Oregon Lien Form

What is the Oregon Lien

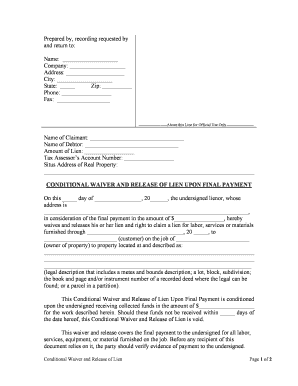

The Oregon lien is a legal claim against a property that ensures payment for services rendered or materials provided. This type of lien is commonly used in the construction industry, allowing contractors and suppliers to secure their payments. When a lien is filed, it becomes a matter of public record, which can affect the property owner's ability to sell or refinance the property until the debt is settled.

Key elements of the Oregon Lien

Understanding the key elements of the Oregon lien is essential for both property owners and contractors. The primary components include:

- Claimant Information: The name and contact details of the individual or business filing the lien.

- Property Description: A clear description of the property subject to the lien, including the address and legal description.

- Amount Owed: The total amount due for services or materials provided.

- Date of Service: The date when the services were rendered or materials were supplied.

- Signature: The signature of the claimant or their authorized representative, affirming the validity of the lien.

Steps to complete the Oregon Lien

Completing the lien waiver form in Oregon involves several important steps to ensure it is legally binding. These steps include:

- Gather Necessary Information: Collect all relevant details about the property, services provided, and the parties involved.

- Fill Out the Form: Accurately complete the lien waiver form with the gathered information, ensuring all sections are filled out correctly.

- Review for Accuracy: Double-check the form for any errors or omissions that could invalidate the lien.

- File the Lien: Submit the completed form to the appropriate county clerk’s office where the property is located.

- Notify Interested Parties: Inform the property owner and any other relevant parties about the filed lien.

Legal use of the Oregon Lien

The legal use of the Oregon lien is governed by state laws that outline how and when a lien can be filed. It is crucial for claimants to understand these regulations to ensure compliance. The lien must be filed within a specific timeframe after the services are rendered, typically within 75 days. Failure to adhere to these timelines can result in the loss of the right to collect payment through a lien.

Filing Deadlines / Important Dates

Timeliness is critical when filing an Oregon lien. The deadlines for filing depend on the type of work performed:

- For construction projects: A lien must be filed within 75 days of the last day of work.

- For materials supplied: The lien should be filed within 75 days from the date the materials were delivered.

It is advisable to keep track of these deadlines to ensure that the lien is enforceable and to avoid complications in the collection process.

Form Submission Methods

In Oregon, the lien waiver form can be submitted through various methods, including:

- Online Submission: Many counties offer online filing options through their official websites.

- Mail: The form can be mailed to the county clerk’s office, ensuring it is sent with sufficient time to meet filing deadlines.

- In-Person: Individuals can also file the form in person at the county clerk’s office, allowing for immediate confirmation of receipt.

Quick guide on how to complete oregon lien 481374224

Effortlessly prepare Oregon Lien on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Oregon Lien on any device with the airSlate SignNow Android or iOS applications and enhance any document-related activity today.

The easiest way to modify and electronically sign Oregon Lien with ease

- Locate Oregon Lien and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then select the Finish button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and electronically sign Oregon Lien and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien waiver form Oregon?

A lien waiver form Oregon is a legal document that relinquishes the right to file a lien against a property after payment has been made. This form protects property owners from future claims by contractors or suppliers, ensuring they have fulfilled their financial obligations.

-

How can airSlate SignNow help me with lien waiver form Oregon?

airSlate SignNow simplifies the process of creating and sending lien waiver forms Oregon electronically. With our easy-to-use platform, you can prepare, sign, and store your documents securely, streamlining your workflows and saving time.

-

What features does airSlate SignNow offer for lien waiver form Oregon?

Our platform offers features such as customizable templates for lien waiver forms Oregon, advanced eSigning capabilities, and automatic notifications. These features enhance efficiency and ensure that all parties can complete transactions securely and quickly.

-

Is there a cost associated with using airSlate SignNow for lien waiver form Oregon?

Yes, airSlate SignNow provides a variety of pricing plans tailored to different business needs. You can select a plan that fits your requirements for managing lien waiver forms Oregon and enjoy the benefits of a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for lien waiver form Oregon?

Absolutely! airSlate SignNow supports integrations with various other applications, such as project management and accounting software, to help manage your lien waiver forms Oregon efficiently. This ensures a seamless workflow between platforms.

-

What are the benefits of using airSlate SignNow for lien waiver form Oregon?

Using airSlate SignNow for lien waiver forms Oregon offers multiple benefits including enhanced security, reduced processing time, and improved collaboration between involved parties. Our electronic signing solution also ensures compliance with industry standards.

-

Can multiple parties sign the lien waiver form Oregon using airSlate SignNow?

Yes, with airSlate SignNow, multiple parties can easily eSign the lien waiver form Oregon. Our platform sends notifications to all signers, allowing for a smooth and timely signing process, regardless of each party's location.

Get more for Oregon Lien

- Requirements for immigrant and nonimmigrant visasus form

- Sample due diligence request checklist kampampl gates form

- Ms ifb template maryland department of health form

- It due diligence checklist free technology mampampa template form

- Common insurance terms in mobile alabama and mississippi form

- 08 checklist for potential director and officer liability issues form

- The cftc division of enforcement enforcement manual form

- A comprehensive guide to due diligence issues in mergers form

Find out other Oregon Lien

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors