Utah Financial Account Transfer to Living Trust Form

What is the Utah Financial Account Transfer To Living Trust

The Utah Financial Account Transfer To Living Trust is a legal document that facilitates the transfer of financial accounts into a living trust. This process allows individuals to manage their assets during their lifetime and ensure a smooth transition of those assets to beneficiaries after their passing. By placing financial accounts within a living trust, individuals can avoid probate, maintain privacy, and potentially reduce estate taxes. This form is essential for anyone looking to streamline their estate planning and protect their financial legacy.

Steps to complete the Utah Financial Account Transfer To Living Trust

Completing the Utah Financial Account Transfer To Living Trust involves several key steps:

- Review your living trust: Ensure that your living trust document is up to date and accurately reflects your wishes regarding asset distribution.

- Gather account information: Collect details about the financial accounts you wish to transfer, including account numbers and financial institution names.

- Complete the transfer form: Fill out the Utah Financial Account Transfer To Living Trust form with the required information, ensuring accuracy to avoid delays.

- Obtain signatures: Depending on the financial institution, you may need to sign the form in front of a notary or provide additional identification.

- Submit the form: Send the completed form to your financial institution, either online or via mail, as per their submission guidelines.

- Confirm the transfer: Follow up with your financial institution to ensure that the transfer has been processed successfully and that the accounts are now held in the name of the trust.

Legal use of the Utah Financial Account Transfer To Living Trust

The legal use of the Utah Financial Account Transfer To Living Trust is grounded in state law, which recognizes living trusts as valid estate planning tools. This form allows individuals to legally transfer ownership of financial accounts into a trust, ensuring that the assets are managed according to the terms outlined in the trust document. It is important to comply with all relevant state regulations to ensure the transfer is legally binding and effective. Consulting with an estate planning attorney can provide additional assurance that the transfer meets all legal requirements.

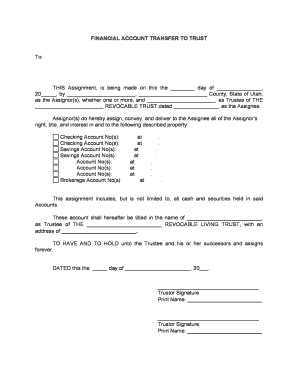

Key elements of the Utah Financial Account Transfer To Living Trust

Several key elements are essential to the Utah Financial Account Transfer To Living Trust:

- Trustee information: The name and contact details of the trustee responsible for managing the trust.

- Account details: Specific information about the financial accounts being transferred, including account numbers and types.

- Beneficiary designations: Clear instructions on how the assets should be distributed among the beneficiaries upon the trustor's passing.

- Signatures: Required signatures from the trustor and, if necessary, witnesses or notaries to validate the transfer.

How to use the Utah Financial Account Transfer To Living Trust

Using the Utah Financial Account Transfer To Living Trust involves a straightforward process. Begin by reviewing your living trust to ensure it accurately reflects your wishes. Next, gather all necessary information about the financial accounts you wish to transfer. Complete the transfer form, ensuring all details are correct. After obtaining the required signatures, submit the form to your financial institution. Once processed, confirm that the accounts are now held in the name of the trust, allowing for effective management and distribution of assets.

State-specific rules for the Utah Financial Account Transfer To Living Trust

In Utah, specific rules govern the use of the Financial Account Transfer To Living Trust. These include requirements for the trust document to be properly executed and the necessity for the transfer form to be signed by the trustor. Additionally, financial institutions may have their own policies regarding the acceptance of trust documents, which must be adhered to for a successful transfer. It is advisable to consult with a legal professional familiar with Utah estate law to navigate these requirements effectively.

Quick guide on how to complete utah financial account transfer to living trust

Effortlessly Prepare Utah Financial Account Transfer To Living Trust on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, amend, and eSign your documents without any delays. Handle Utah Financial Account Transfer To Living Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign Utah Financial Account Transfer To Living Trust with Ease

- Find Utah Financial Account Transfer To Living Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Utah Financial Account Transfer To Living Trust and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for a Utah Financial Account Transfer To Living Trust?

The process for a Utah Financial Account Transfer To Living Trust typically involves preparing the necessary documentation, including a trust agreement, and then working with your financial institution to retitle your accounts. This ensures that assets are properly managed under the trust, avoiding probate. For a smooth transfer, it’s recommended to consult with a legal professional experienced in trusts.

-

Why should I consider a Utah Financial Account Transfer To Living Trust?

Transferring your financial accounts to a living trust in Utah helps avoid probate, provides privacy, and ensures a smoother transition of assets upon death. This option not only simplifies estate management but also enables you to maintain control over your finances during your lifetime. Overall, it's a strategic approach to estate planning.

-

What types of financial accounts can I transfer to a living trust in Utah?

In Utah, you can transfer various financial accounts to a living trust, including bank accounts, investment accounts, and retirement accounts. Each account may have specific paperwork and requirements to effectively execute the Utah Financial Account Transfer To Living Trust. It's essential to check with your financial institution to ensure compliance with their processes.

-

What are the costs associated with a Utah Financial Account Transfer To Living Trust?

The costs of a Utah Financial Account Transfer To Living Trust can vary depending on factors such as legal fees for drafting a trust agreement and any fees charged by financial institutions for retitling accounts. Overall, while there may be initial costs, the long-term savings gained from avoiding probate can be signNow. Evaluating your specific situation with a financial advisor is advisable.

-

How does eSigning documents speed up the Utah Financial Account Transfer To Living Trust?

By utilizing airSlate SignNow's eSigning capabilities, you can quickly sign and send necessary documents for the Utah Financial Account Transfer To Living Trust without the delays of physical paperwork. This expedites the process of establishing your trust and ensures that your financial accounts are transferred promptly. The simple interface makes it easy for everyone involved to interact seamlessly.

-

Can I make changes to my living trust after the Utah Financial Account Transfer To Living Trust?

Yes, one of the main advantages of a living trust in Utah is its flexibility. You can make changes or amendments to the trust at any time, as long as you are alive and competent. This means you can adjust asset allocations, beneficiaries, and terms as your financial situation or desires evolve.

-

What are the tax implications of a Utah Financial Account Transfer To Living Trust?

Generally, a Utah Financial Account Transfer To Living Trust does not trigger tax consequences, as the Internal Revenue Service treats living trusts as 'grantor trusts.' This means that you can still report income on your individual tax return and avoid additional taxation. However, it's wise to consult with a tax advisor for tailored advice regarding your unique financial situation.

Get more for Utah Financial Account Transfer To Living Trust

- Incorporators shareholders and the board of directors of a vermont form

- 81 river street form

- State of vermont form

- Fillable online boiler waiver of civil penalties form bwp

- Civil cover sheet case 418 cv 02246 document 1 filed in txsd form

- Free vermont notarial certificate jurat pdf word form

- Fillable online report form the city clerk regarding a

- Law office study registration form

Find out other Utah Financial Account Transfer To Living Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors