Trustee Notice to Beneficiaries Form

What is the Trustee Notice To Beneficiaries

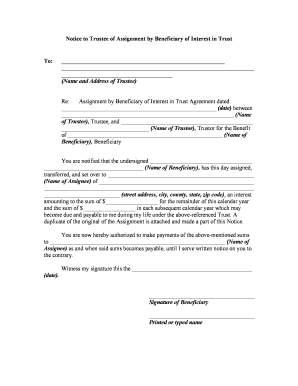

The Trustee Notice to Beneficiaries is a formal document that informs beneficiaries of a trust about their rights and interests. This notice is essential in ensuring that beneficiaries are aware of their entitlement to the trust's assets, the terms of the trust, and any relevant actions taken by the trustee. In the United States, trustees are legally obligated to provide this notice to maintain transparency and uphold fiduciary duties. The notice typically includes information about the trust's purpose, the identity of the beneficiaries, and instructions on how beneficiaries can access more information or assert their rights.

How to Use the Trustee Notice To Beneficiaries

Using the Trustee Notice to Beneficiaries involves several key steps. First, the trustee must prepare the notice, ensuring it contains all necessary details about the trust and its beneficiaries. Once the notice is drafted, it should be delivered to each beneficiary, either by mail or electronically, depending on the preferences of the beneficiaries and applicable state laws. It is crucial for the trustee to retain proof of delivery, as this may be required for legal compliance. Beneficiaries should review the notice carefully and may wish to consult with a legal professional if they have questions regarding their rights or the trust's terms.

Key Elements of the Trustee Notice To Beneficiaries

The Trustee Notice to Beneficiaries should include several key elements to ensure clarity and compliance. These elements typically consist of:

- Trust Name: The official name of the trust being referenced.

- Trustee Information: Contact details for the trustee managing the trust.

- Beneficiary List: A clear identification of all beneficiaries entitled to receive notice.

- Trust Purpose: A brief description of the trust's purpose and how it operates.

- Rights and Responsibilities: Information on the rights of beneficiaries and any responsibilities they may have.

- Next Steps: Instructions on how beneficiaries can respond or seek further information.

Steps to Complete the Trustee Notice To Beneficiaries

Completing the Trustee Notice to Beneficiaries involves a systematic approach. First, the trustee should gather all relevant information about the trust and its beneficiaries. Next, a template or form should be selected to ensure all necessary details are included. The trustee then fills out the form with accurate information, ensuring clarity and compliance with state laws. After completing the notice, it should be reviewed for accuracy before being distributed to the beneficiaries. Finally, the trustee should document the delivery of the notice, maintaining records for future reference.

Legal Use of the Trustee Notice To Beneficiaries

The legal use of the Trustee Notice to Beneficiaries is crucial to uphold the fiduciary responsibilities of the trustee. In the United States, failure to provide this notice can lead to legal repercussions for the trustee, including potential claims of breach of fiduciary duty. The notice serves as a formal communication that helps protect the rights of beneficiaries and ensures they are informed about their interests in the trust. Additionally, state laws may dictate specific requirements regarding the timing and method of delivering this notice, making compliance essential for legal validity.

State-Specific Rules for the Trustee Notice To Beneficiaries

State-specific rules govern the Trustee Notice to Beneficiaries, as laws can vary significantly across jurisdictions. Each state may have different requirements regarding the content of the notice, the timeline for delivery, and the method of communication. For example, some states may require that the notice be sent within a certain period after the trust becomes irrevocable or after the death of the trustor. It is important for trustees to familiarize themselves with the laws in their state to ensure compliance and avoid potential legal issues.

Quick guide on how to complete trustee notice to beneficiaries

Prepare Trustee Notice To Beneficiaries effortlessly on any device

Digital document management has become widely adopted by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools for quick creation, editing, and electronic signing of your documents without delays. Manage Trustee Notice To Beneficiaries on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Trustee Notice To Beneficiaries with minimal effort

- Find Trustee Notice To Beneficiaries and click Get Form to begin.

- Use the available tools to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Trustee Notice To Beneficiaries to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is included in a living trust?

In a living trust, the trust holds the assets for the benefit of the beneficiaries. This means that in a living trust, the trust is the beneficiary, allowing for seamless management and distribution of assets upon the grantor's passing. Understanding this structure can help streamline estate planning and provide clarity on asset distribution.

-

How does airSlate SignNow enhance the process of setting up a living trust?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents related to a living trust. With airSlate SignNow, you can easily manage the documentation needed for your beneficiaries, ensuring they are well-informed and protected. This simplifies the process, making it easier to establish who in a living trust is the trust the beneficiary.

-

What features does airSlate SignNow offer for living trust documents?

AirSlate SignNow offers features like eSignature capabilities, templates for living trust documents, and collaborative options for multiple parties involved. Users can streamline their workflows, ensuring that all parties—especially those who are identified as beneficiaries—can sign and access the documents efficiently. This modern approach simplifies the management of a living trust.

-

Is airSlate SignNow cost-effective for managing living trust documentation?

Yes, airSlate SignNow is known for its affordability. By utilizing this platform for your living trust documentation, you're saving on potential legal costs while maintaining compliance and professionalism. Understanding how in a living trust is the trust the beneficiary can optimize costs associated with estate planning.

-

Can I integrate airSlate SignNow with other tools I use for estate planning?

Absolutely! airSlate SignNow allows for seamless integrations with various tools and platforms commonly used in estate planning. This connectivity ensures that all aspects of your living trust documentation and management, including identifying who in a living trust is the trust the beneficiary, can be handled smoothly.

-

What are the main benefits of using airSlate SignNow for estate planning?

The main benefits of using airSlate SignNow include increased efficiency, reduced turnaround time for document processing, and enhanced accuracy. These advantages are especially important when managing the complexities of a living trust, where knowing who in a living trust is the trust the beneficiary is critical. It provides peace of mind during a crucial time.

-

How secure is the airSlate SignNow platform for handling sensitive living trust documents?

Security is a top priority for airSlate SignNow, which employs encryption and stringent access controls to protect sensitive living trust documents. These measures ensure that only authorized users can view and sign documents, safeguarding the rights of beneficiaries. When in a living trust is the trust the beneficiary, maintaining document integrity is vital.

Get more for Trustee Notice To Beneficiaries

- Have a life estate in the property form

- Executor to administer your estate and who will form

- Fourth 211 taxonomy form

- Executor to administer your estate who you will form

- Your spouse does not survive you and who will form

- Has more than one child but only one child resides form

- Article nine this article sets forth powers of your personal representative and is form

- Designed to give broad powers without the requirement that court approval be sought for form

Find out other Trustee Notice To Beneficiaries

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word