Maryland Warranty Deed for Parents to Child with Reservation of Life Estate Form

What is the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

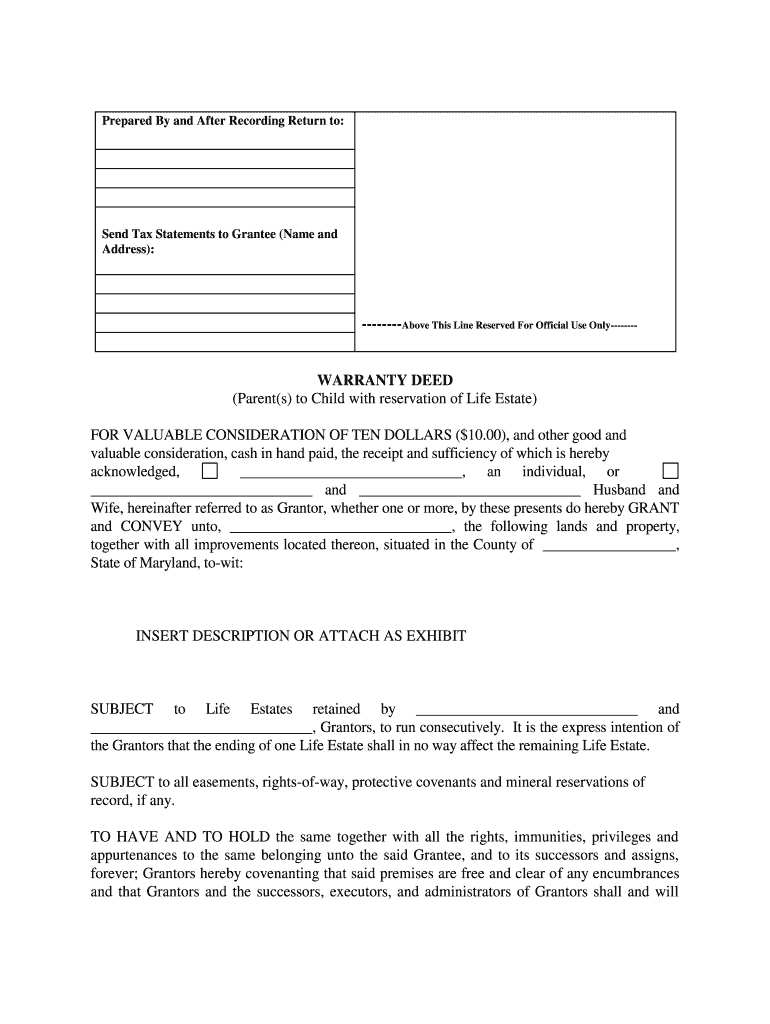

The Maryland warranty deed for parents to child with reservation of life estate is a legal document that allows parents to transfer property ownership to their child while retaining the right to live in the property for the remainder of their lives. This type of deed ensures that the parents maintain control over the property during their lifetime, while also providing the child with a future interest in the property. It is commonly used in estate planning to facilitate the transfer of family property and to avoid probate issues upon the parents' passing.

Steps to Complete the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

Completing the Maryland warranty deed for parents to child with reservation of life estate involves several key steps:

- Gather necessary information, including the full names of the parents and child, property description, and any relevant legal descriptions.

- Obtain the appropriate form for the warranty deed, ensuring it includes a reservation of life estate clause.

- Fill out the form accurately, making sure to include all required details and signatures from both parents.

- Have the document notarized to ensure its legal validity.

- File the completed deed with the local county land records office to make the transfer official.

Legal Use of the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

The legal use of the Maryland warranty deed for parents to child with reservation of life estate is primarily for estate planning purposes. It allows parents to transfer property while retaining the right to live there, thus providing financial security and stability. This deed is legally binding and must comply with Maryland state laws regarding property transfers. It is important to ensure that all legal requirements are met, including notarization and proper filing, to avoid any future disputes or complications.

Key Elements of the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

Several key elements define the Maryland warranty deed for parents to child with reservation of life estate:

- Grantor and Grantee Information: The names and addresses of the parents (grantors) and the child (grantee) must be clearly stated.

- Property Description: A detailed description of the property being transferred, including its legal description.

- Reservation Clause: A specific clause that outlines the parents' right to occupy the property for their lifetime.

- Signatures and Notarization: The deed must be signed by the grantors and notarized to ensure its validity.

State-Specific Rules for the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

In Maryland, specific rules govern the use of warranty deeds, including those with a reservation of life estate. These rules include:

- The deed must be executed in writing and signed by the grantors.

- Notarization is required to validate the deed.

- The deed must be recorded with the local land records office to provide public notice of the transfer.

- Compliance with state tax laws may be necessary, including potential transfer taxes.

How to Obtain the Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

To obtain the Maryland warranty deed for parents to child with reservation of life estate, individuals can follow these steps:

- Visit the local county land records office or their official website to access the necessary forms.

- Consult with a legal professional to ensure the form meets all legal requirements and includes the reservation clause.

- Download or request a physical copy of the deed form, ensuring it is the most current version.

Quick guide on how to complete maryland warranty deed for parents to child with reservation of life estate

Accomplish Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate effortlessly on any gadget

Virtual document management has become increasingly favored among enterprises and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and safely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The simplest way to modify and electronically sign Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate with ease

- Obtain Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your choice. Modify and electronically sign Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a life estate deed in Maryland?

A life estate deed in Maryland is a legal document that allows a property owner to transfer ownership to another party while retaining the right to use the property during their lifetime. This type of deed helps avoid probate and can simplify the transfer of property upon the owner's death.

-

How does a life estate deed benefit Maryland homeowners?

The life estate deed in Maryland offers several benefits, including the ability to maintain control over the property during your lifetime while ensuring a seamless transition to heirs. Additionally, it helps prevent the property from going through probate, saving time and costs for your beneficiaries.

-

What are the costs associated with creating a life estate deed in Maryland?

The costs of creating a life estate deed in Maryland may vary based on attorney fees and additional expenses related to property transfer. It's essential to consult with a legal expert to understand the overall costs, including filing fees and any other charges associated with the deed.

-

Can I revoke a life estate deed in Maryland?

In Maryland, revoking a life estate deed is possible, but it requires following specific legal procedures. The owner must draft a new deed that clearly states the revocation and have it executed properly. Consulting with a legal professional is recommended to ensure the process is handled correctly.

-

Does a life estate deed in Maryland affect property taxes?

A life estate deed in Maryland itself does not typically change how property taxes are assessed, as the original owner retains the right to use the property. However, it is advisable to check with local tax authorities to understand any potential implications on assessments or exemptions.

-

How can airSlate SignNow assist with life estate deeds in Maryland?

airSlate SignNow offers a simple and efficient solution for drafting and executing life estate deeds in Maryland. With our eSignature features, users can easily sign legal documents online, ensuring that life estate deeds are completed securely and conveniently.

-

Are life estate deeds in Maryland subject to federal or state regulations?

Yes, life estate deeds in Maryland are subject to both state and federal regulations. It is crucial to follow Maryland's specific legal requirements when creating and executing a life estate deed to ensure the document is valid and enforceable.

Get more for Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

Find out other Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure