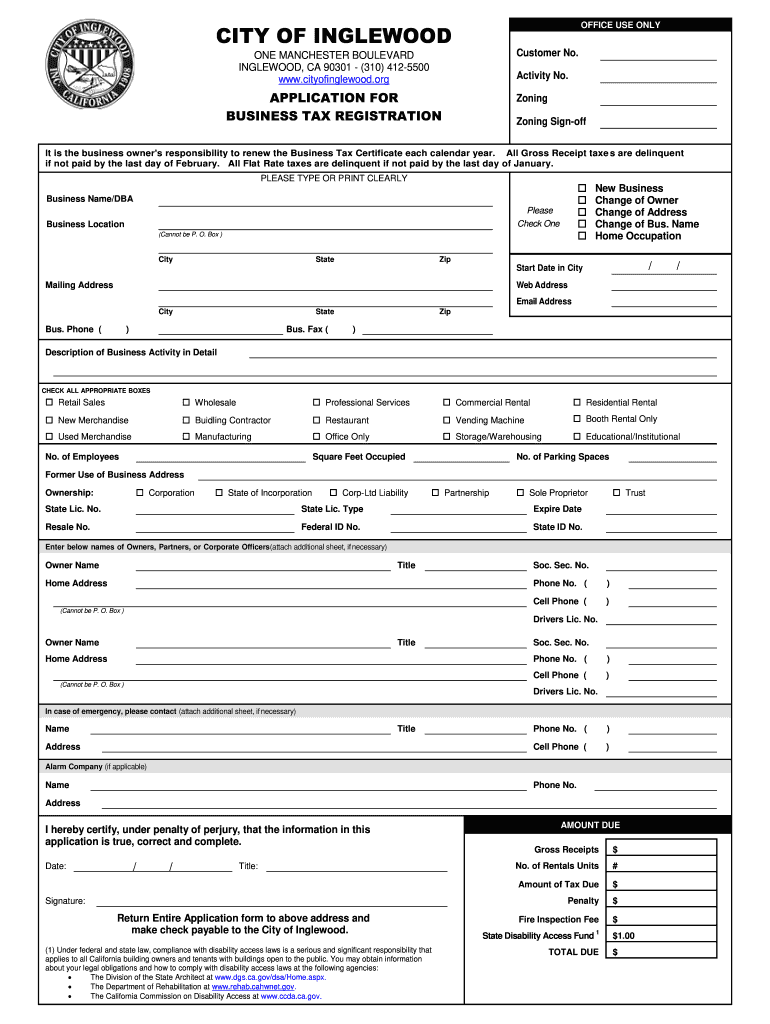

Business Tax Certificate Application City of Inglewood Form

What is the Business Tax Certificate Application for the City of Inglewood

The Business Tax Certificate Application is a document required by the City of Inglewood for businesses operating within its jurisdiction. This certificate serves as proof that a business is registered and compliant with local tax regulations. It is essential for legal operation and can affect various aspects of business functionality, including licensing, permits, and tax obligations. The application process ensures that businesses contribute to the local economy while adhering to city laws.

Steps to Complete the Business Tax Certificate Application for the City of Inglewood

Completing the Business Tax Certificate Application involves several key steps:

- Gather necessary information about your business, including the legal name, address, and type of business entity.

- Determine the appropriate business tax rate based on your business activities and revenue.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any supporting documents, such as identification or proof of address.

- Submit the application either online, by mail, or in person at the designated city office.

Required Documents for the Business Tax Certificate Application for the City of Inglewood

When applying for a Business Tax Certificate in Inglewood, certain documents are required to support your application. These may include:

- A valid government-issued identification, such as a driver's license or passport.

- Proof of business address, which could be a utility bill or lease agreement.

- Any relevant business licenses or permits that may be required for your specific industry.

- Financial documents that demonstrate your business's revenue, if applicable.

Eligibility Criteria for the Business Tax Certificate Application for the City of Inglewood

To be eligible for a Business Tax Certificate in Inglewood, applicants must meet certain criteria. These include:

- The business must be legally registered and operating within the city limits.

- All required licenses and permits for the specific business type must be obtained.

- The applicant must provide accurate and truthful information on the application form.

- Any outstanding taxes or fees owed to the city must be settled before applying.

Who Issues the Business Tax Certificate for the City of Inglewood

The Business Tax Certificate is issued by the City of Inglewood's Finance Department. This department is responsible for processing applications, collecting business taxes, and ensuring compliance with local tax laws. Upon approval, businesses receive their certificate, which must be displayed prominently at their place of business.

Penalties for Non-Compliance with the Business Tax Certificate Application for the City of Inglewood

Failure to comply with the Business Tax Certificate requirements can result in various penalties. These may include:

- Fines or late fees for not submitting the application on time.

- Potential legal action against the business for operating without a valid certificate.

- Revocation of business licenses or permits, which can hinder operations.

Quick guide on how to complete pay business tax certificate form

Effortlessly Prepare Business Tax Certificate Application City Of Inglewood on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Business Tax Certificate Application City Of Inglewood on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

Efficiently Edit and eSign Business Tax Certificate Application City Of Inglewood with Ease

- Obtain Business Tax Certificate Application City Of Inglewood and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow makes available for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details, then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Business Tax Certificate Application City Of Inglewood to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is a cyber cafe business in India still profitable?

It is most profitable business in current situation. Normal people will think Cyber cafe has only PC, Internet and print out. If you provide following services then you can earn more than 1.5 lakhs only in direct profit.(personal experience from Chennai).Fund transfer and micro atms. People need immediate transfer and if your cafe is open from 9 am to 10 pm you can cross 800 to 1500rs per day. Bank Holidays higher profits.Train ticket agent. Avoid personal login booking. Non bailable offense.Seat seller Agent(red bus).Flight ticket, Tour planner and hotel booking.Visa Services and passport.Pan card and DSC.IT returns and GST filings. Tie up with local Tax people or learn yourself. IT return filing for Salaried people is much easier.EB payment, postpaid, rechargesCredit card payment.Movie ticketsCollege and school fees paymentsExam fees(state and Central)Online form filling for exams from Neet to UPSC.Certificates from caste, Employment, Life, birth and death.Corrections in Aadhar, PAN any online documents.Life insurance renewals and royalty if you are LIC agent.bike and car insurance, road tax etcCurrency exchangeXerox , Plastic card , Color print out & Lamination For cropping, resizing additional cost.PF update and withdrawal.International and local Courier if you have space.Ola collections, Paytm KYC etcTTD, Sabarimala, Shirdi darshans.Typing in local languages & EnglishLand EC checking, Online tax paying like water, property etcIn some states there are different online schemes to get enrolled, renewals and withdrawals.CIBIL Score certificateCredit card swiping(2 to 3% commission)Moreover with digital India, people are looking for local knowledge nearby.All payments are becoming digital and cyber cafes with good reputation will give you best returns. Make sure your cafe never closes on any day even for lunch break. Trust, reliability, friendliness will yield positive feedback from customers.No matter how many Smartphones, Paytm, TEZ services comes, People looks for specific Knowledge locally. You can be creative and make changes as per consumer needs and requirements in future.Your cafe should be one stop solution for all. Use credit cards to make online payments which gives you back rewards points in most cases.Reward points alone provides more than 1 Lakh if you use continuously(indirect profit) and specific bank cards only provides 4x to 10x benefits while using online.Make sure you use Credit card after statement date so that the money will be in rotation for 50 days. My Statement generates on 10th January and due date is 30th January. I will start using from 11th January and Next due date is on February End or March 1st week. That gives me 45 to 49 days.Have 3 to 5 or more credit cards and be calculative on when, where and how to use. Minimum use if emergency arise.CAFE should be at center point or near to bank area for visibility. Even top geek will have to set foot once to avail one of the services above. Trust is one thing that make business popular. It takes more months to avail.Google, Digital God.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I buy a car in Dubai?

Knowing how to buy a car in Dubai will allow you to access a market full of luxury cars at affordable prices or, at least, lower than in Europe and other neighboring countries.5 Tips When Buying a Used Car in Dubai, UAEThe city of Dubai in the United Arab Emirates attracts people from all over the world due, in part, to the income of non-tax residents. Owning a car in Dubai is a must, because the city's residential center is quite distant from the commercial and business areas.There is not much in the way of public transport. Dubai residents will find that they can buy either new or used vehicles with relative ease, but they will have to follow a series of points and steps to do so.Eight Steps to follow:Step 1:The first thing is to locate the car model that you are interested in, what you can do through the Internet, thus searching between new and used cars. It is also very common to hold auctions in Dubai with second-hand luxury cars that their previous owners have not been able to pay. Although as a general rule they are much cheaper than in Europe, find out how much the same model costs in this country.Step 2:Once you have made the decision, you should know that you have to meet two very important requirements to buy a car in Dubai:Have a residence visa.Dubai requires vehicle buyers to own a residence visa. Residents of Dubai can obtain the required documentation for residence visas through their employers.Possess a driver's license from the UAE or an international license. Anyone who buys a car in the UAE must have a valid UAE driver's license. Citizens of other countries can use their driver's licenses to obtain a license from the UAE without a driving test. They have to fill out an authorization form in Arabic, pass an eye exam in Dubai, have a passport from their country of origin and pay a fee.Step 3:You can find used cars for sale published in newspaper ads or on the Internet. They can also buy a used car from car dealerships. In addition, you can bid on a used car at an auction.Step 4:Car retailers of new and used cars offer buyers the opportunity to finance their purchase. The terms of the car loans are between one and four years.Step 5:Car buyers who need financing could also get a loan through their bank. The bank will offer the loanee with a series of deferred payment checks that must be given to the dealer once a month.Step 6:The buyer of a used car in Dubai must transfer ownership. The current and previous owner of the car must fill out an application in the Traffic Police, and present the car license plates, registration card, insurance certificate and proof the previous owner has no outstanding debt in the car in order to transfer ownership.Step 7:Any person who owns a car in Dubai should have it insured. The owner can purchase insurance through an insurance company for approximately four to six percent of the value of the vehicle. Car owners must have a driver's license from the UAE, a passport and a car test registered with the previous owner or car dealer to buy insurance in Dubai.Step 8:Once the car is insured, it must be registered. The car dealers will help the new owner with this process for new and used cars.

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

What is the legal procedure required for starting-up in India?

A guide on how to register Startup or new business in India with documents needed, fees breakdown and time to complete company registration.A startup is an energy booster for the Indian economy. Whether your startup is a sole proprietorship or a partnership business, it’s better to give your business a legal existence. The reason being, a registered company, can be closed down only by legal authorities in case of any unforeseen issues. Here we look at the steps to register a start-up or a new business in India.The Ministry of Corporate Affairs has made it convenient for the new startups by introducing the online registration. In May 2015, Ministry of Corporate Affairs introduced a five-in-one form to make the process of registration easier. The new form known as Integrated Incorporation Form INC-29 will require you to fill only one form instead of the tedious process of filling out eight forms. An advantage of the new form is that it reduces the interaction with the authorities at the various levels.Now you can register your new business from the comfort of your home. There are four steps that you need to do follow.Apply for Director Identification Number(DIN)The first and foremost process is to the registration of the company directors. You should create a login id in the LegalRaasta website.A nominal amount of Rs 500 for DIN will be charged and normally it takes a day to get this number.Acquire Digital Signature Certificate (DSC)This is important to ensure the authenticity of the documents that you file electronically. Also, understand that the digital signature certificate should be authenticated by the agencies appointed by the controller of certificate agencies.You would have to pay a nominal amount Rs 1299/-. It will get at least four days to get the certificate.Approval of the company name and certificate of IncorporationThe company name will be approved by Registrar of Company (ROC). Once the name is approved by ROC apply for the Certificate of Incorporation. This is done by filling out Form 1, Form 18 and Form 32.You would have to pay Rs 1000/- for the approval of the name and the Certificate of Incorporation, the amount can be anywhere between Rs 1000 to 4000.The name approval will take at least two days while the certificate of incorporation will take a week.The following documents that have to be attached to Form 1 while applying for the certificate of Incorporation.Signed copy of the Memorandum of Association (MOA).Signed copies of Articles of Association (AOA).The power of Attorney from the various subscribers on judicial stamp paper worth Rs 100 and finally, the identification of the subscribers.Apply for Permanent Account Number and Tax Account Number for the registered companyThe PAN card can be obtained from Income Tax Department, India by paying a nominal amount of INR 94. You can apply for the TAN card by visiting the website TIN. You will be charged INR 62.The total time span to obtain these is seven days.The other formalities that you can go about during this period include getting a rubber stamp of the company, registering for VAT and professional tax, employees provident fund and health insurance and so on.Hence, the entire process of registering a company in India takes about 10–15 days with cost of around INR 13,499/-For more information you can visit : Private Limited Company RegistrationYou can apply online : LegalRaasta.com

Create this form in 5 minutes!

How to create an eSignature for the pay business tax certificate form

How to make an electronic signature for the Pay Business Tax Certificate Form online

How to make an electronic signature for your Pay Business Tax Certificate Form in Google Chrome

How to generate an electronic signature for putting it on the Pay Business Tax Certificate Form in Gmail

How to generate an eSignature for the Pay Business Tax Certificate Form right from your mobile device

How to create an eSignature for the Pay Business Tax Certificate Form on iOS devices

How to make an electronic signature for the Pay Business Tax Certificate Form on Android OS

People also ask

-

What is a vehicle tax certificate sample?

A vehicle tax certificate sample is a document that provides official proof of tax payments on a vehicle. It includes essential details such as the vehicle identification number, owner information, and tax payment history. Using a reliable service like airSlate SignNow, you can easily create and manage your vehicle tax certificate sample to ensure compliance.

-

How can airSlate SignNow help me create a vehicle tax certificate sample?

airSlate SignNow offers a user-friendly platform designed for creating and signing documents efficiently. You can easily customize your vehicle tax certificate sample by filling in necessary details, and then share it securely with stakeholders for eSignature. This process helps streamline document management for your vehicles.

-

Is there a cost associated with obtaining a vehicle tax certificate sample through airSlate SignNow?

Yes, there is a competitive pricing structure associated with using airSlate SignNow for document management. Depending on your needs, you can choose from different subscription plans that provide various features, including the ability to create and manage your vehicle tax certificate sample. Check our pricing page for detailed information on costs.

-

What features does airSlate SignNow offer for vehicle tax certificate sample management?

airSlate SignNow provides a range of features designed for efficient document management, including customizable templates, easy eSigning, cloud storage, and document tracking. These features simplify the creation and distribution of your vehicle tax certificate sample, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other applications while using a vehicle tax certificate sample?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and many more. This means you can easily incorporate your vehicle tax certificate sample into your existing workflows, enhancing productivity and ensuring seamless document management.

-

What are the benefits of using airSlate SignNow for vehicle tax certificate samples?

Using airSlate SignNow for your vehicle tax certificate samples brings numerous advantages, including improved efficiency, time-saving eSigning, and reduced paper consumption. Its intuitive interface makes document creation easy, while its security features ensure your certification information is protected and compliant.

-

How long does it take to get a vehicle tax certificate sample signed using airSlate SignNow?

The time it takes to get a vehicle tax certificate sample signed depends on the number of signers and their availability. However, with airSlate SignNow's streamlined eSigning process, many users report obtaining signatures in minutes. The platform notifies you when signers complete their part, allowing for quick processing.

Get more for Business Tax Certificate Application City Of Inglewood

Find out other Business Tax Certificate Application City Of Inglewood

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template