Business License Tax Appl Pg 1 Revised City of Lawndale 2018-2026

Understanding the Business License Tax Application for Lawndale

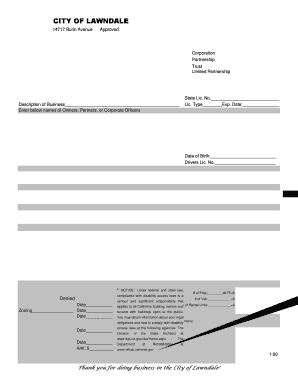

The Business License Tax Application for the City of Lawndale is a crucial document for individuals and businesses looking to operate legally within the city. This application serves as a formal request for a business license, which is necessary for compliance with local regulations. It outlines the type of business, its location, and other relevant details that help the city assess the business's impact on the community.

Steps to Complete the Business License Tax Application

Completing the Business License Tax Application involves several key steps:

- Gather necessary information about your business, including its name, address, and type of business entity.

- Fill out the application form accurately, ensuring all fields are completed to avoid delays.

- Calculate the applicable business license tax based on your business type and revenue.

- Review the application for accuracy before submission.

- Submit the application along with any required documentation and payment to the appropriate city department.

Eligibility Criteria for the Business License Tax Application

To be eligible for a business license in Lawndale, applicants must meet certain criteria:

- The business must comply with all local zoning laws and regulations.

- Applicants must provide proof of identity and, if applicable, business registration documents.

- All required fees must be paid at the time of application submission.

Required Documents for the Business License Tax Application

When submitting the Business License Tax Application, the following documents are typically required:

- A completed Business License Tax Application form.

- Proof of identity, such as a driver's license or state ID.

- Any additional documentation specific to your business type, such as permits or certifications.

Form Submission Methods for the Business License Tax Application

Applicants can submit the Business License Tax Application through various methods:

- Online submission via the city’s official website, which often allows for quicker processing.

- Mailing the completed application to the designated city department.

- In-person submission at the city hall or designated office.

Penalties for Non-Compliance with the Business License Tax Application

Failure to comply with the requirements for the Business License Tax Application can result in penalties, including:

- Fines imposed by the city for operating without a valid business license.

- Possible legal action against the business owner.

- Revocation of any existing business licenses or permits.

Quick guide on how to complete business license tax appl pg 1 revised 2013 city of lawndale

Your instructional manual on how to prepare your Business License Tax Appl Pg 1 Revised City Of Lawndale

If you’re curious about how to generate and submit your Business License Tax Appl Pg 1 Revised City Of Lawndale, here are a few brief guidelines to facilitate the tax filing process.

To start, simply register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document management tool that enables you to modify, create, and complete your tax paperwork with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and return to edit responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing options.

Follow these steps to complete your Business License Tax Appl Pg 1 Revised City Of Lawndale in just a few minutes:

- Establish your account and start editing PDFs in no time.

- Browse our directory to find any IRS tax form; sift through various versions and schedules.

- Select Get form to access your Business License Tax Appl Pg 1 Revised City Of Lawndale in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and rectify any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual for electronic tax filing with airSlate SignNow. Keep in mind that paper filing can lead to increased errors and delayed refunds. It’s advisable to check the IRS website for filing rules applicable to your state before e-filing your taxes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business license tax appl pg 1 revised 2013 city of lawndale

How to generate an eSignature for the Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale online

How to create an electronic signature for your Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale in Chrome

How to create an electronic signature for putting it on the Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale in Gmail

How to create an electronic signature for the Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale right from your smart phone

How to create an electronic signature for the Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale on iOS devices

How to generate an eSignature for the Business License Tax Appl Pg 1 Revised 2013 City Of Lawndale on Android

People also ask

-

What is the Business License Tax Appl Pg 1 Revised City Of Lawndale?

The Business License Tax Appl Pg 1 Revised City Of Lawndale is a form required for businesses operating in Lawndale to apply for a business license. This document ensures compliance with local regulations and allows businesses to legally operate within the city. airSlate SignNow can streamline the signing process of this important document, making it easy and efficient.

-

How can airSlate SignNow help me with the Business License Tax Appl Pg 1 Revised City Of Lawndale?

airSlate SignNow simplifies the process of completing and signing the Business License Tax Appl Pg 1 Revised City Of Lawndale. Our platform allows you to fill out the form digitally, eSign it, and send it directly to the appropriate city department. This eliminates the hassle of paper forms and speeds up the application process.

-

Is there a cost associated with using airSlate SignNow for the Business License Tax Appl Pg 1 Revised City Of Lawndale?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for individual users and teams. While there may be a fee associated with using our eSigning services, the efficiency gained by using airSlate SignNow can save you time and resources when handling the Business License Tax Appl Pg 1 Revised City Of Lawndale.

-

What features does airSlate SignNow offer for handling the Business License Tax Appl Pg 1 Revised City Of Lawndale?

With airSlate SignNow, you get features like easy document upload, customizable templates, and secure eSigning that are perfect for the Business License Tax Appl Pg 1 Revised City Of Lawndale. Additionally, our platform offers tracking capabilities, so you can monitor the status of your application in real-time.

-

Can I integrate airSlate SignNow with other tools for the Business License Tax Appl Pg 1 Revised City Of Lawndale?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and platforms to enhance your workflow. You can connect our service with CRM systems, cloud storage solutions, and more, ensuring that your Business License Tax Appl Pg 1 Revised City Of Lawndale is part of a streamlined process.

-

How secure is the airSlate SignNow platform for the Business License Tax Appl Pg 1 Revised City Of Lawndale?

Security is a top priority at airSlate SignNow. Our platform uses industry-standard encryption to protect your data when you are filling out and signing the Business License Tax Appl Pg 1 Revised City Of Lawndale. You can trust that your sensitive information is kept safe throughout the eSigning process.

-

What benefits does airSlate SignNow provide for small businesses applying for the Business License Tax Appl Pg 1 Revised City Of Lawndale?

For small businesses, airSlate SignNow offers an affordable and user-friendly solution for completing the Business License Tax Appl Pg 1 Revised City Of Lawndale. By reducing paperwork and streamlining the signing process, small businesses can save time and focus on their core operations while ensuring compliance with local regulations.

Get more for Business License Tax Appl Pg 1 Revised City Of Lawndale

- Real estate 101 promulgated contract forms wo quizlet

- New home insulation addendum form

- Trec no 16 5 buyers temporary residential lease solid realty form

- All cash assumption third party conventional or seller form

- Texas promulgated contract forms slideshare

- Notice not for use for condominium transactions or closings form

- Bill of sale form unimproved property contract templates

- Texas real estate commission residential sales contract form

Find out other Business License Tax Appl Pg 1 Revised City Of Lawndale

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo