Printable Irrevocable Trust Forms

What is the printable irrevocable trust form?

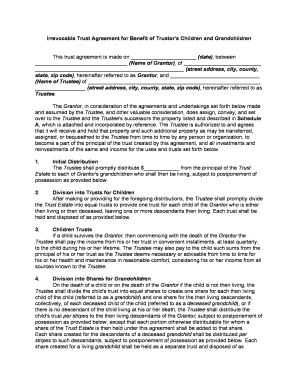

The printable irrevocable trust form is a legal document that establishes a trust that cannot be modified or revoked once created. This form is essential for individuals looking to transfer assets to beneficiaries while minimizing estate taxes and ensuring that the assets are managed according to specific terms. It is particularly useful for estate planning, allowing individuals to secure their wealth for future generations, such as grandchildren or children.

How to use the printable irrevocable trust form

Using the printable irrevocable trust form involves several steps to ensure that it is completed accurately and legally. First, gather all necessary information regarding the trust assets, beneficiaries, and the terms of the trust. Next, fill out the form with precise details, including the names of the grantor and beneficiaries, and specify how the assets should be managed. After completing the form, it must be signed in the presence of a notary public to ensure its validity. Finally, keep a copy for personal records and provide copies to the beneficiaries as needed.

Steps to complete the printable irrevocable trust form

Completing the printable irrevocable trust form requires careful attention to detail. Follow these steps:

- Identify the grantor, who is the person creating the trust.

- List all beneficiaries, including names and relationships to the grantor.

- Detail the assets being placed into the trust, including real estate, bank accounts, and other valuables.

- Outline the specific terms of the trust, such as distribution methods and any conditions for beneficiaries.

- Sign the form in front of a notary public to validate the document.

- Store the completed form in a safe place and share copies with relevant parties.

Key elements of the printable irrevocable trust form

The printable irrevocable trust form contains several key elements that must be included for it to be legally binding. These elements typically include:

- Grantor Information: Full name and address of the person creating the trust.

- Beneficiary Details: Names, addresses, and relationships of all beneficiaries.

- Trust Assets: A detailed list of all assets being transferred into the trust.

- Terms of the Trust: Specific instructions on how the assets should be managed and distributed.

- Signatures: Signatures of the grantor and witnesses, along with notarization.

Legal use of the printable irrevocable trust form

The printable irrevocable trust form is legally recognized when it meets specific requirements set by state laws. It is crucial to ensure that the form complies with the Uniform Trust Code and any state-specific regulations. Proper execution, including notarization and witnessing, is necessary for the trust to be enforceable in court. This form can help protect assets from creditors and ensure that they are distributed according to the grantor's wishes.

Examples of using the printable irrevocable trust form

There are various scenarios in which individuals might use the printable irrevocable trust form. Common examples include:

- Setting up a trust for grandchildren to ensure their financial security and education.

- Transferring family property into a trust to avoid probate and streamline the inheritance process.

- Creating a charitable trust to support a cause while providing tax benefits to the grantor.

Quick guide on how to complete printable irrevocable trust forms

Complete Printable Irrevocable Trust Forms seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and safely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Printable Irrevocable Trust Forms on any device using airSlate SignNow apps for Android or iOS and enhance any document-related operation today.

How to modify and eSign Printable Irrevocable Trust Forms effortlessly

- Locate Printable Irrevocable Trust Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important parts of the documents or redact confidential information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere moments and carries the same legal standing as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Printable Irrevocable Trust Forms and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are irrevocable trust forms?

Irrevocable trust forms are legal documents used to establish an irrevocable trust, which cannot be altered or revoked once created. These forms are essential for transferring assets into the trust, protecting them from creditors, and managing estate taxes. Using airSlate SignNow simplifies the process of completing and eSigning these forms effortlessly.

-

How much do irrevocable trust forms cost with airSlate SignNow?

The cost of using airSlate SignNow for irrevocable trust forms varies based on the subscription plan you choose. Our pricing is competitive and offers cost-effective solutions for individuals and businesses. You can access various features that help streamline the completion and signing of your forms.

-

What features does airSlate SignNow offer for managing irrevocable trust forms?

airSlate SignNow provides user-friendly features for managing irrevocable trust forms, including document templates, eSignature capabilities, and secure storage. Our platform allows you to customize forms, automate workflows, and track the status of your documents in real-time. This ensures a smooth and efficient process for creating and managing your trusts.

-

Can I integrate airSlate SignNow with other software for managing irrevocable trust forms?

Yes, airSlate SignNow offers seamless integrations with various software solutions, making it easy to manage irrevocable trust forms within your existing workflow. Popular integrations include CRM systems, document management platforms, and cloud storage services. This connectivity enhances productivity and simplifies document handling.

-

What are the benefits of using airSlate SignNow for irrevocable trust forms?

Using airSlate SignNow for irrevocable trust forms brings numerous benefits, including time savings, cost-effectiveness, and enhanced security. You can easily create, complete, and eSign your forms online, eliminating the need for printing and mailing. With our platform, you’ll have peace of mind regarding the confidentiality of your sensitive documents.

-

Is it easy to eSign irrevocable trust forms with airSlate SignNow?

Absolutely! airSlate SignNow provides a straightforward process for eSigning irrevocable trust forms. Users can sign documents digitally, ensuring legal compliance and convenience, all while eliminating the hassle of manual signatures. Our platform is designed for users of all skill levels, making it easy to navigate and use.

-

How can I get started with airSlate SignNow for irrevocable trust forms?

Getting started with airSlate SignNow for irrevocable trust forms is simple. Visit our website, choose a subscription plan that suits your needs, and create an account. Once registered, you can begin exploring our library of templates and tools to create and manage your irrevocable trust forms effectively.

Get more for Printable Irrevocable Trust Forms

- Complaint for intentional interference with attorney client relationship form

- Jury trial 481378312 form

- Complaint for class action for wrongful conduct rico by insurers form

- Certificate discharge template form

- Authority to release of deed of trust form

- Donation land form

- Accounts receivable guaranty form

- Accounts contract form

Find out other Printable Irrevocable Trust Forms

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT