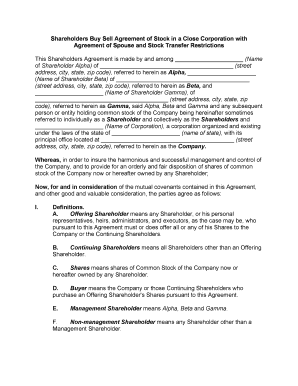

Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions Form

What is the Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

The Shareholders Buy Sell Agreement of stock in a close corporation with agreement of spouse and stock transfer restrictions is a legal document that outlines the terms under which shareholders can buy or sell their shares. This agreement is particularly important in close corporations, where ownership is often limited to a small group of individuals. It ensures that shares are transferred only under agreed-upon conditions, which can help maintain control over the corporation and protect the interests of existing shareholders. The inclusion of spouse agreements and stock transfer restrictions adds another layer of protection, ensuring that shares do not end up in the hands of unintended parties.

Key elements of the Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

Several key elements are essential for a comprehensive shareholders buy sell agreement. These include:

- Valuation Method: A clear method for determining the value of shares at the time of transfer.

- Transfer Restrictions: Specific conditions under which shares can be sold or transferred, including any limitations on who can purchase shares.

- Spousal Agreement: Provisions that require the consent of a shareholder's spouse before shares can be sold, ensuring that family interests are considered.

- Buyout Terms: Detailed terms outlining how and when shareholders can buy out a departing shareholder's shares.

- Dispute Resolution: Mechanisms for resolving conflicts that may arise regarding the agreement.

Steps to complete the Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

Completing the shareholders buy sell agreement involves several important steps:

- Draft the Agreement: Begin by drafting the agreement, incorporating all necessary elements such as valuation methods and transfer restrictions.

- Review with Shareholders: Shareholders should review the draft to ensure it meets everyone's expectations and needs.

- Consult Legal Counsel: It is advisable to consult with a legal professional to ensure compliance with state laws and regulations.

- Obtain Signatures: All parties, including spouses where applicable, should sign the agreement to make it legally binding.

- Store Securely: Keep the signed agreement in a secure location, ensuring that all shareholders have access to it when needed.

Legal use of the Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

The legal use of this agreement is crucial for protecting the interests of shareholders in a close corporation. It serves as a binding contract that outlines the rights and responsibilities of shareholders regarding the sale and transfer of shares. By adhering to the terms set forth in the agreement, shareholders can avoid potential disputes and ensure that any transfer of ownership is conducted fairly and transparently. Additionally, the agreement can be enforced in a court of law, providing legal recourse in case of non-compliance.

How to use the Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

Using the shareholders buy sell agreement effectively involves understanding its provisions and applying them when necessary. Shareholders should refer to the agreement when contemplating the sale or transfer of shares, ensuring compliance with the outlined restrictions and requirements. In the event of a shareholder's departure or death, the agreement provides a clear process for handling the transfer of shares, facilitating a smooth transition. Regularly reviewing and updating the agreement can also help ensure it remains relevant and effective as circumstances change.

Quick guide on how to complete shareholders buy sell agreement of stock in a close corporation with agreement of spouse and stock transfer restrictions

Prepare Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions on any platform using airSlate SignNow mobile applications for Android or iOS and enhance any document-focused operation today.

How to modify and eSign Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions effortlessly

- Obtain Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your modifications.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

A Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions is a legal document that outlines the terms under which shareholders can buy or sell their shares, including any agreements with their spouses and restrictions on stock transfers. This agreement helps protect the interests of shareholders and ensures a smooth transition of stock ownership.

-

Why do I need a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

Having a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions is essential for preventing disputes among shareholders and ensuring clarity on how shares can be transferred. This agreement ensures that all parties are aware of their rights and obligations, providing peace of mind for both shareholders and their spouses.

-

How much does it cost to create a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

The cost of creating a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions can vary depending on the complexity and the service provider. Using airSlate SignNow can be a cost-effective solution, offering competitive pricing for drafting and eSigning such documents.

-

What features does airSlate SignNow offer for a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

airSlate SignNow offers features such as document templates, eSigning, and real-time collaboration for creating a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions. These tools streamline the process, making it easier for businesses to manage important agreements efficiently.

-

Can I customize a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions to meet your specific needs. You can easily add clauses and modify templates to suit your corporation's unique dynamics.

-

How can I share a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions with other stakeholders?

With airSlate SignNow, you can effortlessly share your Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions with stakeholders through secure links or email invitations. This feature allows all necessary parties to review and eSign the document from anywhere, enhancing collaboration.

-

What are the benefits of using airSlate SignNow for a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

Using airSlate SignNow provides numerous benefits for a Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions, such as increased efficiency, cost savings, and enhanced security. The platform simplifies the signing process, allowing stakeholders to act quickly while ensuring compliance with legal requirements.

Get more for Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

- Contract for deed sellers annual accounting statement district of columbia form

- Notice of default for past due payments in connection with contract for deed district of columbia form

- Final notice of default for past due payments in connection with contract for deed district of columbia form

- Assignment of contract for deed by seller district of columbia form

- Notice of assignment of contract for deed district of columbia form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement district of columbia form

- Buyers home inspection checklist district of columbia form

- Sellers information for appraiser provided to buyer district of columbia

Find out other Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed