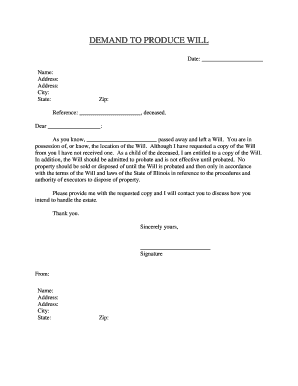

Illinois Heir Form

What is the Illinois Heir?

The Illinois heir refers to an individual who is legally entitled to inherit property or assets from a deceased person's estate under Illinois state law. This designation is crucial in the probate process, determining how an estate is distributed when someone passes away without a valid will. Heirs can include immediate family members such as spouses, children, and parents, as well as more distant relatives, depending on the circumstances of the estate and the absence of a will.

Key Elements of the Illinois Heir

Understanding the key elements of the Illinois heir is essential for navigating inheritance matters. The primary factors include:

- Intestate Succession: When a person dies without a will, Illinois law dictates how the estate is divided among heirs.

- Types of Heirs: Heirs can be classified as primary or contingent, with primary heirs receiving first priority in inheritance.

- Legal Rights: Heirs have specific legal rights to claim their inheritance, which must be honored during the probate process.

Steps to Complete the Illinois Heir

Completing the Illinois heir process involves several steps to ensure that the inheritance is legally recognized. The process typically includes:

- Identify the Estate: Determine the assets and liabilities of the deceased to assess the estate's value.

- File for Probate: Submit the necessary documents to the probate court to initiate the legal process.

- Notify Heirs: Inform all potential heirs of their rights and the probate proceedings.

- Distribute Assets: Once the court approves, distribute the assets according to Illinois intestate laws.

Legal Use of the Illinois Heir

The legal use of the Illinois heir designation is significant in estate planning and probate law. It ensures that the rightful heirs receive their inheritance according to state regulations. This designation is also critical in cases where disputes arise among potential heirs, as it provides a legal framework for resolving such issues. Proper documentation and adherence to Illinois laws are necessary to uphold the rights of heirs during the distribution process.

Who Issues the Form?

The Illinois heir form is typically issued by the probate court in the county where the deceased person resided at the time of death. The court oversees the probate process, ensuring that all legal requirements are met for the distribution of the estate. It is essential for heirs to work closely with the court to obtain the necessary forms and guidance throughout the probate proceedings.

Required Documents

To process the Illinois heir designation, several documents are required. These may include:

- Death Certificate: An official record of the deceased's passing.

- Will (if applicable): A valid will outlining the deceased's wishes regarding asset distribution.

- Petition for Probate: A legal document filed with the court to initiate probate proceedings.

- List of Heirs: A comprehensive list detailing all potential heirs and their relationships to the deceased.

Quick guide on how to complete illinois heir

Easily Prepare Illinois Heir on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Illinois Heir on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Edit and Electronically Sign Illinois Heir Effortlessly

- Obtain Illinois Heir and then select Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Heir to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Illinois copy?

airSlate SignNow is a comprehensive eSignature solution that enables businesses to send and sign documents online. With features that enhance efficiency and security, it specifically benefits industries requiring Illinois copy agreements and contracts. Utilizing airSlate SignNow ensures compliance with state regulations while streamlining your document management process.

-

How much does airSlate SignNow cost for Illinois copy use?

Pricing for airSlate SignNow is competitive and designed to meet the needs of various users, including those needing Illinois copy functionalities. Options range from basic plans suitable for small businesses to advanced features for larger organizations. You can choose a monthly or annual subscription based on your specific needs to manage your Illinois copy efficiently.

-

What features does airSlate SignNow offer for managing Illinois copy documents?

airSlate SignNow provides an array of features tailored for effective management of Illinois copy documents, including custom templates, automated workflow processes, and comprehensive tracking. These features ensure that your document transitions are managed seamlessly and securely. Users can easily integrate Illinois copy options within their existing workflows for enhanced productivity.

-

Can I integrate airSlate SignNow with other platforms for Illinois copy workflows?

Yes, airSlate SignNow allows for seamless integration with various platforms, which is crucial for Illinois copy workflows. You can connect it with popular CRM, cloud storage, and productivity tools to enhance functionality. This ensures that document management and signing processes for Illinois copy are both efficient and user-friendly.

-

What are the benefits of using airSlate SignNow for Illinois copy documents?

Using airSlate SignNow for Illinois copy documents offers several advantages, including enhanced security, increased efficiency, and easy collaboration. Businesses can reduce paper usage and speed up the signing process, leading to better overall productivity. Additionally, airSlate SignNow’s compliance features help maintain adherence to Illinois-specific regulations.

-

Is airSlate SignNow mobile-friendly for executing Illinois copy documents?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to execute Illinois copy documents on any device. This means you can send and sign documents anytime, anywhere, increasing flexibility and responsiveness. The user interface is intuitive, ensuring a smooth experience on both smartphones and tablets.

-

How does airSlate SignNow ensure the security of Illinois copy documents?

airSlate SignNow employs advanced security measures to protect Illinois copy documents, including encryption and secure cloud storage. The platform is compliant with industry standards, ensuring that sensitive information remains protected during transmission and storage. You can trust airSlate SignNow to keep your Illinois copy documents safe and secure.

Get more for Illinois Heir

- Hereinafter purchaser whether form

- And state of wisconsin to wit form

- Any guaranty or insurance or the making of any loan by the secretary form

- Clerk of courts welcome to jefferson county form

- Justia notice of hearing criminal traffic wisconsin criminal form

- Order of commitment not guilty by reason of mental form

- I am the district attorney for form

- Directing compensation for form

Find out other Illinois Heir

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation