Death Deed Form

What is the Death Deed

The death deed, also known as a transfer on death deed, is a legal document that allows an individual to transfer real property upon their death without going through probate. This deed specifies the beneficiaries who will receive the property, ensuring a smooth transition of ownership. In Oregon, this process is particularly beneficial as it simplifies estate management and can help avoid lengthy legal proceedings.

How to Use the Death Deed

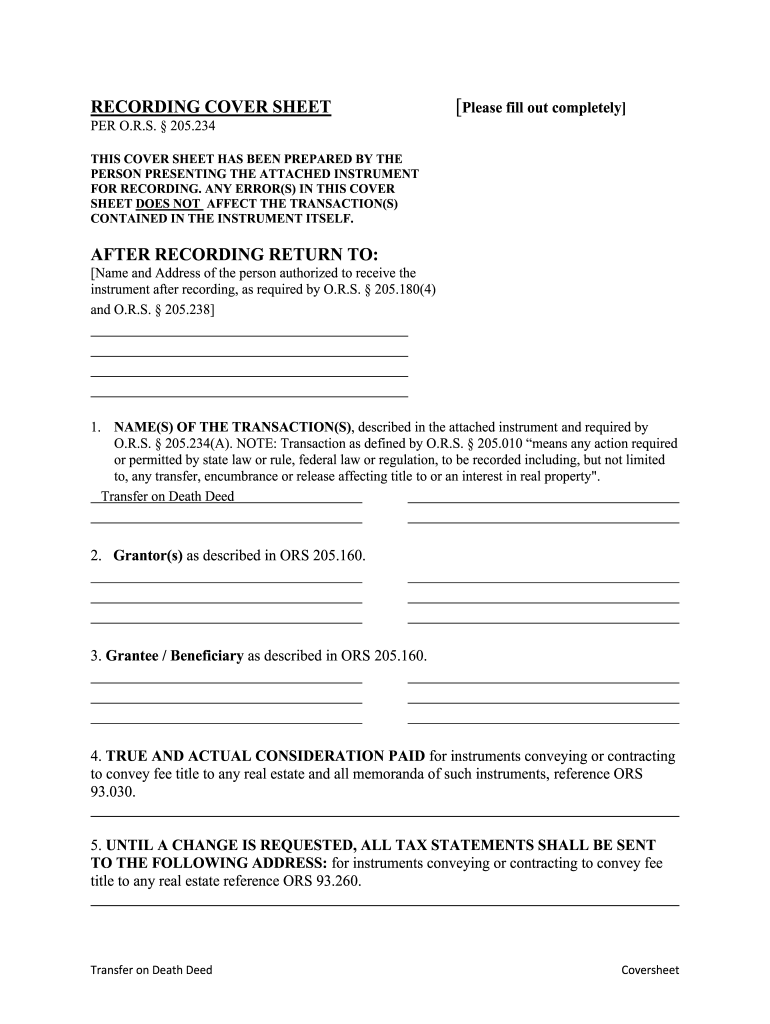

To use the death deed effectively, you must first complete the form with accurate information regarding the property and the designated beneficiaries. Once the document is filled out, it must be signed before a notary public and recorded with the county clerk's office where the property is located. This recording makes the transfer legally binding and ensures that the beneficiaries can claim the property upon the owner's death.

Steps to Complete the Death Deed

Completing the death deed involves several key steps:

- Gather necessary information about the property, including its legal description and address.

- Identify the beneficiaries who will inherit the property.

- Fill out the death deed form, ensuring all details are accurate.

- Sign the form in the presence of a notary public.

- Submit the signed deed to the county clerk's office for recording.

Key Elements of the Death Deed

Several key elements must be included in the death deed to ensure its validity:

- Property Description: A clear legal description of the property being transferred.

- Beneficiary Information: Names and addresses of the beneficiaries who will receive the property.

- Grantor's Signature: The individual transferring the property must sign the deed.

- Notary Acknowledgment: A notary public must witness the signing of the deed.

- Recording Information: The deed must be recorded with the appropriate county office to be effective.

State-Specific Rules for the Death Deed

In Oregon, specific rules govern the use of death deeds. The deed must comply with state laws regarding property transfers and must be recorded within a certain timeframe after execution. Additionally, the beneficiaries must be clearly identified to avoid any disputes. Understanding these state-specific regulations is crucial for ensuring the deed's effectiveness and legality.

Required Documents

When preparing to file a death deed, several documents are required:

- The completed death deed form.

- A valid form of identification for the grantor.

- Proof of property ownership, such as a title deed.

- Any previous deeds related to the property, if applicable.

Quick guide on how to complete death deed

Prepare Death Deed seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage Death Deed on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Death Deed effortlessly

- Locate Death Deed and then select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to保存 your modifications.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Death Deed and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the typical cost for managing an Oregon appointment using airSlate SignNow?

The pricing for managing an Oregon appointment with airSlate SignNow is competitive and affordable. We offer various plans that cater to different business sizes, ensuring you get the best value for your needs. These plans can help streamline the document signing process associated with your appointments.

-

How can airSlate SignNow streamline my Oregon appointment process?

airSlate SignNow simplifies the Oregon appointment process by allowing you to send, sign, and manage documents electronically. Our user-friendly interface helps reduce the time spent on paperwork and eliminates the need for in-person signings. This efficiency can signNowly enhance your appointment management.

-

What features does airSlate SignNow offer for scheduling Oregon appointments?

airSlate SignNow offers features designed to enhance the scheduling of Oregon appointments, including customizable templates, automated reminders, and real-time tracking. These tools help ensure that both parties remain informed and engaged throughout the appointment lifecycle. Integration with calendar apps further supports seamless scheduling.

-

Is it easy to integrate airSlate SignNow with other tools for Oregon appointments?

Yes, integrating airSlate SignNow with other tools for Oregon appointments is straightforward. Our platform easily connects with popular applications like Google Workspace, Salesforce, and Microsoft Office, among others. This integration allows for a smoother workflow when managing appointments and related documents.

-

What are the advantages of using airSlate SignNow for Oregon appointments?

Using airSlate SignNow for Oregon appointments offers numerous advantages, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are legally binding and secure, providing peace of mind for you and your clients. Additionally, the accessibility of eSignatures speeds up the appointment confirmation process.

-

Can airSlate SignNow help with regulatory compliance for Oregon appointments?

Absolutely, airSlate SignNow helps ensure compliance with local regulations for Oregon appointments. We provide features that adhere to industry standards and legal requirements, aiding users in maintaining the integrity of their signed documents. This compliance is critical for businesses operating within regulated industries.

-

What kind of support does airSlate SignNow offer for Oregon appointment users?

airSlate SignNow provides comprehensive support for users handling Oregon appointments. Our customer service team is available via chat, email, and phone to assist with any inquiries or issues you may face. Additionally, we offer a robust knowledge base filled with FAQs and user guides to help you navigate our solutions effectively.

Get more for Death Deed

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497298468 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property california form

- Notice intent vacate 497298470 form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property california form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497298472 form

- California lease form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497298476 form

- California lease landlord form

Find out other Death Deed

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF