Pennsylvania Trust Form

What is the Pennsylvania Trust

The Pennsylvania trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries. This trust can be revocable or irrevocable, with the irrevocable trust being a popular choice for estate planning. Once established, the assets placed in an irrevocable trust cannot be altered or removed by the grantor, offering a level of protection from creditors and potential estate taxes. Understanding the nuances of this trust type is essential for effective estate management.

Key elements of the Pennsylvania Trust

Several key elements define the Pennsylvania trust. These include:

- Trustee: The individual or entity responsible for managing the trust assets and ensuring that the terms of the trust are followed.

- Beneficiaries: The individuals or entities who will receive the benefits from the trust, such as income or assets.

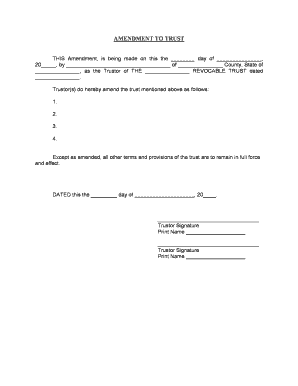

- Trust Document: A legally binding document that outlines the terms and conditions of the trust, including the powers of the trustee and the rights of the beneficiaries.

- Assets: The property or financial resources placed into the trust, which can include real estate, stocks, bonds, and cash.

Steps to complete the Pennsylvania Trust

Completing the Pennsylvania irrevocable trust form involves several steps to ensure compliance with state laws:

- Determine the type of trust: Decide if an irrevocable trust is suitable for your estate planning needs.

- Draft the trust document: Include all necessary details such as the trustee, beneficiaries, and specific terms.

- Sign the document: Ensure that the trust document is signed in accordance with Pennsylvania law, which may require witnesses or notarization.

- Fund the trust: Transfer assets into the trust, which may involve retitling property or transferring bank accounts.

- Maintain records: Keep detailed records of all transactions and communications regarding the trust for future reference.

Legal use of the Pennsylvania Trust

The legal use of a Pennsylvania trust is governed by state laws that dictate how trusts should be established and managed. An irrevocable trust must comply with specific legal requirements to be valid, including proper documentation and execution. It is essential to consult with a legal professional to ensure that the trust adheres to Pennsylvania statutes and effectively serves its intended purpose, such as asset protection and tax planning.

Required Documents

To establish a Pennsylvania irrevocable trust, several documents are typically required:

- Trust Agreement: The primary document outlining the terms of the trust.

- Asset Transfer Documents: Documentation for transferring ownership of assets into the trust.

- Identification: Valid identification for the trustee and beneficiaries to verify their identities.

- Tax Identification Number: An Employer Identification Number (EIN) may be necessary for tax purposes.

Eligibility Criteria

Eligibility to create a Pennsylvania irrevocable trust generally requires the grantor to be of legal age and sound mind. The grantor must clearly understand the implications of establishing an irrevocable trust, including the inability to alter or revoke the trust once it is created. Additionally, the trust must have identifiable beneficiaries and assets that can be placed into the trust.

Quick guide on how to complete pennsylvania trust

Effortlessly Prepare Pennsylvania Trust on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Pennsylvania Trust on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Modify and eSign Pennsylvania Trust with Ease

- Find Pennsylvania Trust and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional physical signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Pennsylvania Trust to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Pennsylvania irrevocable trust form?

A Pennsylvania irrevocable trust form is a legal document used to create an irrevocable trust in Pennsylvania. This form outlines the terms and conditions of the trust and specifies how the assets within it will be managed and distributed. By using this form, individuals can ensure their estate plans are executed according to their wishes.

-

How can I obtain a Pennsylvania irrevocable trust form?

You can obtain a Pennsylvania irrevocable trust form through various online legal service providers, including airSlate SignNow. Our platform offers easy access to customizable trust forms that comply with Pennsylvania regulations, allowing you to create a legally binding document efficiently and conveniently.

-

What are the benefits of using a Pennsylvania irrevocable trust form?

Using a Pennsylvania irrevocable trust form provides multiple benefits, including asset protection from creditors and the ability to manage your assets during your lifetime. It also helps to minimize estate taxes and ensures that your assets are distributed according to your wishes after your passing. Additionally, irrevocable trusts can provide peace of mind knowing your estate plan is secure.

-

Is it easy to fill out the Pennsylvania irrevocable trust form through airSlate SignNow?

Yes, filling out the Pennsylvania irrevocable trust form through airSlate SignNow is straightforward and user-friendly. Our platform provides step-by-step guidance and intuitive editing tools, making it easy for anyone to complete the form accurately. Plus, you can eSign and store your documents securely all in one place.

-

What features does airSlate SignNow offer for managing Pennsylvania irrevocable trust forms?

airSlate SignNow offers several features for managing Pennsylvania irrevocable trust forms, including document collaboration, secure storage, and customizable templates. Users can easily share documents for review, track changes, and even automate workflows. These features streamline the process and ensure a smooth experience from creation to execution.

-

What is the pricing for creating a Pennsylvania irrevocable trust form with airSlate SignNow?

The pricing for creating a Pennsylvania irrevocable trust form with airSlate SignNow varies depending on the plan you choose. We offer a cost-effective solution tailored to your needs, providing comprehensive access to all document types, including trust forms. Visit our website for detailed pricing options and to find the best plan for your situation.

-

Can I integrate airSlate SignNow with other applications for Pennsylvania irrevocable trust forms?

Yes, airSlate SignNow supports integrations with various applications, promoting seamless management of your Pennsylvania irrevocable trust forms. Integrate with popular tools like Google Drive, Dropbox, and other productivity software for enhanced functionality. This allows you to streamline your workflow and access your documents effortlessly.

Get more for Pennsylvania Trust

- D r a f t district of north dakota united states courts form

- Letter of no objection request charlotte county form

- Order of name change north dakota supreme court form

- North dakota fixed rate note installment payments unsecured form

- Guide to financing the community supported farm new form

- North dakota fixed rate note installment payments secured by personal property form

- North dakota fixed rate note installment payments secured commercial property form

- Names of individuals making statement form

Find out other Pennsylvania Trust

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement