City of Detroit Property Tax Exemption Form

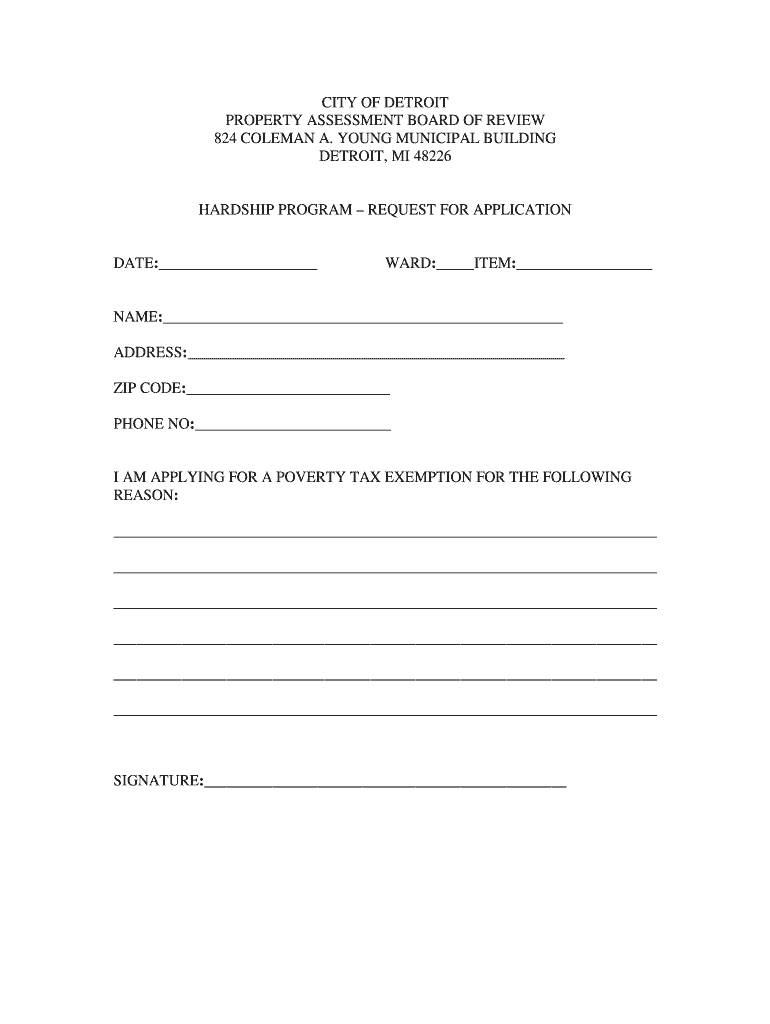

What is the City Of Detroit Property Tax Exemption Form

The City of Detroit Property Tax Exemption Form is a legal document that allows eligible residents to apply for a reduction or exemption from property taxes. This form is specifically designed for homeowners who meet certain criteria, such as income limits or disability status. By submitting this form, individuals can potentially lower their financial burden related to property taxes, making homeownership more affordable. Understanding the purpose and importance of this form is crucial for those seeking tax relief in Detroit.

Eligibility Criteria

To qualify for the City of Detroit Property Tax Exemption, applicants must meet specific eligibility requirements. These criteria typically include:

- Being a resident of the City of Detroit.

- Meeting income limits set by the city.

- Owning and occupying the property as a primary residence.

- Providing necessary documentation to verify income and residency.

It is essential for applicants to review these criteria carefully before completing the form to ensure they qualify for the exemption.

Steps to Complete the City Of Detroit Property Tax Exemption Form

Completing the City of Detroit Property Tax Exemption Form involves several key steps:

- Gather required documents, including proof of income and residency.

- Access the form online or obtain a physical copy from the local tax office.

- Fill out the form accurately, ensuring all information is complete.

- Review the form for any errors or missing information.

- Submit the completed form along with any required documentation.

Following these steps can help streamline the application process and improve the chances of approval.

Required Documents

When applying for the property tax exemption, applicants must provide specific documents to support their application. Commonly required documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Identification, such as a driver's license or state ID.

- Documentation verifying residency, like utility bills or lease agreements.

Having these documents ready can facilitate a smoother application process and help ensure that the form is processed without delays.

Form Submission Methods

Applicants can submit the City of Detroit Property Tax Exemption Form through various methods. These include:

- Online submission via the city's official website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated city offices.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Application Process & Approval Time

The application process for the City of Detroit Property Tax Exemption typically involves several stages. After submission, the city will review the application and the accompanying documents. The approval time can vary, but applicants can generally expect a response within a few weeks. It is advisable to check the status of the application if no communication is received within the expected timeframe. Understanding this process can help manage expectations and ensure timely follow-up.

Quick guide on how to complete detroit property tax hardship form

Your assistance manual on how to prepare your City Of Detroit Property Tax Exemption Form

If you’re curious about how to generate and dispatch your City Of Detroit Property Tax Exemption Form, here are some brief instructions on how to simplify tax submission.

To begin, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to adjust, create, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and return to modify details as needed. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your City Of Detroit Property Tax Exemption Form in no time:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; navigate through various versions and schedules.

- Click Get form to access your City Of Detroit Property Tax Exemption Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and rectify any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing in paper form may result in return errors and delay refunds. Of course, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the detroit property tax hardship form

How to create an electronic signature for your Detroit Property Tax Hardship Form in the online mode

How to generate an eSignature for your Detroit Property Tax Hardship Form in Chrome

How to generate an electronic signature for signing the Detroit Property Tax Hardship Form in Gmail

How to generate an electronic signature for the Detroit Property Tax Hardship Form straight from your smartphone

How to make an electronic signature for the Detroit Property Tax Hardship Form on iOS

How to generate an electronic signature for the Detroit Property Tax Hardship Form on Android devices

People also ask

-

What is the property tax exemption city of Detroit and who qualifies for it?

The property tax exemption city of Detroit is a program designed to provide financial relief to eligible homeowners by reducing or eliminating property taxes. To qualify, applicants typically need to meet income requirements, residency criteria, and property ownership status. It's essential to review the specific guidelines set by the city to ensure compliance.

-

How can airSlate SignNow assist with the property tax exemption city of Detroit application process?

AirSlate SignNow streamlines the documentation process for property tax exemption city of Detroit applications. Our platform allows users to easily prepare, send, and eSign necessary documents, ensuring that all applications are filled out correctly and submitted on time. This efficiency can help applicants avoid common pitfalls during the application process.

-

Are there fees associated with applying for the property tax exemption city of Detroit?

Generally, there are no application fees for the property tax exemption city of Detroit. However, it's important to check with local authorities for any related costs or service fees that might apply to specific processes. AirSlate SignNow offers a cost-effective solution for handling all document-related tasks without additional fees.

-

What documents do I need to provide for the property tax exemption city of Detroit?

To apply for the property tax exemption city of Detroit, you typically need to provide proof of income, property ownership documents, and various identification forms. Using airSlate SignNow, you can securely create and manage these documents to ensure that you have everything you need in one convenient location.

-

What are the benefits of obtaining the property tax exemption city of Detroit?

Obtaining the property tax exemption city of Detroit can signNowly reduce your annual tax burden, allowing you to allocate more funds towards other expenses. Additionally, this exemption can enhance your financial stability, making homeownership more attainable. AirSlate SignNow helps simplify this benefit through an efficient documentation process.

-

Can I apply for the property tax exemption city of Detroit online?

Yes, the city of Detroit offers online applications for the property tax exemption, facilitating easy access for applicants. With airSlate SignNow, users can prepare, send, and eSign their applications digitally, reducing the need for in-person visits and ensuring a faster processing time.

-

How does airSlate SignNow integrate with other tools for managing property tax exemption applications?

AirSlate SignNow integrates seamlessly with various tools and platforms that can assist in managing property tax exemption applications. These integrations allow for enhanced workflows, enabling users to collaborate with others and keep track of important deadlines and documents. This connectivity makes it easier to apply for the property tax exemption city of Detroit efficiently.

Get more for City Of Detroit Property Tax Exemption Form

- Indemnity agreement in connection with warehouse receipt form

- Reason for tardiness form

- We have acted as counsel for a form

- Resolution to approve amendment of bylaws whereas now form

- Appendix of forms oregon

- Rule 3692 petition to seal or expunge a requirements form

- Alegal forms ampampamp documents

- Arrest and bail duty of sheriff to serve warrant issued form

Find out other City Of Detroit Property Tax Exemption Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online