City of Berwyn Real Estate Transfer Transfer Tax PDF Form 2011-2026

Understanding the City of Berwyn Real Estate Transfer Tax PDF Form

The City of Berwyn Real Estate Transfer Tax PDF form is a crucial document required for the transfer of property ownership within the city. This form is used to report the sale of real estate and to calculate the applicable transfer tax based on the sale price. It ensures compliance with local regulations governing real estate transactions. The form typically includes sections for the buyer and seller's information, property details, and the total sale price, which directly influences the transfer tax amount owed.

How to Complete the City of Berwyn Real Estate Transfer Tax PDF Form

Completing the City of Berwyn Real Estate Transfer Tax PDF form involves several key steps. First, gather all necessary information, including the names and addresses of both the buyer and seller, the property address, and the sale price. Next, accurately fill out each section of the form, ensuring that all details are correct to avoid delays. After completing the form, both parties must sign it to validate the transaction. It is advisable to keep a copy for your records before submitting it to the appropriate city office.

Obtaining the City of Berwyn Real Estate Transfer Tax PDF Form

The City of Berwyn Real Estate Transfer Tax PDF form can be obtained through the official city website or by visiting the local city hall. Many municipalities provide downloadable versions of these forms online, which can be filled out electronically or printed for manual completion. If assistance is needed, local real estate professionals or legal advisors can offer guidance on how to access and complete the form correctly.

Key Elements of the City of Berwyn Real Estate Transfer Tax PDF Form

Key elements of the City of Berwyn Real Estate Transfer Tax PDF form include the following:

- Buyer and Seller Information: Names, addresses, and contact details of both parties involved in the transaction.

- Property Description: A detailed description of the property being transferred, including its address and parcel number.

- Sale Price: The total amount for which the property is being sold, which determines the transfer tax.

- Signatures: Required signatures from both the buyer and seller to validate the form.

Legal Use of the City of Berwyn Real Estate Transfer Tax PDF Form

The legal use of the City of Berwyn Real Estate Transfer Tax PDF form is essential for ensuring that property transfers comply with local laws. This form serves as an official record of the transaction and is necessary for the assessment of transfer taxes. Failure to complete and submit this form can result in penalties or delays in the transfer process. It is important for both buyers and sellers to understand their obligations under local real estate laws when using this form.

Filing Deadlines and Important Dates

Filing deadlines for the City of Berwyn Real Estate Transfer Tax PDF form are typically aligned with the closing date of the property sale. It is essential to submit the form promptly to avoid any penalties. Local regulations may specify a time frame within which the form must be filed after the transaction occurs. Keeping track of these deadlines ensures compliance and helps facilitate a smooth transfer process.

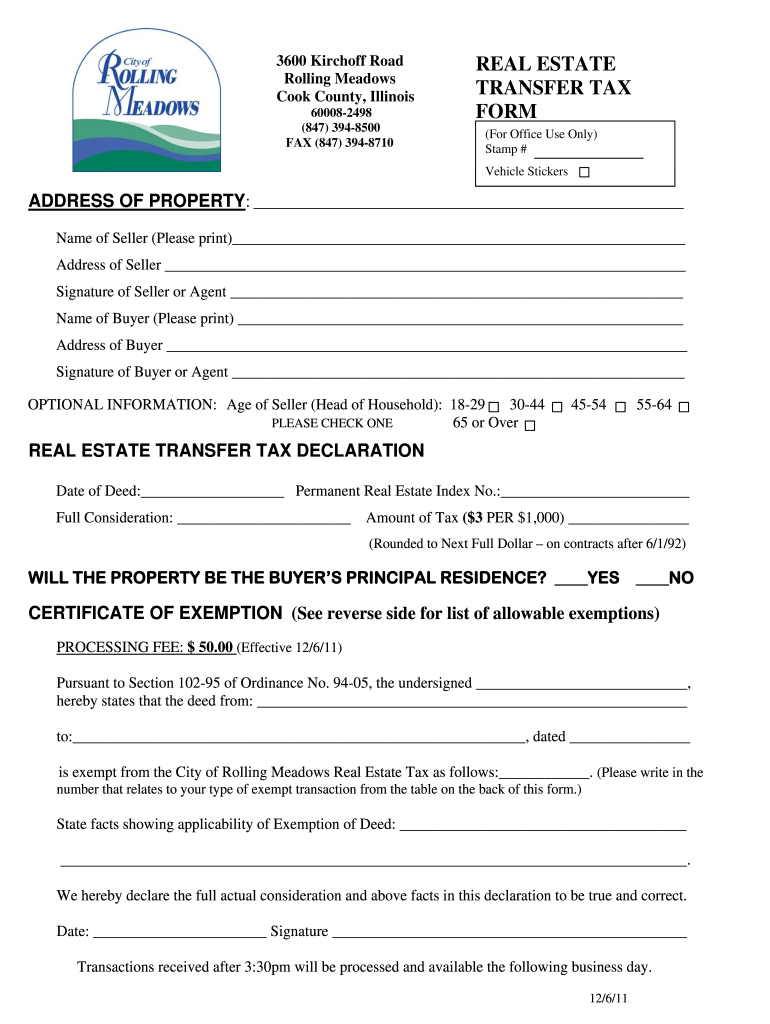

Quick guide on how to complete real estate transfer tax form city of rolling meadows

Ensure Accuracy on City Of Berwyn Real Estate Transfer Tax Pdf Form

Managing contracts, handling listings, coordinating calls, and conducting viewings—real estate agents and professionals navigate a range of responsibilities daily. Many of these responsibilities require substantial documentation, such as City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form, which needs to be completed by specified deadlines and with the utmost accuracy.

airSlate SignNow serves as a comprehensive platform that allows real estate professionals to alleviate the burden of paperwork, enabling them to focus more on their clients' objectives during the entire negotiation phase and assist them in securing the best possible deal.

Steps to Complete City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form with airSlate SignNow:

- Access the City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form page or utilize our library's search capabilities to find the necessary form.

- Select Get form—you will be redirected to the editor promptly.

- Begin filling out the form by selecting the fillable fields and entering your information.

- Add additional text and adjust its settings if necessary.

- Click on the Sign option in the top toolbar to create your signature.

- Explore other tools available for marking up and enhancing your document, such as drawing, highlighting, and adding shapes.

- Open the comment tab to add notes regarding your document.

- Complete the process by downloading, sharing, or sending your document to the relevant parties or organizations.

Eliminate paper for good and enhance the home-buying experience with our intuitive and powerful solution. Experience greater efficiency when completing City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How can I pull money out of my 401k to invest in real estate without paying taxes?

Many company plans allow you to borrow up to half of your account balance, for any reason, or $50,000, whichever is the lowest amount.The cool thing about this, is that you are YOUR OWN bank, and paying interest to your future self!Downsides, if you quit, you have to immediately pay all the money on the loan back right away, or pay the penalties, taxes and possible interest on the transaction.If that isn’t enough to do the trick, then you can talk to your boss.Quit your job. Rollover the money to an IRA at a self-directed IRA trustee. I am unable to recommend any at this time, as they are all too expensive, for what they provide, but they exist. Some are dishonest. Read my other Quora answers on this point.Buy the real estate with your self-directed IRA. SERIOUSLY reconsider your decision, if it won’t pay for the ENTIRE cost of the property, as well as sufficient operating funds for the first year or two, until you have stable income coming in to keep up with property taxes, insurance and maintenance!You are ALLOWED to take out a non-recourse loan in your retirement accounts, but loans are ALWAYS a bad idea. You also have to learn about UBIT, and ERISA regulations always put you to sleep.Once the dust settles, you can go to work for ANY company in the world. Including your former employer. Imagine that!If the company plan permits it, you can ALSO do ANOTHER rollover, this time, taking ALL your standard IRA money, and putting it into your “new” employer 401(k) plan. If YOUR employer plan doesn’t yet permit this, start agitating for corrective action. It only takes a one line addition to make it permissable. The IRS is okay with it, and most plans have it.So, if you WOULD be able to get by with half of your account balance, or $50,000, but your current company won’t allow it, then do the above steps, and go to work for a company with a plan that WILL do it!Once the money is back in the 401(k) plan, take out the market rate loan, and live happily ever after!Just in case you happen to be of an entrepreneurial nature, an almost unbelievable option exists. You can now start a C Corporation, which sets up a 401(k) plan for its employees.This plan allows TWO important, one line provisions. You can buy company stock with your 401(k) funds, and the plan can accept rollovers from IRA accounts.You see where this is going, right?You then rollover your vast, IRA assets TO the C corporation. The C corporation puts the money into the 401(k) plan.The 401(k) plan buys stock in the C corporation, (sole shareholder is more predictable), giving the company back any portion of the money as YOU deem fit and proper!The corporation then spends the money as you, the CEO, deem to be in the best interests of the company! Owned entirely, by YOUR 401(k) plan! So don’t screw up! You can actually get into trouble for taking advantage of, and making decisions that are NOT IN THE BEST INTEREST OF, your own, 401(k) plan!Do NOT abuse this job! You have an idiot for a boss, so you should immediately set out to correct that situation, by obtaining the self-education that you WILL need, in order to handle the bookkeeping, accounting, management and specfic niche fuctions needed in whatever business or industry that you will be operating in!The good news is, you AND your spouse are allowed to work on your investments!In ALL other retirement accounts set up at a self-directed custodian, you are FORBIDDEN to work on your own investments, other than as a “property manager”! Crazy!But as the sole employee, you MUST put in at least 1,000 hours per year, in order to qualify as a full time employee!Naturally, you can ALSO have a company match of your 401(k) contributions, of up to 100%! Yes, of course there are limits! USE them!You still have to pay the 15.3% FICA and Medicare taxes on your earnings, but that is inevitable in any case.It would seem to me, that with a cooperative spouse, you should be able to otherwise shelter over $100,000 worth of profits per year, before owing ANY income taxes! To further research this, Google “401(k) financing”.A less appealing option is “checkbook control LLC”.Don’t do either of these, until you have at least 5 years worth of “successful” business experience. Because once your company stock value drops to zero, the portion of your retirement accounts that you set aside for the business, your ENTIRE company retirement account, is bankrupt as well!As always, upvote and follow me, either if you are entertained by my answers, or, if you are now able to move forward with your investment plans by unlocking the value safely tucked away in your retirement accounts!Thanks for watching!

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How can a wealth tax work, as Warren is proposing? What is wealth? Will you need to distinguish between liquid and illiquid forms of wealth, like real estate? Will it only impact a small percentage of Americans?

A wealth tax is fundamentally a tax on your net worth above a basic limit to ensure that it does not hit everyone.In my native Denmark, when I was a kid, there was a wealth tax of about 1% on wealth above something like USD 10,000.In today’s USA, it would make sense to make the basic exemption something like $500,000 or the median price of a single family home in the state of residence.Depending on how the base exemption was divided, it might affect many or few people.Wealth is loosely the same as “net worth” - everything you own minus all of your debt.My recommendation would be to set the parameters such that most people would not be affected, and to make the rules very simple. People with enough wealth will of course scream bloody murder and want to have complicated rules that put less value on the exact items that they want, but for people to feel that it is fair, they need to be able to understand it; we already have way too many complex loopholes.I would NOT want to exempt all real estate. A modest family home should not be taxed, but I would address that via the baseline exemption, as discussed above.I would NOT want to exempt the value of business assets.I would NOT want to exempt assets in foreign countries, be they bank accounts, yachts or vacation condos.I am open to arguments about whether assets held in tax-deferred savings accounts (IRAs, SEPs, 401(k)s etc) should be counted or only charged at half the value.

Create this form in 5 minutes!

How to create an eSignature for the real estate transfer tax form city of rolling meadows

How to create an electronic signature for the Real Estate Transfer Tax Form City Of Rolling Meadows online

How to create an eSignature for your Real Estate Transfer Tax Form City Of Rolling Meadows in Chrome

How to generate an electronic signature for signing the Real Estate Transfer Tax Form City Of Rolling Meadows in Gmail

How to create an electronic signature for the Real Estate Transfer Tax Form City Of Rolling Meadows right from your smart phone

How to generate an eSignature for the Real Estate Transfer Tax Form City Of Rolling Meadows on iOS devices

How to generate an eSignature for the Real Estate Transfer Tax Form City Of Rolling Meadows on Android

People also ask

-

What are Berwyn transfer stamps?

Berwyn transfer stamps are official documents required for certain property transactions in Berwyn. These stamps verify that the transfer of ownership is legally recognized and that applicable taxes have been paid. Utilizing a reliable eSignature platform like airSlate SignNow simplifies the process of obtaining and managing these stamps.

-

How much do Berwyn transfer stamps cost?

The cost of Berwyn transfer stamps can vary based on the property value involved in the transaction. It's essential to check with your local municipality for the exact fees, which are typically based on a percentage of the property's sale price. Using airSlate SignNow can help ensure that all necessary fees are calculated correctly during the transaction process.

-

Do I need Berwyn transfer stamps for all property transactions?

Most property transactions in Berwyn require transfer stamps to be valid and legally recognized. This includes sales, gifts, and certain leases. By using airSlate SignNow, you can streamline the process of acquiring the necessary stamps and ensure compliance with local regulations.

-

How can airSlate SignNow assist with Berwyn transfer stamps?

airSlate SignNow provides an easy-to-use platform to electronically sign and manage the documentation required for obtaining Berwyn transfer stamps. This solution allows for quick processing and ensures that all parties involved can access the documents securely and promptly. It simplifies the complexity often associated with real estate transactions.

-

Are there any deadlines associated with Berwyn transfer stamps?

Yes, there are specific deadlines for acquiring Berwyn transfer stamps that can vary based on your transaction type. It's important to ensure that these stamps are secured timely to avoid delays in closing your real estate deal. With airSlate SignNow, you can track your document's progress and stay ahead of these deadlines.

-

What features does airSlate SignNow offer for managing Berwyn transfer stamps?

airSlate SignNow offers several features including customizable templates, secure eSignature options, and real-time document tracking, which are beneficial for managing Berwyn transfer stamps. These tools not only enhance efficiency, but they also promote collaboration among all parties involved. This ensures that the stamp acquisition process is smooth and hassle-free.

-

Can I integrate airSlate SignNow with other platforms for Berwyn transfer stamps?

Absolutely! airSlate SignNow integrates seamlessly with various platforms allowing for an enhanced experience when managing Berwyn transfer stamps. This can include integration with existing CRM systems or financial software, facilitating better document management and communication throughout the transfer process.

Get more for City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form

- New sales representative form

- Guidelines for progressive discipline ampamp grievance nctq form

- Name change secgov form

- Google domains domain name registration agreement form

- Sample lease klines resort form

- Confidentiality notice this e mail communication and form

- Email confidentiality disclaimers annoying but are they form

- Buy sell agreementfree legal forms

Find out other City Of Berwyn Real Estate Transfer Transfer Tax Pdf Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online