Mortgage Extension Form

What is the Mortgage Extension

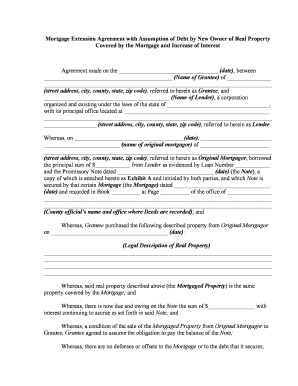

A mortgage extension is a legal agreement that allows a borrower to extend the term of their existing mortgage. This extension can provide additional time for the borrower to repay the loan, often under the same terms and conditions as the original mortgage. It is particularly useful for homeowners who may be facing financial difficulties or need more time to stabilize their financial situation. Understanding the specific terms of the mortgage extension agreement is crucial, as it can impact the total interest paid and the overall length of the loan.

How to use the Mortgage Extension

Using a mortgage extension involves several steps. First, the borrower should review their current mortgage agreement to understand the terms and conditions. Next, they should contact their lender to discuss the possibility of extending the mortgage. The lender may require documentation of the borrower’s financial status, including income and expenses. Once the lender agrees to the extension, the borrower will need to fill out a mortgage assumption form to formalize the agreement. This form typically includes details about the original mortgage, the new terms, and signatures from both parties.

Steps to complete the Mortgage Extension

Completing a mortgage extension involves a series of steps to ensure all legal requirements are met. Begin by gathering necessary financial documents, such as pay stubs, tax returns, and bank statements. Next, approach your lender to express your interest in extending the mortgage. Upon approval, fill out the mortgage assumption form accurately, ensuring all information is correct. After submitting the form, keep a copy for your records. Finally, follow up with your lender to confirm that the extension has been processed and to receive any updated documentation.

Legal use of the Mortgage Extension

The legal use of a mortgage extension is governed by state laws and the terms of the original mortgage agreement. It is essential for borrowers to ensure that their request for an extension complies with these regulations. The mortgage extension must be documented properly, typically through a mortgage assumption form, which serves as a legal record of the agreement between the borrower and lender. Failure to adhere to legal requirements may result in complications or disputes regarding the mortgage terms.

Key elements of the Mortgage Extension

Key elements of a mortgage extension include the duration of the extension, interest rates, payment terms, and any fees associated with the process. It is important for borrowers to understand how these elements will affect their overall financial obligations. Additionally, the agreement should specify any conditions that must be met for the extension to remain valid, such as timely payments or maintaining homeowner's insurance. Clarity on these points helps prevent misunderstandings between the borrower and lender.

Required Documents

When applying for a mortgage extension, borrowers typically need to provide several documents to their lender. These may include proof of income, such as pay stubs or tax returns, a current mortgage statement, and any relevant financial statements that demonstrate the borrower’s ability to meet the new terms. Additionally, the completed mortgage assumption form is essential for processing the extension. Having all required documents ready can expedite the approval process and facilitate clear communication with the lender.

Eligibility Criteria

Eligibility for a mortgage extension can vary based on the lender's policies and the borrower's financial situation. Generally, lenders will assess the borrower's credit score, payment history, and current income to determine eligibility. Borrowers who have maintained consistent payments and have a stable income are more likely to qualify for an extension. Additionally, some lenders may have specific criteria based on the type of mortgage or the borrower's overall financial health. Understanding these criteria is crucial for borrowers seeking to extend their mortgage.

Quick guide on how to complete mortgage extension

Effortlessly Prepare Mortgage Extension on Any Device

Digital document administration has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Manage Mortgage Extension on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to edit and electronically sign Mortgage Extension effortlessly

- Find Mortgage Extension and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you want to send your form: via email, SMS, link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and electronically sign Mortgage Extension and ensure excellent communication at each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage assumption form?

A mortgage assumption form is a legal document that allows a buyer to take over the seller's existing mortgage. This form outlines the terms and conditions under which the buyer assumes the loan, ensuring that all parties are protected during the transfer of ownership. Understanding this form is crucial for anyone considering buying a property with an existing mortgage.

-

How do I complete a mortgage assumption form with airSlate SignNow?

Completing a mortgage assumption form with airSlate SignNow is straightforward. Simply upload your document, fill in the required fields, and add eSignature fields for all parties involved. The platform guides you through each step, making it easy to complete and send your mortgage assumption form securely.

-

What are the benefits of using airSlate SignNow for mortgage assumption forms?

Using airSlate SignNow for mortgage assumption forms streamlines the process of document management and signatures. The platform offers efficiency, cost-effectiveness, and the ability to track document status in real-time. Additionally, it ensures compliance with legal requirements, making the entire process easier and more reliable.

-

Are there any costs associated with using airSlate SignNow for mortgage assumption forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those using mortgage assumption forms. Pricing may vary based on the number of users and features required, but there are no hidden fees. For detailed pricing information, it's best to visit the airSlate website or contact their support team.

-

Can I integrate airSlate SignNow with other platforms for mortgage assumption forms?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing your workflow for managing mortgage assumption forms. Whether you use CRM software, accounting systems, or other document management tools, airSlate allows for easy syncing and collaboration.

-

Is it legally binding to use eSignatures on a mortgage assumption form?

Yes, using eSignatures on a mortgage assumption form is legally binding in most jurisdictions, as long as the process complies with the ESIGN Act and UETA regulations. airSlate SignNow provides a secure electronic signature platform that ensures your mortgage assumption form meets legal standards, giving you peace of mind.

-

What features does airSlate SignNow offer for managing mortgage assumption forms?

airSlate SignNow offers a range of features tailored for managing mortgage assumption forms, including customizable templates, audit trails, and real-time document tracking. The platform also allows for collaborative editing and easy sharing, making it convenient for all parties involved. These features simplify the entire process and enhance productivity.

Get more for Mortgage Extension

Find out other Mortgage Extension

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online