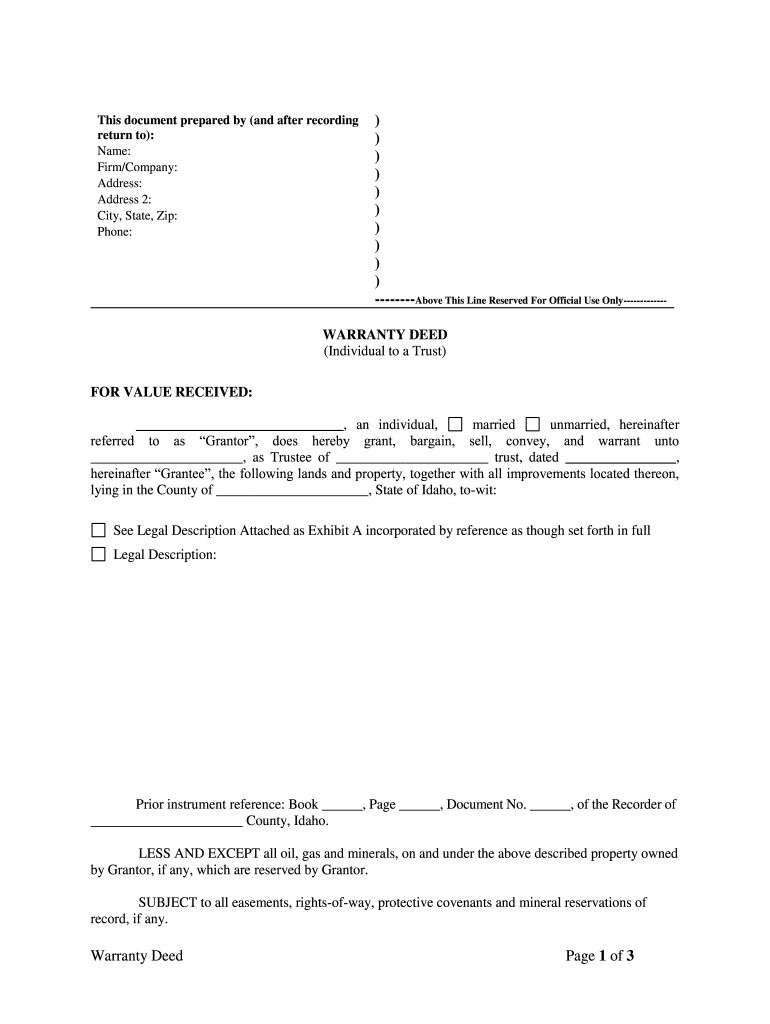

Idaho Deed Trust Form

What is the Idaho Deed Trust

The Idaho deed trust is a legal document that allows property owners to transfer their real estate into a trust. This arrangement provides benefits such as estate planning, asset protection, and privacy. In a deed trust, the property is held by a trustee for the benefit of the beneficiaries designated by the property owner. This structure can help avoid probate and streamline the transfer of assets upon the owner's death.

How to use the Idaho Deed Trust

Using the Idaho deed trust involves several steps. First, the property owner must create the trust document, specifying the terms and beneficiaries. Next, the owner must execute the deed, transferring the property into the trust. This deed must be recorded with the county recorder's office to be legally effective. It is essential to ensure that the trust complies with Idaho laws and regulations to maintain its validity.

Key elements of the Idaho Deed Trust

Several key elements define the Idaho deed trust. These include:

- Trustee: The individual or entity responsible for managing the trust assets.

- Beneficiaries: The individuals or entities who will benefit from the trust.

- Trust terms: The specific guidelines and conditions under which the trust operates.

- Property description: A detailed description of the property being placed into the trust.

Understanding these components is crucial for effective management and execution of the deed trust.

Steps to complete the Idaho Deed Trust

Completing the Idaho deed trust involves a series of important steps:

- Draft the trust document, outlining the terms, trustee, and beneficiaries.

- Prepare the deed that transfers the property into the trust.

- Sign the deed in the presence of a notary public.

- File the deed with the appropriate county recorder's office.

- Ensure all parties involved have copies of the executed documents.

Following these steps helps ensure the trust is established correctly and legally binding.

Legal use of the Idaho Deed Trust

The Idaho deed trust is legally recognized and can be used for various purposes, including estate planning and asset protection. It is essential to comply with Idaho state laws when creating and executing the trust to ensure its enforceability. The trust must be properly documented and recorded to prevent any legal disputes or challenges in the future.

State-specific rules for the Idaho Deed Trust

Idaho has specific regulations governing the use of deed trusts. These rules include requirements for drafting the trust document, the necessity of notarization, and stipulations for recording the deed with the county. Additionally, it is important to be aware of any tax implications or obligations that may arise from transferring property into a trust. Consulting with a legal professional familiar with Idaho laws can provide clarity and guidance.

Quick guide on how to complete idaho deed trust

Complete Idaho Deed Trust effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your files quickly without delays. Manage Idaho Deed Trust on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-centered process today.

The easiest way to modify and electronically sign Idaho Deed Trust without effort

- Find Idaho Deed Trust and click on Get Form to begin.

- Utilize the tools we provide to submit your document.

- Identify important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Idaho Deed Trust to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Idaho deed trust?

An Idaho deed trust is a legal document used to secure a loan by transferring the property's title to a trustee, who holds it for the benefit of the lender. This arrangement offers flexibility and can sometimes simplify the process of foreclosure in Idaho. Understanding how an Idaho deed trust works is essential for homeowners and borrowers.

-

How does airSlate SignNow help with Idaho deed trust documentation?

airSlate SignNow streamlines the process of creating and signing Idaho deed trust documents by providing easy-to-use templates and eSignature capabilities. Our platform ensures that all signatures are legally binding, making it a reliable choice for individuals and businesses alike. With SignNow, preparing your Idaho deed trust is both efficient and compliant.

-

What are the costs associated with using airSlate SignNow for Idaho deed trust?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, including those who require Idaho deed trust documentation. Pricing generally includes a subscription fee that covers all features, including eSignature capabilities and document storage. For detailed pricing on specific plans, visit our website.

-

Can I integrate airSlate SignNow with other tools for managing Idaho deed trust?

Yes, airSlate SignNow allows seamless integration with various business tools for efficient management of Idaho deed trust documentation. Our platform can connect with CRM, cloud storage, and other applications, enhancing your workflow and making document management easier. This integration capability helps streamline the process for users needing comprehensive document management solutions.

-

What are the benefits of using airSlate SignNow for Idaho deed trust documents?

Using airSlate SignNow for Idaho deed trust documents provides multiple benefits, including speed, security, and convenience. Our eSigning process is quick, ensuring that your documents are completed faster than traditional methods. Additionally, SignNow keeps all your documents safe and accessible, helping you manage your real estate transactions efficiently.

-

Are there templates available for Idaho deed trust on airSlate SignNow?

Yes, airSlate SignNow offers pre-built templates specifically for Idaho deed trust documentation. These templates simplify the process of creating legally-compliant documents, saving you time and reducing errors. You can customize these templates to fit your specific needs and ensure all necessary information is included.

-

Is airSlate SignNow compliant with Idaho state laws for deed trusts?

airSlate SignNow is designed to comply with relevant laws and regulations, including those applicable to Idaho deed trusts. Our templates are crafted to meet legal standards, and our ongoing updates ensure that you are using compliant documentation. It is always advisable to consult a legal professional for specific legal advice.

Get more for Idaho Deed Trust

- Motion for license to sell or convey real estate form

- Townstate 490243686 form

- Under vermont law an equine activity sponsor is not liable for an injury to or the form

- To me that heshethey executed the same to be hishertheir free act and deed form

- Control number vt 04 82 form

- Personal property notice of value appeal form

- Report on license to convey mortgage or lease form

- Rules of the circuit court probate division form

Find out other Idaho Deed Trust

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe