California Disclaimer Form

Understanding the California Disclaimer

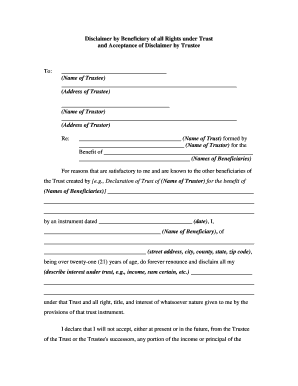

The California Disclaimer is a legal document used to relinquish certain rights or interests in a trust or estate. It is particularly relevant for beneficiaries who wish to decline their inheritance or specific benefits under a trust. This form is crucial in ensuring that the decision to disclaim is legally recognized, allowing the assets to pass to other designated beneficiaries without complications. It is important to understand the implications of this disclaimer, as it can affect the distribution of assets and the rights of other beneficiaries.

Steps to Complete the California Disclaimer

Completing the California Disclaimer involves several key steps to ensure its validity:

- Obtain the Form: The disclaimer form can typically be obtained from legal resources or estate planning professionals.

- Fill Out the Form: Provide accurate information regarding the trust, the beneficiaries, and the specific interests being disclaimed.

- Sign the Form: The form must be signed by the disclaiming beneficiary in the presence of a notary public to ensure its legal standing.

- Submit the Form: File the completed disclaimer with the appropriate court or trust administrator as required.

Legal Use of the California Disclaimer

The California Disclaimer serves a specific legal purpose in estate planning. It allows beneficiaries to formally refuse an inheritance, which can help avoid potential tax liabilities or disputes among heirs. For the disclaimer to be legally binding, it must comply with California Probate Code, which outlines the necessary criteria and procedures. Ensuring compliance with these regulations is vital to uphold the disclaimer's validity and effectiveness.

Key Elements of the California Disclaimer

Several key elements must be present in a California Disclaimer for it to be effective:

- Clear Identification: The document should clearly identify the disclaiming beneficiary and the specific interest being disclaimed.

- Intent to Disclaim: The language used must unequivocally express the beneficiary's intent to refuse the inheritance.

- Compliance with Legal Requirements: The disclaimer must adhere to the stipulations set forth in the California Probate Code.

- Timeliness: The disclaimer must be filed within a specific timeframe following the acceptance of the inheritance.

Who Issues the California Disclaimer

The California Disclaimer is typically issued by the beneficiary who wishes to decline their interest in a trust or estate. It is a self-generated document, meaning the beneficiary can draft it, provided it meets the legal requirements outlined in California law. However, it is advisable to consult with an estate planning attorney to ensure that the disclaimer is properly formatted and executed.

Form Submission Methods

The California Disclaimer can be submitted through various methods, depending on the requirements of the trust or estate:

- Online Submission: Some courts may allow electronic filing of the disclaimer.

- Mail: The completed form can be mailed to the appropriate court or trust administrator.

- In-Person: Beneficiaries may also choose to submit the disclaimer in person at the relevant court or office.

Eligibility Criteria for the California Disclaimer

To be eligible to file a California Disclaimer, the beneficiary must meet certain criteria:

- Beneficiary Status: The individual must be a designated beneficiary under the trust or estate.

- Intent to Disclaim: The beneficiary must have a clear intent to refuse the inheritance.

- Timeliness: The disclaimer must be filed within the statutory time limits set by California law.

Quick guide on how to complete california disclaimer

Complete California Disclaimer effortlessly on any gadget

Digital document management has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage California Disclaimer on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign California Disclaimer without hassle

- Find California Disclaimer and then click Access Form to begin.

- Employ the tools we offer to complete your document.

- Underline pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Finish button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign California Disclaimer and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an acceptance trustee form?

An acceptance trustee form is a legal document used to designate a trustee for a trust. This form is essential for outlining the responsibilities of the trustee and ensuring compliance with trust regulations. Using airSlate SignNow can streamline the process of creating and signing this important document.

-

How can airSlate SignNow help with the acceptance trustee form?

airSlate SignNow simplifies the process of preparing and signing an acceptance trustee form. The platform provides easy-to-use tools that allow you to create customizable forms quickly. Additionally, you can send the form for eSignature, making the entire process efficient and compliant.

-

Is there a cost associated with using airSlate SignNow for the acceptance trustee form?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for document management. Pricing plans are designed to meet the needs of both individuals and businesses, ensuring that you can efficiently handle tasks like completing acceptance trustee forms without breaking the bank.

-

What features does airSlate SignNow offer for managing the acceptance trustee form?

airSlate SignNow includes features like customizable templates, eSignature capabilities, and secure storage for your acceptance trustee form. The platform also allows for real-time collaboration, ensuring that all parties can review and sign the document swiftly and securely.

-

Can I integrate airSlate SignNow with other applications for managing the acceptance trustee form?

Absolutely! airSlate SignNow offers integrations with various applications like CRM systems and cloud storage services. This means you can manage your acceptance trustee form alongside other business processes seamlessly and enhance overall productivity.

-

What benefits will I gain by using airSlate SignNow for my acceptance trustee form?

Using airSlate SignNow for your acceptance trustee form offers several advantages, such as increased efficiency, reduced processing times, and a user-friendly experience. You’ll also benefit from superior security measures that protect sensitive information related to your trust documents.

-

Is eSigning the acceptance trustee form legally binding?

Yes, eSigning your acceptance trustee form with airSlate SignNow is legally binding and compliant with eSignature laws. This means that your digitally signed documents hold the same legal weight as traditional handwritten signatures, giving you peace of mind.

Get more for California Disclaimer

- 012 action by written consent of board of directors upon incorporation form

- Was called and held at location on the date day of month year at time form

- View html sec filingdar bioscience form

- We the undersigned being all of the members of the board of directors of form

- Sec info sub surface waste management of delaware inc form

- Island connections 694 by island connections media group issuu form

- Boyd gaming corpdef 14a for 51806 sec info form

- Applied dna sciences inc form 8 k ex 101 exhibit 101

Find out other California Disclaimer

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile