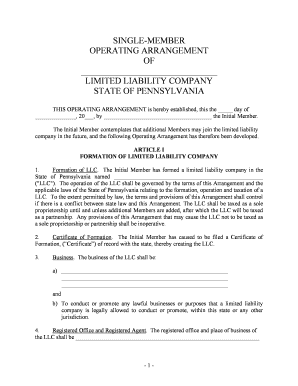

Limited Liability Company Form

What is the Limited Liability Company

A Limited Liability Company (LLC) is a popular business structure in Pennsylvania that combines the benefits of both a corporation and a partnership. This structure provides limited liability protection to its owners, known as members, meaning their personal assets are generally protected from business debts and liabilities. An LLC can be owned by one or more individuals or entities, allowing for flexibility in management and ownership.

In Pennsylvania, the LLC is governed by state laws that outline its formation, operation, and dissolution. This structure is particularly appealing to small business owners due to its pass-through taxation, where profits and losses are reported on the members' personal tax returns, avoiding double taxation at the corporate level.

Steps to complete the Limited Liability Company

Forming a Limited Liability Company in Pennsylvania involves several key steps:

- Choose a name: The name must be unique and include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- Designate a registered agent: This individual or entity will receive legal documents on behalf of the LLC.

- File the Certificate of Organization: This document must be submitted to the Pennsylvania Department of State, along with the required filing fee.

- Create an Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary permits and licenses: Depending on the business type, additional permits may be required at the local, state, or federal level.

- Apply for an EIN: An Employer Identification Number is necessary for tax purposes and can be obtained from the IRS.

Legal use of the Limited Liability Company

The legal framework surrounding Limited Liability Companies in Pennsylvania ensures that they operate within the law while providing certain protections to their members. An LLC can engage in various business activities, but it must adhere to specific regulations set forth by the state. This includes maintaining proper records, filing annual reports, and complying with tax obligations.

Members of an LLC benefit from limited liability, meaning they are not personally responsible for the debts or liabilities incurred by the company, provided they do not engage in fraudulent activities or fail to adhere to corporate formalities. This legal protection is a significant advantage for entrepreneurs looking to mitigate personal risk while pursuing business ventures.

Key elements of the Limited Liability Company

Several key elements define a Limited Liability Company in Pennsylvania:

- Limited Liability: Members are protected from personal liability for business debts.

- Pass-Through Taxation: Profits and losses pass through to members' personal tax returns, avoiding double taxation.

- Flexible Management Structure: Members can choose to manage the LLC themselves or appoint managers.

- Fewer Formalities: LLCs have fewer ongoing compliance requirements compared to corporations.

- Unlimited Members: An LLC can have one or more members, including individuals, corporations, or other LLCs.

Eligibility Criteria

To form a Limited Liability Company in Pennsylvania, certain eligibility criteria must be met:

- At least one member is required to establish the LLC.

- The chosen name must comply with Pennsylvania naming regulations and be distinguishable from existing entities.

- Members must be of legal age, typically eighteen years or older.

- Individuals or entities from outside Pennsylvania can also form an LLC in the state.

Application Process & Approval Time

The application process for establishing a Limited Liability Company in Pennsylvania involves submitting the Certificate of Organization to the Department of State. The processing time can vary, but typically, it takes about seven to ten business days for the application to be approved. Expedited services may be available for an additional fee, allowing for quicker processing.

Once the application is approved, the LLC is officially recognized, and members can begin conducting business under the new entity. It is essential to ensure that all required documents are correctly completed and submitted to avoid delays in the approval process.

Quick guide on how to complete limited liability company 481377539

Complete Limited Liability Company effortlessly on any device

Web-based document handling has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Limited Liability Company on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign Limited Liability Company without any hassle

- Obtain Limited Liability Company and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Mark signNow sections of your documents or hide sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Limited Liability Company and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Pennsylvania liability and how does it affect my business?

Pennsylvania liability refers to the legal responsibilities businesses have under Pennsylvania law. Understanding these liabilities is crucial for businesses operating in the state, as it affects contract management and compliance. Utilizing airSlate SignNow can help ensure that your documents are legally binding and compliant with Pennsylvania liability regulations.

-

How can airSlate SignNow help manage Pennsylvania liability issues?

AirSlate SignNow provides a reliable platform that helps businesses effectively manage their documents while considering Pennsylvania liability. Our eSigning and document management solutions streamline the signing process, reducing the risk of legal complications associated with improper documentation or unsigned contracts.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers various pricing plans to cater to the needs of businesses of all sizes. Our plans are designed to be cost-effective, allowing you to manage Pennsylvania liability documents without overspending. You can choose the plan that best fits your business requirements while ensuring compliance with state laws.

-

Does airSlate SignNow offer features tailored for Pennsylvania businesses?

Yes, airSlate SignNow offers features specifically designed to help Pennsylvania businesses comply with state regulations regarding liability. These features include customizable templates, secure document storage, and eSigning capabilities that ensure your agreements meet Pennsylvania liability standards.

-

Can airSlate SignNow integrate with other tools I use for my business?

Absolutely! AirSlate SignNow seamlessly integrates with various business tools and applications, making it easy to manage your workflow without interruption. This integration capability is essential for handling Pennsylvania liability documentation efficiently across your current systems.

-

What security measures does airSlate SignNow implement for handling sensitive Pennsylvania liability documents?

AirSlate SignNow prioritizes security by employing advanced encryption methods and secure servers to protect your sensitive Pennsylvania liability documents. We ensure that all data is kept confidential and secure, allowing you to manage your business without concerns about unauthorized access.

-

How does airSlate SignNow streamline the eSigning process for Pennsylvania liability documents?

AirSlate SignNow simplifies the eSigning process by providing an intuitive interface that allows users to sign documents securely within minutes. This ease of use is particularly beneficial for managing Pennsylvania liability documents, ensuring that contracts are signed promptly to avoid potential legal issues.

Get more for Limited Liability Company

Find out other Limited Liability Company

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy