form is crucial when a mortgage holder wishes to assign their rights and obligations under the mortgage agreement to another entity or individual. It serves to officially document the change in ownership of the mortgage, ensuring that the new holder has the legal authority to enforce the terms of the mortgage. This assignment is particularly relevant in cases of refinancing, selling property, or transferring ownership for various personal or business reasons.

Steps to Complete the Ohio Assignment of Mortgage by Individual Mortgage Holder

Completing the Ohio Assignment of Mortgage involves several key steps to ensure that the document is legally binding and properly executed:

- Gather necessary information: Collect details about the original mortgage, including the names of the parties involved, the property address, and the mortgage account number.

- Draft the assignment: Use a template or create a document that includes all required information, such as the names of the assignor (current mortgage holder) and assignee (new mortgage holder).

- Include legal language: Ensure that the document contains appropriate legal language to signify the transfer of rights and obligations.

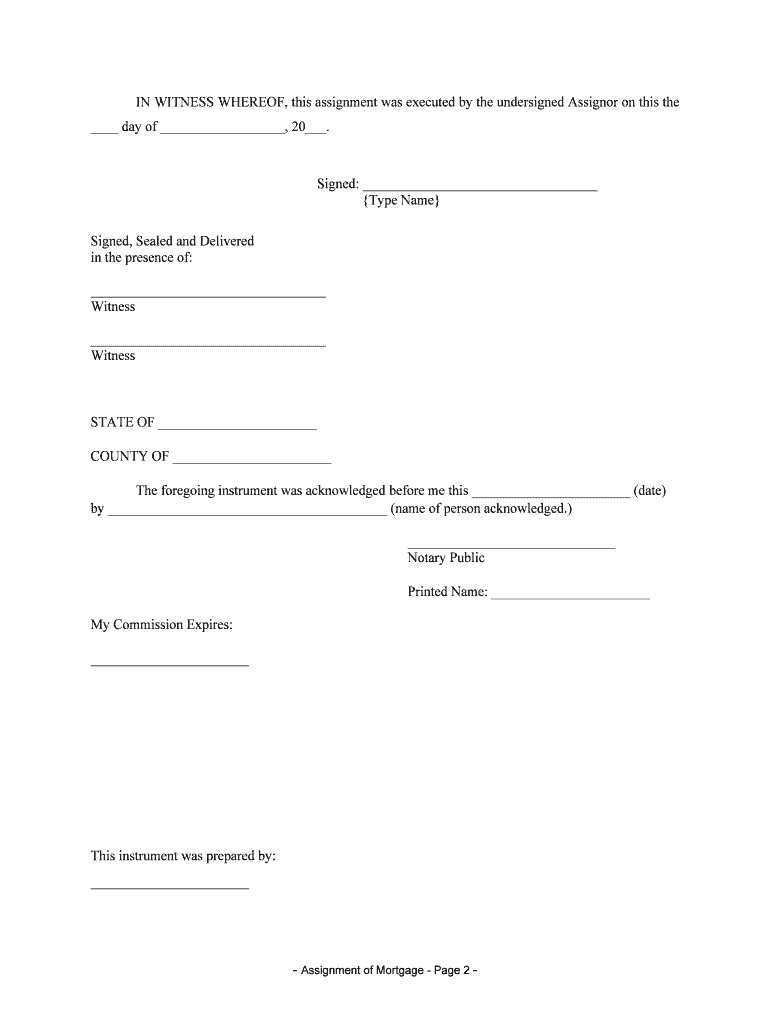

- Sign the document: The assignor must sign the assignment in the presence of a notary public to validate the transfer.

- File the assignment: Submit the completed assignment to the appropriate county recorder's office to officially record the change.

Legal Use of the Ohio Assignment of Mortgage by Individual Mortgage Holder

The legal use of the Ohio Assignment of Mortgage is governed by state laws that dictate how such assignments must be executed and recorded. To be legally valid, the assignment must be signed by the original mortgage holder and notarized. Additionally, it must be filed with the local county recorder's office to provide public notice of the transfer. This process ensures that the new mortgage holder's rights are protected and recognized by law. Failure to properly execute and record the assignment may result in legal complications, including challenges to the enforceability of the mortgage.

Key Elements of the Ohio Assignment of Mortgage by Individual Mortgage Holder

Several key elements must be included in the Ohio Assignment of Mortgage to ensure its validity:

- Names of the parties: Clearly state the names of both the assignor and assignee.

- Property description: Provide a detailed description of the property associated with the mortgage.

- Mortgage details: Include the original mortgage amount, date, and account number.

- Effective date: Specify the date on which the assignment takes effect.

- Signatures: Ensure that the assignor signs the document in front of a notary public.

How to Obtain the Ohio Assignment of Mortgage by Individual Mortgage Holder

Obtaining the Ohio Assignment of Mortgage can be done through several methods. Individuals can access templates online that comply with Ohio law, or they may choose to consult with a legal professional to draft a custom document. Additionally, local county recorder's offices may provide guidance or resources for completing the assignment. It is important to ensure that any template used meets the specific requirements of Ohio law to avoid issues during the recording process.

Examples of Using the Ohio Assignment of Mortgage by Individual Mortgage Holder

There are various scenarios in which the Ohio Assignment of Mortgage may be utilized:

- When a homeowner sells their property and needs to transfer the mortgage to the buyer.

- In cases of refinancing, where the original lender's interest is assigned to a new lender.

- When a mortgage holder wishes to transfer their interest to a family member or business partner.

Quick guide on how to complete ohio assignment of mortgage by individual mortgage holder

Effortlessly Prepare Ohio Assignment Of Mortgage By Individual Mortgage Holder on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without holdups. Manage Ohio Assignment Of Mortgage By Individual Mortgage Holder on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Ohio Assignment Of Mortgage By Individual Mortgage Holder With Ease

- Locate Ohio Assignment Of Mortgage By Individual Mortgage Holder and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight the important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Ohio Assignment Of Mortgage By Individual Mortgage Holder, ensuring exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Ohio mortgage form, and why is it important?

The Ohio mortgage form is a legal document that outlines the terms of a mortgage agreement in Ohio. It is crucial for both borrowers and lenders, as it protects the rights and responsibilities of each party involved in the transaction.

-

How does airSlate SignNow streamline the Ohio mortgage form process?

airSlate SignNow simplifies the Ohio mortgage form process by allowing users to fill out, sign, and send documents electronically. This enhances efficiency, reduces paperwork, and speeds up the overall mortgage approval process.

-

Is there a cost associated with using airSlate SignNow for Ohio mortgage forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Users can choose a plan that fits their budget while benefiting from the efficient management of Ohio mortgage forms and other documents.

-

What features does airSlate SignNow offer for managing Ohio mortgage forms?

airSlate SignNow provides features such as document templates, electronic signatures, real-time tracking, and notifications. These tools make it easier to manage Ohio mortgage forms and ensure a smooth signing process.

-

Can I integrate airSlate SignNow with other software for handling Ohio mortgage forms?

Absolutely! airSlate SignNow allows seamless integration with other software applications, such as CRM systems and document management tools. This ensures that your workflow remains efficient when processing Ohio mortgage forms.

-

How does eSigning Ohio mortgage forms benefit customers?

eSigning Ohio mortgage forms enhances convenience by allowing customers to sign documents from anywhere, on any device. This not only saves time but also reduces the need for physical meetings to finalize transactions.

-

What security measures are in place when using airSlate SignNow for Ohio mortgage forms?

airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your Ohio mortgage forms and sensitive information. You can trust that your documents are safe and compliant with legal standards.

Get more for Ohio Assignment Of Mortgage By Individual Mortgage Holder

- Unilab corp de form 8 k filing date 05271999

- Mitchell hutchins securities trust form

- Bylaws of the board of trustees tompkins cortland community form

- Marine purchase agreement without personalization form

- Lobel financial payment address list template global form

- Registration rights agreement sample registration rights form

- Sample purchase agreement between tesoro petroleum corp form

- This putcall option agreement theagreement investor form

Find out other Ohio Assignment Of Mortgage By Individual Mortgage Holder

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors