Wi Widow Form

What is the Wi Widow

The Wi Widow form is a specific document used in the context of estate management and tax reporting for widowed individuals in the United States. This form allows the surviving spouse to claim certain benefits or exemptions that may be available to them following the death of their partner. Understanding the purpose and implications of the Wi Widow form is essential for ensuring compliance with tax regulations and for making informed decisions regarding estate matters.

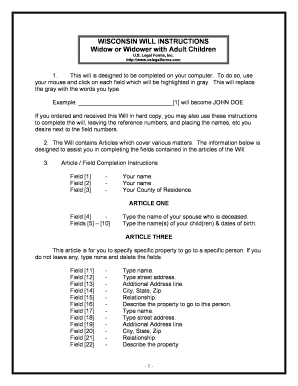

How to use the Wi Widow

Using the Wi Widow form involves several steps to ensure accurate completion. First, gather all necessary documents, including any previous tax returns and relevant financial statements. Next, fill out the form carefully, ensuring that all information is correct and complete. It is important to review the form for any errors before submission. Finally, submit the form through the appropriate channels, which may include online submission or mailing it to the relevant tax authority.

Steps to complete the Wi Widow

Completing the Wi Widow form requires attention to detail. Here are the essential steps:

- Gather required documentation, such as your spouse's death certificate and previous tax returns.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your spouse, including their name and date of death.

- Complete any sections related to income, deductions, and credits that apply to your situation.

- Review the form for accuracy before submission.

Legal use of the Wi Widow

The legal use of the Wi Widow form is governed by specific tax laws and regulations. It is crucial to ensure that the form is filled out correctly and submitted on time to avoid penalties. The form must be used in accordance with IRS guidelines to qualify for any benefits or exemptions. Consulting with a tax professional can provide additional assurance that the form is being used appropriately and in compliance with all legal requirements.

Key elements of the Wi Widow

Key elements of the Wi Widow form include personal identification information, details about the deceased spouse, and financial information relevant to the estate. The form may also require information about any dependents and specific deductions or credits the surviving spouse may claim. Understanding these elements is vital for accurate completion and to ensure that all potential benefits are maximized.

Eligibility Criteria

Eligibility for using the Wi Widow form typically includes being a surviving spouse of a deceased individual and meeting specific criteria set forth by the IRS. This may involve considerations such as the timing of the spouse's death, whether the couple filed jointly in previous years, and the overall income level of the surviving spouse. Reviewing these criteria is essential to ensure compliance and to determine if the form can be utilized effectively.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Wi Widow form can be done through various methods. Online submission is often the quickest and most efficient way, allowing for immediate processing. Alternatively, the form can be mailed to the appropriate tax authority, ensuring it is sent well before any deadlines. In-person submission may also be an option at certain tax offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete wi widow

Complete Wi Widow effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to retrieve the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Wi Widow on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Wi Widow with ease

- Access Wi Widow and select Get Form to begin.

- Make use of the tools we offer to finish your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form hunts, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Wi Widow to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the pricing strategy for wi widow users on airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored for wi widow users, ensuring that you can select an option that best fits your business needs. Whether you're an individual or part of a larger organization, our cost-effective solutions provide excellent value. Additionally, there are discounts available for annual subscriptions that can signNowly reduce your expenses.

-

How does airSlate SignNow enhance document management for wi widow users?

With airSlate SignNow, wi widow users can enhance document management through seamless eSignature capabilities and automated workflows. This means you can prepare, send, and manage documents efficiently, saving time and reducing errors. The platform ensures that all documents are stored securely while being easily accessible from any device.

-

What are the key features of airSlate SignNow for wi widow users?

Key features of airSlate SignNow for wi widow users include customizable templates, advanced routing options, and real-time tracking of document status. These features allow you to tailor the signing process to your needs while providing transparency throughout. Furthermore, our integration capabilities also ensure that you can connect with other essential tools effortlessly.

-

How can airSlate SignNow benefit businesses looking to cater to wi widow customers?

airSlate SignNow provides businesses the tools to cater effectively to wi widow customers by simplifying the document signing process. By using our easy-to-navigate platform, you can enhance customer satisfaction through faster transaction times. Moreover, the secure environment guarantees that sensitive information remains protected, helping to build trust with your clients.

-

Is airSlate SignNow suitable for small businesses with a wi widow focus?

Absolutely! airSlate SignNow is designed to meet the needs of small businesses, especially those targeting wi widow segments. Our user-friendly interface and cost-effective pricing make it accessible for businesses of any size, allowing you to streamline operations and focus on growth without overspending.

-

What integrations are available for wi widow users with airSlate SignNow?

airSlate SignNow offers a variety of integrations that are beneficial for wi widow users, including popular platforms like Google Drive, Salesforce, and Microsoft Office. These integrations allow for seamless document management within your existing workflows. By connecting with these apps, you can enhance productivity and ensure that all your tools work harmoniously.

-

How secure is the document signing process for wi widow clients?

The security of document signing for wi widow clients is a top priority at airSlate SignNow. Our platform employs advanced encryption and complies with industry standards to ensure that all documents are protected throughout the signing process. You can trust that sensitive information remains confidential and secure.

Get more for Wi Widow

- 30 day notice 481379101 form

- Arizona assignment of deed of trust by corporate mortgage holder form

- Arizona notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property form

- Termination lease landlord 481379104 form

- Arizona commercial sublease form

- Arizona alternative dispute resolution statement to the court form

- Az deposit form

- Arizona settlement statement form

Find out other Wi Widow

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form