Hawaii Legal Last Will and Testament Form for Divorced Person Not Remarried with Adult Children

Understanding the Hawaii Legal Last Will and Testament Form for Divorced Persons Not Remarried with Adult Children

The Hawaii legal last will and testament form for divorced persons not remarried with adult children is a crucial document that allows individuals to outline their wishes regarding asset distribution after their passing. This form is specifically designed to cater to the unique circumstances of individuals who have experienced divorce and have adult children. It ensures that their estate is managed according to their preferences, providing clarity and reducing potential disputes among heirs.

This form typically includes sections for naming beneficiaries, appointing an executor, and specifying any particular wishes regarding personal property or guardianship of dependents. It is essential for individuals in this situation to understand the implications of their choices, as the form serves as a legal declaration of their intentions.

Steps to Complete the Hawaii Legal Last Will and Testament Form for Divorced Persons Not Remarried with Adult Children

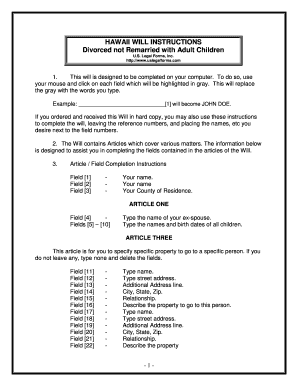

Completing the Hawaii legal last will and testament form involves several important steps to ensure that the document is valid and accurately reflects your wishes. Here are the key steps:

- Gather necessary information: Collect details about your assets, debts, and the individuals you wish to name as beneficiaries.

- Fill out the form: Clearly indicate your wishes regarding asset distribution, executor appointment, and any specific directives.

- Sign the document: Ensure that you sign the form in the presence of at least two witnesses who are not beneficiaries.

- Store the document safely: Keep the completed form in a secure location, such as a safe deposit box, and inform your executor of its location.

Following these steps carefully will help ensure that your last will and testament is legally binding and reflects your intentions accurately.

Legal Use of the Hawaii Legal Last Will and Testament Form for Divorced Persons Not Remarried with Adult Children

The legal use of the Hawaii legal last will and testament form is governed by state law, which outlines specific requirements for the document to be considered valid. In Hawaii, a will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. This ensures that the will is executed in a manner that protects against fraud and misinterpretation.

Additionally, the form must clearly articulate the testator's intentions regarding the distribution of their estate. It is advisable to consult with a legal professional to ensure compliance with all state-specific regulations and to address any unique circumstances related to divorce and adult children.

Key Elements of the Hawaii Legal Last Will and Testament Form for Divorced Persons Not Remarried with Adult Children

Several key elements must be included in the Hawaii legal last will and testament form to ensure its effectiveness:

- Testator's information: Full name, address, and date of birth.

- Beneficiaries: Names and relationships of individuals receiving assets.

- Executor appointment: Designation of a trusted individual to manage the estate.

- Specific bequests: Detailed instructions for particular items or assets.

- Residuary clause: Instructions for the distribution of remaining assets not specifically mentioned.

Including these elements ensures that the will is comprehensive and minimizes the likelihood of disputes among heirs.

Obtaining the Hawaii Legal Last Will and Testament Form for Divorced Persons Not Remarried with Adult Children

Obtaining the Hawaii legal last will and testament form is a straightforward process. Individuals can typically access the form through the following methods:

- Online resources: Many legal websites offer downloadable versions of the form.

- Local legal offices: Attorneys specializing in estate planning can provide the form and guidance on its completion.

- State government websites: The official Hawaii state website may offer resources and links to the necessary forms.

Once acquired, it is essential to ensure that the form is filled out correctly and complies with all legal requirements to be considered valid.

Quick guide on how to complete hawaii legal last will and testament form for divorced person not remarried with adult children

Effectively Prepare Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Administer Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Modify and eSign Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children Effortlessly

- Find Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the state of Hawaii last will and testament form?

The state of Hawaii last will and testament form is a legal document that allows individuals to outline how their assets will be distributed after their death. This form ensures that your wishes are honored and can help prevent disputes among heirs. It is crucial to have a valid last will and testament to secure your estate planning needs.

-

How can I complete the state of Hawaii last will and testament form online?

You can complete the state of Hawaii last will and testament form online using airSlate SignNow's user-friendly platform. Our service allows you to fill out the form digitally, ensuring that all necessary information is accurately captured. With easy navigation and straightforward prompts, completing your will has never been simpler.

-

Is there a cost associated with the state of Hawaii last will and testament form?

Yes, there may be a nominal fee associated with creating the state of Hawaii last will and testament form through airSlate SignNow. We provide a cost-effective solution that allows you to manage all your document signing needs efficiently. Our pricing is transparent, ensuring you only pay for what you need.

-

What are the benefits of using airSlate SignNow for my last will and testament?

Using airSlate SignNow for your state of Hawaii last will and testament form offers numerous benefits, including ease of use, security, and accessibility. Our platform ensures that your document is protected and legally binding. Additionally, you can access your will anytime and anywhere, making document management convenient.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with a variety of applications and services. This includes popular productivity tools that help streamline your document workflow, including cloud storage services and project management platforms. Integrating these tools can enhance your overall experience when managing your state of Hawaii last will and testament form.

-

What features does airSlate SignNow offer for creating a last will and testament?

AirSlate SignNow provides essential features for creating your state of Hawaii last will and testament form, such as customizable templates, e-signature options, and document tracking. Our platform ensures that the entire process is straightforward and secure, making it easy to finalize your will from start to finish.

-

Is legal advice needed when completing the state of Hawaii last will and testament form?

While using the state of Hawaii last will and testament form, it's always advisable to consult with a legal professional, especially concerning complex estates. AirSlate SignNow can guide you through the process, but having expert legal advice ensures that your will meets all legal requirements. This ensures that your wishes are protected and upheld.

Get more for Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children

- Alabama quitclaim deed 481376761 form

- Alabama warranty deed from husband to himself and wife form

- Husband wife property form

- Alabama quitclaim deed from husband and wife to husband and wife form

- Alabama warranty deed form

- Al estate form

- Alabama quitclaim deed 481376767 form

- Alabama motion to declare marriage void ab initio and judgment of annulment form

Find out other Hawaii Legal Last Will And Testament Form For Divorced Person Not Remarried With Adult Children

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form