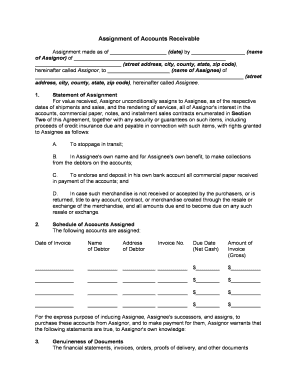

Assignment of Accounts Receivable Form

What is the Assignment Of Accounts Receivable

The assignment of accounts receivable is a legal document that allows a business to transfer its rights to collect payments from customers to another party. This process is often used to improve cash flow, as it enables businesses to receive immediate funds by selling their receivables. The party receiving the assignment, known as the assignee, gains the right to collect the debts owed to the assignor, who is the original creditor. This document must clearly outline the terms of the assignment, including the specific accounts being transferred and any obligations of the parties involved.

How to use the Assignment Of Accounts Receivable

Using the assignment of accounts receivable involves several steps. First, the assignor must identify the accounts they wish to assign and ensure they have the legal right to do so. Next, both parties should negotiate the terms of the assignment, including payment amounts and timelines. Once agreed, the assignor completes the assignment form, providing necessary details such as the names of both parties and the specific accounts being assigned. After signing, the assignor should notify the customers of the assignment to ensure proper payment routing. This process can be streamlined through electronic means, making it easier for businesses to manage their receivables.

Steps to complete the Assignment Of Accounts Receivable

Completing the assignment of accounts receivable involves a series of straightforward steps:

- Identify the accounts receivable to be assigned.

- Draft the assignment document, including relevant details such as the parties involved and the accounts being transferred.

- Ensure both parties review and agree to the terms outlined in the document.

- Sign the assignment form, ensuring all signatures are legally valid.

- Notify the customers of the assignment to redirect payments accordingly.

By following these steps, businesses can effectively transfer their receivables and improve cash flow.

Legal use of the Assignment Of Accounts Receivable

The assignment of accounts receivable is legally binding when executed properly. To ensure its legality, it must comply with relevant laws and regulations, including those governing contracts and commercial transactions. Both parties should retain copies of the signed document for their records. The assignment should also include clear terms regarding the rights and responsibilities of each party, as well as any conditions that may affect the assignment. Using a reliable electronic signature platform can help ensure compliance with legal standards, making the process secure and efficient.

Key elements of the Assignment Of Accounts Receivable

Several key elements must be included in the assignment of accounts receivable to ensure its effectiveness:

- Parties involved: Clearly identify the assignor and assignee.

- Description of accounts: Specify which accounts receivable are being assigned.

- Terms of the assignment: Outline payment terms, obligations, and any conditions.

- Signatures: Ensure all necessary parties sign the document to validate it.

- Notification clause: Include a provision for notifying customers of the assignment.

Incorporating these elements helps protect the interests of both parties and facilitates a smooth transfer of rights.

Examples of using the Assignment Of Accounts Receivable

Businesses frequently use the assignment of accounts receivable in various scenarios. For instance, a small manufacturing company may assign its receivables to a financial institution to secure a loan. This allows the company to access immediate funds while the lender takes on the responsibility of collecting payments. Another example is a service provider who may assign its receivables to a factoring company, which pays a percentage upfront and collects the full amount from customers later. These examples illustrate how businesses can leverage their receivables to enhance liquidity and support growth.

Quick guide on how to complete assignment of accounts receivable

Prepare Assignment Of Accounts Receivable effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the proper forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Assignment Of Accounts Receivable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Assignment Of Accounts Receivable seamlessly

- Locate Assignment Of Accounts Receivable and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Assignment Of Accounts Receivable to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assignment Of Accounts Receivable?

An Assignment Of Accounts Receivable is a financial transaction where a business transfers its accounts receivable to another entity, often to secure financing. This process allows businesses to improve cash flow by receiving immediate funds based on outstanding invoices. Understanding how airSlate SignNow can streamline this process will benefit companies looking to optimize their revenue cycle.

-

How can airSlate SignNow assist with the Assignment Of Accounts Receivable?

airSlate SignNow simplifies the Assignment Of Accounts Receivable by providing a seamless electronic signature solution that allows businesses to sign and manage documents online. With automated workflows, users can ensure that agreements are executed quickly and efficiently, enhancing overall productivity. This leads to faster processing of accounts receivable and improved cash flow management.

-

What are the pricing options for airSlate SignNow related to Assignment Of Accounts Receivable?

airSlate SignNow offers various pricing plans to accommodate different business needs when it comes to the Assignment Of Accounts Receivable. Pricing is competitive and designed to provide businesses with an affordable solution to manage their documents and signatures effectively. Custom plans are also available, ensuring scalability as your business grows.

-

What features does airSlate SignNow provide for managing Assignment Of Accounts Receivable?

The features of airSlate SignNow for managing Assignment Of Accounts Receivable include customizable templates, automated reminders, and secure cloud storage. These tools allow businesses to create, send, and track documents related to accounts receivable easily. Additionally, the mobile-friendly interface ensures that transactions can be handled anytime, anywhere.

-

Are there any integrations available for airSlate SignNow to facilitate Assignment Of Accounts Receivable?

Yes, airSlate SignNow integrates with various business applications to facilitate the Assignment Of Accounts Receivable. Popular integrations with CRM platforms and accounting software allow for streamlined data transfer and enhanced functionality. This connectivity ensures that all relevant documents are easily accessible and manageable across your business systems.

-

What are the benefits of using airSlate SignNow for the Assignment Of Accounts Receivable?

Using airSlate SignNow for the Assignment Of Accounts Receivable can signNowly improve transaction speed and accuracy. The electronic signature process reduces paper use and minimizes delays associated with traditional methods. By leveraging this efficient platform, businesses can focus on core activities and better manage their cash flow.

-

How secure is airSlate SignNow when dealing with Assignment Of Accounts Receivable?

Security is a top priority for airSlate SignNow, especially concerning sensitive documents like the Assignment Of Accounts Receivable. The platform utilizes advanced encryption methods and complies with industry standards to protect your data. Users can confidently sign and store documents, knowing that their information is secure.

Get more for Assignment Of Accounts Receivable

- Kansas general durable power of attorney for property and finances or financial effective upon disability form

- Transfer on death deed 481371091 form

- Guide selling real estate form

- Az quitclaim deed form

- Arizona deed beneficiary form

- Az wife form

- Ca real estate form

- Esrd death notification 44808421 form

Find out other Assignment Of Accounts Receivable

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement