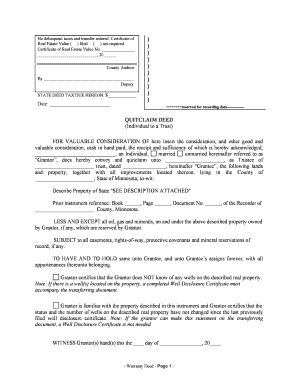

Minnesota Trust Form

What is the Minnesota Trust

The Minnesota Trust is a legal arrangement that allows individuals to manage and protect their assets for the benefit of designated beneficiaries. This type of trust is commonly used for estate planning, ensuring that assets are distributed according to the grantor's wishes while potentially minimizing estate taxes and avoiding probate. It can be tailored to meet specific needs, such as providing for minors or individuals with special needs.

How to use the Minnesota Trust

Using the Minnesota Trust involves several key steps. First, the grantor must decide on the type of trust that best suits their goals, whether it be a revocable or irrevocable trust. Next, the grantor should draft the trust document, detailing the terms, beneficiaries, and the trustee's powers. Once the document is prepared, it must be signed and notarized to ensure its legal validity. Finally, assets should be transferred into the trust to activate it.

Steps to complete the Minnesota Trust

Completing the Minnesota Trust involves a systematic process:

- Determine the type of trust needed based on your financial situation and goals.

- Draft the trust document, including all necessary provisions and details.

- Sign the document in the presence of a notary public.

- Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Review and update the trust periodically to reflect changes in circumstances or laws.

Legal use of the Minnesota Trust

The Minnesota Trust is legally recognized under state law, provided it meets specific requirements. It must be created with clear intent, and the grantor must have the legal capacity to establish the trust. Additionally, the trust document must comply with Minnesota statutes regarding trusts, including proper execution and witnessing. Understanding these legal frameworks is essential to ensure that the trust is enforceable and serves its intended purpose.

Key elements of the Minnesota Trust

Several key elements define the Minnesota Trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and ensuring compliance with the trust terms.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust document: A legally binding document that outlines the terms and conditions of the trust.

- Assets: The property and financial resources placed into the trust for management and distribution.

Eligibility Criteria

Eligibility to establish a Minnesota Trust generally requires the grantor to be of legal age and possess the mental capacity to understand the implications of creating a trust. There are no specific financial requirements to set up a trust, making it accessible to a wide range of individuals. However, the complexity of the trust may vary based on the assets involved and the specific goals of the grantor.

Quick guide on how to complete minnesota trust

Complete Minnesota Trust effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an optimal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Minnesota Trust on any device using the airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest method to modify and eSign Minnesota Trust without hassle

- Locate Minnesota Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Minnesota Trust and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MN trust and how does airSlate SignNow support it?

An MN trust, or Minnesota trust, is a legal arrangement allowing individuals to manage their assets. airSlate SignNow provides seamless eSignature capabilities that facilitate the documentation process for MN trusts. With our platform, you can easily create, sign, and manage trust documents securely and efficiently.

-

How much does airSlate SignNow cost for managing MN trusts?

Pricing for airSlate SignNow varies based on your needs, but it offers competitive rates to support your MN trust documentation. Packages are designed to suit different business sizes, ensuring you can find a cost-effective solution tailored for managing your MN trust. Check our pricing page for specific plans and features.

-

What features does airSlate SignNow offer for MN trust users?

airSlate SignNow includes essential features such as customizable templates, document sharing, and eSigning, making it ideal for MN trust management. Our intuitive interface allows users to collaborate easily on trust documents. Additionally, advanced security features ensure your sensitive information remains protected.

-

Can I integrate airSlate SignNow with other tools for MN trust management?

Yes, airSlate SignNow offers various integrations to enhance your MN trust management process. You can connect with applications like Google Workspace, Salesforce, and more to streamline workflows. These integrations enable a seamless transition of documents between systems, improving efficiency in managing your MN trust.

-

What are the benefits of using airSlate SignNow for MN trusts?

Using airSlate SignNow for MN trusts provides several benefits, including increased efficiency and reduced turnaround times for signing documents. Our platform offers a user-friendly experience, making it easier for clients and trustees alike to manage trust documentation. Plus, electronic signatures ensure that your MN trust documents remain legally binding.

-

Is airSlate SignNow compliant with MN trust regulations?

Yes, airSlate SignNow complies with electronic signature laws, including those relevant to MN trusts, such as the eSign Act and UETA. This compliance guarantees that your electronically signed documents are recognized legally. With airSlate SignNow, you can confidently manage your MN trust documentation while adhering to legal standards.

-

How can I start using airSlate SignNow for my MN trust documentation?

Getting started with airSlate SignNow for your MN trust documentation is easy. Simply sign up for an account, choose a pricing plan that fits your needs, and begin creating or uploading your trust documents. Our intuitive platform provides resources and support to help you through the process of setting up and managing your MN trust.

Get more for Minnesota Trust

- Organizing your personal assets package arkansas form

- Essential documents for the organized traveler package arkansas form

- Essential documents for the organized traveler package with personal organizer arkansas form

- Postnuptial agreement form 497296745

- Letters of recommendation package arkansas form

- Ar mechanics lien form

- Arkansas construction or mechanics lien package corporation arkansas form

- Arkansas business form

Find out other Minnesota Trust

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online