Tennessee Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

What is the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

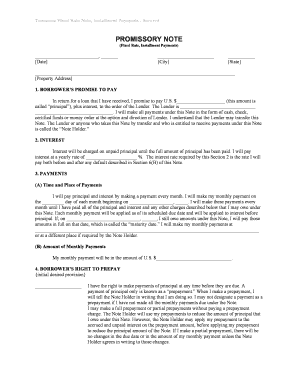

The Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan with fixed payments over a specified period. This note is secured by residential real estate, meaning the property serves as collateral for the loan. If the borrower defaults, the lender has the right to take possession of the property. This type of promissory note is commonly used in real estate transactions and financing arrangements, providing a clear framework for both parties involved.

Key elements of the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements are essential to the validity and effectiveness of this promissory note. These include:

- Borrower and Lender Information: Full names and addresses of both parties must be included.

- Loan Amount: The total amount of money being borrowed should be clearly stated.

- Interest Rate: The fixed interest rate applicable to the loan must be specified.

- Payment Schedule: Details regarding the frequency and amount of payments should be outlined.

- Collateral Description: A detailed description of the residential real estate securing the loan is necessary.

- Default Terms: Conditions under which the borrower may default and the lender's rights in such cases should be included.

Steps to complete the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the Tennessee Tennessee Installments Fixed Rate Promissory Note involves several important steps:

- Gather necessary information about both the borrower and lender.

- Determine the loan amount and interest rate.

- Decide on a payment schedule that works for both parties.

- Clearly describe the residential property being used as collateral.

- Review the terms of default and ensure both parties understand their rights and obligations.

- Sign the document in the presence of a notary, if required, to ensure its legal validity.

Legal use of the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This promissory note is legally binding when executed properly. To ensure its legality, it must comply with state laws governing promissory notes and secured transactions. It is important to follow any specific regulations set forth by Tennessee law, including proper execution and notarization, if necessary. The note should also adhere to federal regulations regarding lending and borrowing practices.

How to use the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Using the Tennessee Tennessee Installments Fixed Rate Promissory Note involves several key actions:

- Ensure all parties involved have a clear understanding of the terms outlined in the note.

- Maintain copies of the signed document for record-keeping purposes.

- Utilize the note as a reference for payment schedules and obligations.

- In case of a default, follow the outlined procedures to address the situation legally.

State-specific rules for the Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Tennessee has specific rules that govern the use of promissory notes and secured transactions. It is essential to be aware of these regulations to ensure compliance. For instance, the note must meet certain formatting requirements and contain specific language to be enforceable in court. Additionally, any disclosures required by state law must be included to protect both the lender and borrower.

Quick guide on how to complete tennessee tennessee installments fixed rate promissory note secured by residential real estate

Complete Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate easily on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate effortlessly

- Find Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements within a few clicks from your selected device. Edit and eSign Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate and foster effective communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

A Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by residential property. It specifies the amount borrowed, repayment schedule, and the interest rate, providing assurance to lenders. This type of promissory note is commonly used in real estate transactions in Tennessee.

-

How does airSlate SignNow facilitate the signing of a Tennessee Tennessee Installments Fixed Rate Promissory Note?

airSlate SignNow simplifies the process of signing a Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate by allowing users to electronically sign documents securely. The platform enables users to manage, send, and store documents conveniently. This enhances efficiency and ensures that all parties can sign from any location.

-

What are the advantages of using a Tennessee Tennessee Installments Fixed Rate Promissory Note for borrowers?

Using a Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate offers several benefits for borrowers. It provides clear repayment terms, potentially lower interest rates compared to unsecured loans, and the ability to leverage real estate as collateral. This can be an effective financing option for homeowners in need of capital.

-

Are there any fees associated with setting up a Tennessee Tennessee Installments Fixed Rate Promissory Note?

Typically, there may be fees involved in creating a Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate, such as legal fees or administrative charges for processing. However, using airSlate SignNow can help reduce overhead costs due to its cost-effective document management solutions. Always check for specific pricing structures before proceeding.

-

Can I customize my Tennessee Tennessee Installments Fixed Rate Promissory Note template?

Yes, airSlate SignNow allows users to create and customize their own Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate templates. You can easily change terms, conditions, and add specific clauses that meet your unique needs. This flexibility enables you to tailor the document for each transaction.

-

What integrations does airSlate SignNow offer for managing Tennessee Tennessee Installments Fixed Rate Promissory Notes?

airSlate SignNow integrates with a variety of platforms, enabling you to manage your Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate alongside other tools. You can connect with CRMs, cloud storage services, and other applications to streamline your workflow. These integrations help ensure a seamless process from document preparation to signing.

-

How secure is the signing process for a Tennessee Tennessee Installments Fixed Rate Promissory Note?

The signing process for a Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate on airSlate SignNow is highly secure. The platform employs industry-standard encryption and authentication methods to protect sensitive information. This ensures that both parties can sign confidently knowing their data is safe.

Get more for Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Escrow agreement provides for delivery of assignment to form

- Legacy09 acquisition forms oil ampampamp gas legal forms

- First interstate bank escrow agreement form

- Analyzing oil and gas farmout agreements reprint first form

- Farmout agreement providing for multiple wells with form

- Legacy energy forms basic oil and gas forms program nk 01

- Agreement to purchase seismic data with option form

- Exv1w1 secgovhome form

Find out other Tennessee Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template