Payroll Deduction Form

What is the payroll deduction form?

The payroll deduction form is a document that allows employees to authorize their employer to withhold a specified amount from their paycheck for various purposes. This could include contributions to retirement plans, health insurance premiums, or other voluntary deductions. The form serves as a formal agreement between the employee and employer, ensuring that the deductions are made consistently and in compliance with applicable laws.

How to use the payroll deduction form

To use the payroll deduction form, employees must first obtain the correct version from their employer or human resources department. Once received, employees should fill out the necessary information, including their name, employee ID, and the specific deductions they wish to authorize. After completing the form, employees should submit it to their payroll department for processing. It is important to keep a copy for personal records and to verify that the deductions are accurately reflected in subsequent paychecks.

Steps to complete the payroll deduction form

Completing the payroll deduction form involves several straightforward steps:

- Obtain the payroll deduction form from your employer.

- Fill in your personal information, including your full name and employee ID.

- Indicate the type and amount of deductions you are authorizing.

- Sign and date the form to validate your authorization.

- Submit the completed form to your payroll department.

Following these steps ensures that your payroll deductions are processed correctly and in a timely manner.

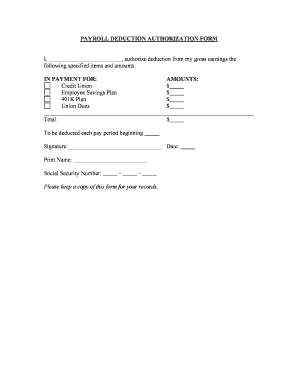

Key elements of the payroll deduction form

The payroll deduction form typically includes several key elements:

- Employee Information: Name, employee ID, and contact information.

- Deduction Details: Types of deductions (e.g., retirement contributions, insurance premiums) and amounts.

- Authorization Signature: Employee's signature confirming consent to the deductions.

- Date: The date when the form is completed and signed.

These elements are essential for ensuring that the deductions are legally authorized and accurately processed.

Legal use of the payroll deduction form

The payroll deduction form must comply with federal and state laws governing employee deductions. Employers are required to maintain accurate records of all deductions and ensure that they are authorized by the employee. The form serves as a legal document that protects both the employee's rights and the employer's obligations. It is crucial for employees to understand their rights regarding deductions and to ensure that any changes to their authorization are documented appropriately.

Form submission methods

Employees can typically submit the payroll deduction form through various methods, depending on their employer's policies:

- Online: Many companies offer digital submission options through their HR platforms.

- Mail: Employees may send the completed form to the payroll department via postal service.

- In-Person: Submitting the form directly to the payroll or HR office is often an option as well.

Choosing the appropriate submission method is important for ensuring that the form is processed efficiently and accurately.

Quick guide on how to complete payroll deduction form 481374499

Complete Payroll Deduction Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Payroll Deduction Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The simplest way to edit and eSign Payroll Deduction Form without hassle

- Find Payroll Deduction Form and click Get Form to get started.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your selection. Edit and eSign Payroll Deduction Form and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is payroll authorization and how does it work with airSlate SignNow?

Payroll authorization is the process by which employees give consent for their payment details to be processed by employers. With airSlate SignNow, you can easily create and send payroll authorization documents for electronic signatures, ensuring a smooth and efficient workflow.

-

How can airSlate SignNow enhance my payroll authorization process?

airSlate SignNow simplifies your payroll authorization process by allowing you to automate document routing and eSigning. This reduces the time spent on paperwork and helps ensure that all necessary approvals are secured promptly, enhancing overall productivity.

-

What are the pricing options for airSlate SignNow's payroll authorization feature?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a plan that includes payroll authorization capabilities at a competitive rate, allowing you to streamline your payroll processes without breaking the bank.

-

Can I integrate airSlate SignNow with my existing payroll software?

Yes, airSlate SignNow offers seamless integrations with various payroll software solutions. This means that you can easily incorporate payroll authorization documents into your existing system, ensuring a smooth transition and improved efficiency in your payroll management.

-

What are the security measures in place for payroll authorization documents?

Security is a top priority for airSlate SignNow. All payroll authorization documents are protected with industry-standard encryption, and we comply with legal regulations to ensure that sensitive information is secure during the eSigning process.

-

Is there a mobile app for managing payroll authorization?

Yes, airSlate SignNow provides a mobile app that allows you to manage payroll authorization documents on the go. You can send, sign, and track your payroll authorization processes from anywhere, making it convenient for busy professionals.

-

How does airSlate SignNow ensure compliance for payroll authorization?

airSlate SignNow is designed to help you maintain compliance with all relevant regulations concerning payroll authorization. Our platform includes customizable templates and built-in compliance features to meet industry standards, ensuring your payroll processes adhere to legal requirements.

Get more for Payroll Deduction Form

- Newstar media inc 1999 optional form for annual and transition

- Form medical device supply agreement

- Form of operating agreement nyiso

- I tfm part 2 chapter 3200 foreign currency accounting form

- Collateral assignment of intellectual property form

- 609 form license of technology and non assertion of

- 15 form patent use analysis worksheet

- The form and instructionsfederal trade commission

Find out other Payroll Deduction Form

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed