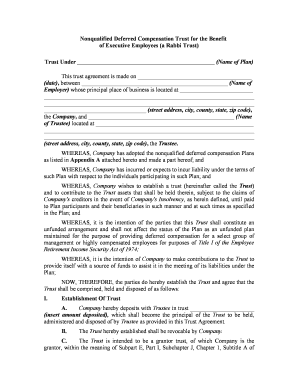

Trust Benefit Form

What is the Trust Benefit

The trust benefit is a financial arrangement designed to provide support to employees, often in the context of compensation and benefits. It typically involves a trust fund that holds assets for the benefit of employees, ensuring that they receive certain financial advantages or protections. This can include retirement benefits, health insurance, or other forms of compensation that are managed through a legal trust structure. Understanding the trust benefit is crucial for employees to navigate their compensation packages effectively.

How to Use the Trust Benefit

Using the trust benefit involves understanding the specific provisions outlined in your compensation plan. Employees should review their benefits documentation to determine how the trust operates, including eligibility criteria and the types of benefits available. Engaging with a human resources representative can provide clarity on how to utilize these benefits effectively. Additionally, employees may need to complete specific forms or provide documentation to access their trust benefits.

Steps to Complete the Trust Benefit

Completing the trust benefit typically requires several steps to ensure compliance and proper execution. First, gather all necessary documentation, such as identification and employment records. Next, fill out the required forms accurately, paying close attention to details to avoid errors. After completing the forms, submit them through the designated channels, whether online, by mail, or in person. Finally, keep copies of all submitted documents for your records and follow up to confirm that your application has been processed.

Legal Use of the Trust Benefit

The legal use of the trust benefit is governed by various laws and regulations that ensure the protection of employees' rights. Trust benefits must comply with federal and state laws, including tax regulations and labor laws. It is essential for both employers and employees to understand these legal frameworks to ensure that the trust operates within the law. This compliance helps prevent legal disputes and ensures that employees receive the benefits they are entitled to under their compensation agreements.

Eligibility Criteria

Eligibility for the trust benefit often depends on specific criteria set forth by the employer or the trust itself. Common factors include the length of employment, job classification, and participation in certain programs. Employees should review their employer's policies and consult with human resources to determine their eligibility. Understanding these criteria is vital for employees to access their benefits and maximize their compensation package.

Required Documents

To access the trust benefit, employees typically need to provide several key documents. These may include personal identification, proof of employment, and any forms required by the trust. Additionally, financial documents may be necessary to verify eligibility for certain benefits. Ensuring that all required documents are complete and accurate is essential for a smooth application process.

IRS Guidelines

IRS guidelines play a significant role in the administration of trust benefits, particularly regarding tax implications. Employees should be aware of how trust benefits are taxed and any reporting requirements that may apply. Understanding these guidelines can help employees make informed decisions about their compensation and ensure compliance with tax laws. Consulting with a tax professional can provide further clarity on how trust benefits impact individual tax situations.

Quick guide on how to complete trust benefit 481377647

Complete Trust Benefit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Trust Benefit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Trust Benefit effortlessly

- Obtain Trust Benefit and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Trust Benefit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the trust benefit of using airSlate SignNow?

The trust benefit of using airSlate SignNow lies in its secure and reliable eSignature solution. Businesses can confidently send and sign documents knowing that they adhere to industry standards and compliance regulations. Trust benefit ensures that sensitive information is protected throughout the signing process.

-

How does airSlate SignNow enhance the signing experience?

The trust benefit of airSlate SignNow enhances the signing experience through a simple and intuitive interface. Users can easily create, distribute, and manage documents, which streamlines workflows and reduces turnaround times. This trust benefit results in higher customer satisfaction and improved productivity.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, the trust benefit of airSlate SignNow is its affordability, making it an excellent choice for small businesses. With flexible pricing plans, businesses can choose a solution that fits their budget without compromising on features. This cost-effectiveness ensures that even startups can access premium eSignature capabilities.

-

What features support the trust benefit of airSlate SignNow?

airSlate SignNow offers several features that reinforce its trust benefit, including advanced security measures like encryption and authentication tools. Additionally, the platform provides templates and customizable workflows to enhance document management. These features build a reliable foundation for secure document transactions.

-

Can airSlate SignNow integrate with other software applications?

Absolutely! The trust benefit of airSlate SignNow includes seamless integrations with various software applications like CRMs, document management systems, and cloud storage. This capability allows businesses to enhance their workflows and ensures that all document-related tasks are efficiently managed from one platform.

-

What measures are in place to ensure document security?

The trust benefit of airSlate SignNow is reinforced by robust security measures that protect documents at every stage. Features like two-factor authentication, secure SSL encryption, and audit trails keep all signing activities documented and protected. This commitment to security helps build confidence among users.

-

How does airSlate SignNow benefit remote teams?

The trust benefit of airSlate SignNow is particularly advantageous for remote teams, allowing them to collaborate efficiently from anywhere. With cloud-based capabilities, team members can send and sign documents in real-time, ensuring smooth communication and project progress. This flexibility is essential in today’s remote work environment.

Get more for Trust Benefit

- Annulment form

- Lot purchase form

- Pennsylvania real estate home sales package with offer to purchase contract of sale disclosure statements and more for form

- Contempt form

- Parental rights 481366606 form

- Alabama real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential form

- Life documents planning form

- Contract no broker form

Find out other Trust Benefit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors